Amazon (And Others) Brace For India’s New eCommerce Tax

PYMNTS

FEBRUARY 10, 2020

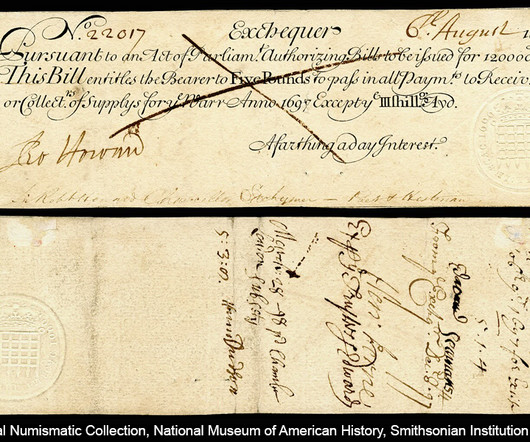

The jousting over eCommerce taxes — especially for U.S. Last week in India, the government proposed a tax on eCommerce transactions that will likely increase operating costs for sellers large and small. The tax, technically known as “Tax Deducted at Source” (TDS), is sent directly to an account held by the central government.

Let's personalize your content