Regulators will take comments on Basel III endgame impact analysis

American Banker

JANUARY 9, 2024

Federal Reserve Vice Chair for Supervision Michael Barr said feedback received will be incorporated into the final version of the capital reform rule.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

American Banker

JANUARY 9, 2024

Federal Reserve Vice Chair for Supervision Michael Barr said feedback received will be incorporated into the final version of the capital reform rule.

Perficient

MARCH 3, 2022

Federal bank regulators work together to design Comprehensive Capital Analysis and Review (“CCAR”) stress tests that are designed to ensure that even in the case of a severe recession, significant banks can lend to households and businesses. dollar against those countries’ currencies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Elevating Accounting Practices: The Power of Outsourcing and Automation in the Digital Age

PYMNTS

MARCH 27, 2019

While regulators had transparency and financial security in mind when introducing more stringent requirements for banks following the global financial crisis, financial institutions faced a sudden surge in the burden compliance. The Key To Compliance Is Data.

PYMNTS

SEPTEMBER 25, 2019

Regulators the world over are beginning to take a closer look at the alternative and marketplace lending business model. Know Your Customer is another area of compliance friction for these companies, added Wales, as money laundering and terrorist financing become more significant threats to the borrowing and lending space. In the U.S.,

Abrigo

FEBRUARY 16, 2024

Takeaway 3 Credit analysts need training to understand the working capital cycle, look for hidden risks, and be aware of accounting changes. Assign clear responsibilities and establish accountability at all levels—from mechanics and calculations to analysis of covenant breaches. Talk to a specialist to learn more.

Abrigo

FEBRUARY 6, 2024

Cash flow analysis: Draft policies focused on consistent and accurate cash flow analyses. Consider that global cash flow analysis will be necessary for complex borrowers and outline cases in which analysis is encouraged. How robust is your compliance program? However, with opportunities come inherent risks.

Insights on Business

MARCH 4, 2019

It seems like just yesterday when complying with regulation was the end goal in itself. The bulk of these efforts were focused on simply churning out reports to keep regulators happy. In addition to the data challenge, regulations are becoming more complex. There is a new and more complex reality now.

BankUnderground

APRIL 28, 2023

This post investigates whether large and small banks in the UK and US differ in the cyclical patterns of capital positions and credit provision. The reforms aimed to ensure that banks have sufficient capital resources to absorb losses and reduce the cyclical effects of bank capital (and regulation) on the supply of bank credit in stress.

CB Insights

OCTOBER 29, 2020

Capital markets infrastructure powers the trade of stocks, bonds, and other securities, handling $3000T+ in transactions each year. Currently, complex processes are needed to ensure regulatory compliance and enable secure, trustworthy trades. Submit your application here before November 25. Please click to enlarge.

Abrigo

JANUARY 24, 2024

The rapidly increasing interest rates in 2023 led to publicly traded banks with more than $20 billion in assets having tangible common equity ratios (adjusted for fair value adjustments on held-to-maturity instruments such as loans) of less than 3% as of September 30, 2023, according to S&P Capital IQ. Should we panic?

Perficient

MARCH 8, 2023

Investing in real-time monitoring can result in much smaller future remediation costs and more satisfied clients, as well as regulators who, in the banking industry, are able to make capital requirement adjustments based on the bank’s risk profile.

Abrigo

JUNE 5, 2023

Banking reports to inform risk management and strategy These reports on capital, growth, and liquidity help financial institutions spot warning signs. Takeaway 2 Reports that assess capital, growth, and liquidity provide banking professionals data to drive decisions. Regulators review them to assess safety and soundness.

Abrigo

MAY 19, 2023

In addition, they should be familiar with pertinent laws and regulations affecting credit and lending activities. Some banks have enough critical mass to rotate junior teammates from credit analysis to workout to loan review for 6-month exposures to each of these areas before sending them on to lending assignments.

Abrigo

AUGUST 1, 2022

Takeaway 2 Even small banks or credit unions not regulated by the Federal Reserve are required to address control risks from models. As financial regulators have noted , this oversight is important because of the "possible adverse consequences (including financial loss) of decisions based on models that are incorrect or misused.”

PYMNTS

JUNE 10, 2019

The FSB announced Friday the findings of its analysis of Basel III regulations on the small business lending space. Some regulators aimed to mitigate that impact. As such, the FSB said it does not expect to introduce any new industry regulations.

PYMNTS

JULY 2, 2020

With the pandemic nudging businesses further into the digital payments realm, commercial card innovation is heating up to capitalize on the opportunity for adoption. ” Capital On Tap Enables Receipt Bank Card. Capital on Tap wields the commercial card to connect small and medium-sized businesses (SMBs) to financing.

