How To Let Borrowers Choose the Wrong Loan Structure

South State Correspondent

APRIL 9, 2024

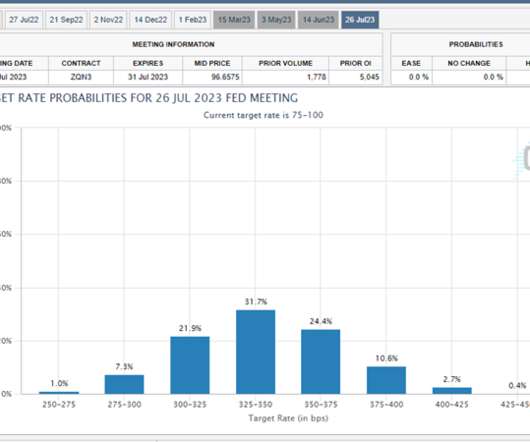

We estimate that the average contractual loan commitment for term credit at community banks has decreased from just under five years in 2022 to just under three years currently. Community banks should carefully consider the prudence of such a strategy from both a risk and revenue perspective. cuts through the end of the year.

Let's personalize your content