Will eSports And Other Online Businesses Spike Digital Taxes?

PYMNTS

JANUARY 17, 2020

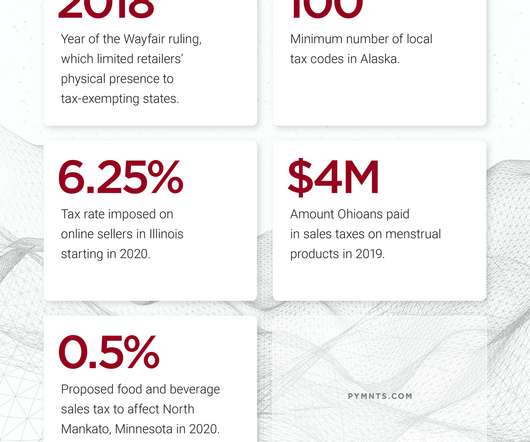

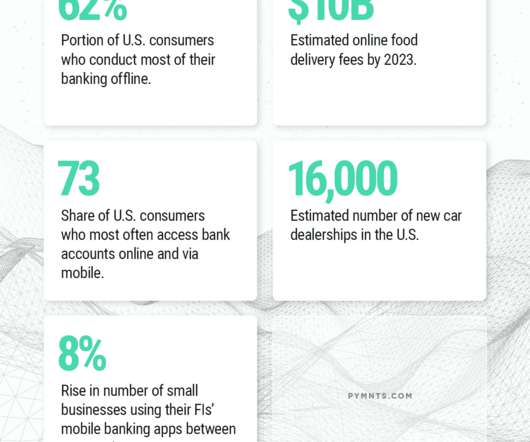

Historians and economists regularly look to tax policies to get a sense of what happened within a particular industry, society or country. No doubt the chronicles to come about the rise of the internet age and the spread of digital culture will include serious treatment of tax issues. Taxing Confusion. billion in 2022.”.

Let's personalize your content