Abrigo

DECEMBER 2, 2021

Learn how a core deposit analysis helped improve this institution's forecasts. The challenge with the influx of capital is that most financial institutions don’t know how much of the money at their institutions will hang around – or for how long. One way to find out is by allocating surplus budget money to a core deposit analysis.

Abrigo

OCTOBER 14, 2022

You might also like this whitepaper, "Stress Testing: Managing Capital Levels and Credit Risk." Takeaway 3 Utilize regulatory guidance to understand regulators' expectations, which are likely to include consistent stress testing. Read the whitepaper, "Stress Testing: Managing Capital Levels and Credit Risk.". keep me informed.

Abrigo

NOVEMBER 18, 2016

As noted in a recent American Banker article , many banks are increasing their investment in CRE loans, with many even exceeding the OCC guidance to limit CRE concentration to 300% of Risk Based Capital. In fact, software solutions are often key to both profitability and regulatory approval.

Abrigo

SEPTEMBER 7, 2023

The institution can more easily capitalize on opportunities and avoid unnecessary risk. With the amount of data an institution has at its fingertips, it can be hard to determine what’s relevant and how to apply it for the most effective reporting and analysis. Learn how to tap your data to generate management insights.

PYMNTS

JUNE 20, 2017

But Big Data lands new capabilities in the hands of corporate treasurers and other executives that yields active, real-time assessments of risks from multiple angles, from counterparties to compliance. A weak data management strategy could heighten the risk of non-compliance. One is in assessing counterparty strength.

Abrigo

JULY 14, 2023

Before finalizing this goal, management should consider the following: Historical trends Current CRE concentrations Market analysis Loan pricing considerations Real estate industry performance and Peer comparisons. This exercise may reveal the need for bigger-picture data analysis. CRE concentration report.

Abrigo

MAY 29, 2019

The compliance department is already one of the most understaffed areas of the institution and when staff turnover occurs or an employee goes on vacation or family leave, it can be cause for panic. They provide in-depth analysis of each alert or case and the reason behind their decision to clear it or escalate. Connect with an advisor.

Insights on Business

MAY 21, 2019

Those would be meaningful advantages to any business, but they are especially relevant to financial services and risk analysis. Compliance with change. Another reason is compliance with mounting regulations, which leads to avoidance of penalties and losses. Learn more at ibm.com/RegTech.

PYMNTS

JULY 2, 2019

Investors have reportedly been “spooked,” with the Australian Transaction Reports and Analysis Center (AUSTRAC) ordering an external audit of the company to investigate potential non-compliance with anti-money laundering laws. Afterpay’s shares were up as high as 7.6 percent on the news, Reuters reported. Afterpay notched $221.08

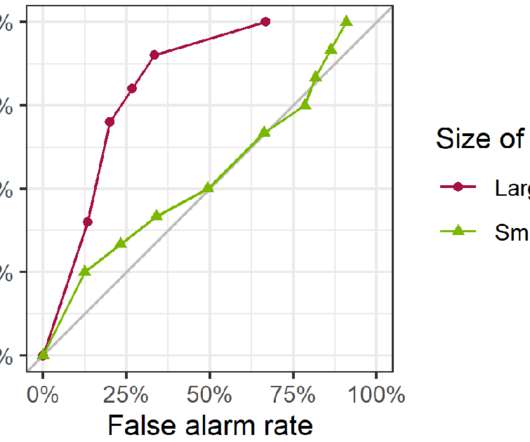

BankUnderground

AUGUST 10, 2021

Do prudential regulations that work well for big banks work as well for small ones? We do so using ‘receiver operating characteristic’ – or ‘ROC’ – analysis of simple threshold rules. This provides evidence that an efficient set of regulations for large banks might not be as efficient for small ones. One size fits all?

PYMNTS

JUNE 21, 2016

Chamber of Commerce uncovered the challenge businesses face in the wake of financial reforms and regulations, like Dodd-Frank. Nearly 80 percent said they had taken some kind of measure to make up for the financial cost of compliance. What Regulation Does. Last week, reports emerged that the U.S.

PYMNTS

SEPTEMBER 28, 2017

Overstock has been very methodical on getting the necessary regulators on board,” said Tom Forte, analyst at employee-owned broker-dealer DA Davidson, which has a buy rating on the stock. We can start moving these ICOs in and provide good, regulated trading,” Byrne said. based investors is a lack of regulation clearly governing them.

American Banker

OCTOBER 19, 2023

again pressed the Federal Reserve for economic analysis of capital proposals, while Rep. Andy Barr, R-Ky., French Hill, R-Ark., reintroduced a bill that would limit the Fed's ability to extend money to the Consumer Financial Protection Bureau.

