Bank Credit Risk: A Risk-Return Analysis

South State Correspondent

MARCH 19, 2023

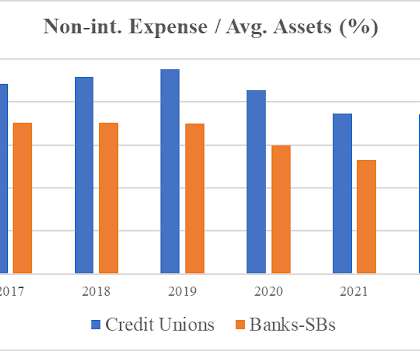

While every bank will take some level of credit, interest rate, liquidity, and operational risk, the question is this: Are banks in the business of taking risk to earn higher revenue, or are banks managing relationships and should avoid risk (and the higher return) when possible? The markets (i.e., The markets (i.e.,

Let's personalize your content