Abrigo

OCTOBER 23, 2015

Portfolio stress tests can provide a number of benefits beyond compliance with regulatory expectations, Behringer said recently at the 2015 Risk Management Summit hosted by Sageworks. How does a negative change in capitalization rates on multi-family or non-owner occupied commercial real estate impact net operating income for our borrowers?”

PYMNTS

JANUARY 22, 2018

There are two key focuses for mid-market expense management tools, he said: infrastructure and regulatory compliance. Regulation is a massive component, Deleval said – and with mid-market firms operating and traveling across various markets, the regulatory environment shifts from place to place.

CB Insights

NOVEMBER 2, 2017

It’s been nearly a decade since the financial crisis exposed how a weak risk management framework and lack of governance can almost permanently debilitate even one of the strongest capital markets. Looking at the top breaches since the financial crisis highlights some of the impacts that major gaps in regulation have on consumers.

Abrigo

NOVEMBER 9, 2022

The Q1 2023 compliance date is near for smaller SEC-reporting financial institutions and private or not-for-profit banks and credit unions, and progress is decidedly mixed, according to the Abrigo 2022 CECL Survey. Use a software tool [and] ensure your auditors and regulators are in the loop on progress.” CECL Regulation.

PYMNTS

JULY 27, 2018

. — specifically the Building Engineering Services Association (BESA) and the Electrical Contractors Association (ECA) — have stated this month that the overwhelming majority of councils are not, in fact, doing their jobs of making sure that suppliers are meeting the 30-day payment terms mandated by the three-year-old Public Contracts Regulations.

CFPB Monitor

FEBRUARY 10, 2021

On January 26, 2021, the FTC sent its annual letter to the CFPB reporting on the FTC’s activities related to the Equal Credit Opportunity Act (“ECOA”) and Regulation B. The FTC has authority to enforce the ECOA and Regulation B with respect to nonbank financial service providers within its jurisdiction. Capital One, N.A.

Jeff For Banks

JULY 14, 2016

I have written about banks determining their own well-capitalized by allocating capital to different balance sheet categories based on the bank's perceived risk of those categories. But what if this analysis starts at the most granular level. It is a top down approach. every customer? Sure, there will be challenges.

PYMNTS

JUNE 28, 2018

A poll of attendees found that fraud stands as “the main compliance concern of 31 percent of delegates, closely followed by correspondent relationships (27 percent), and OFAC and sanctions (23 percent).”. The lack of security cooperation between bankers and regulators also comes up for blame. Fraud is a Top Worry.

PYMNTS

DECEMBER 5, 2019

But many of these areas of capital outflow suffer the same points of friction, says Erik Ingvoldstad, chief experience officer and co-founder of Norway-based payments technology firm EedenBull. New regulations, new technologies and new players are forever changing the way consumers and businesses thank about payments,” he said. “To

CB Insights

FEBRUARY 6, 2018

S tartups in the space offer services ranging from automated data collection from unstructured sources to real-time data analysis and syntehsis. . Select Investors: Data Collective, Intel Capital, Microsoft Ventures, Tencent Holdings, 500 Startups. Select Investors: Accel Partners, Credo Ventures, Earlybird Venture Capital .

PYMNTS

FEBRUARY 20, 2018

Regulators, banks, customs, shipping, logistics and FinTech companies need to work together to inform new regulatory, legal and technical standards.”. There are a number of reasons behind the shortage in financing, one of them being the impact of regulatory and compliance requirement since the financial crisis,” Ramadurai explained.

PYMNTS

NOVEMBER 14, 2016

Two-thirds of businesses lack confidence in their company’s security measures , found the latest analysis by Accenture. According to researchers, reduced production cost, greater efficiency, compliance demands and other factors are top reasons why medium-sized enterprises are flocking to ERP software. Brexit vote.

FICO

MAY 20, 2022

With my colleague Prasanth, we put together a toolkit in FICO Business Outcome Simulator (BOS) to allow capital model managers quick access to explainability of their new machine learning algorithms. Download FICO Comprehensive Support for Basel II Compliance. Quick Access to explainability for machine learning models.

CFPB Monitor

JUNE 11, 2019

Involve a business model, delivery mechanism, or element that may require the applicant to be licensed or authorized to act as a financial institution or other entity regulated by the Utah Financial Institutions Act. The size of transactions involving money transmission are similarly regulated on a case-by-case basis.

CB Insights

JULY 16, 2017

Amid the influx of capital to both auto tech and supply chain & logistics tech , it’s no surprise that trucking tech startups — which sit at the juncture of these two trends — are drawing investor interest. Accel Partners India, Flipkart, Sands Capital. Agility, Goldman Sachs, Lumia Capital, Valor Capital Group.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content