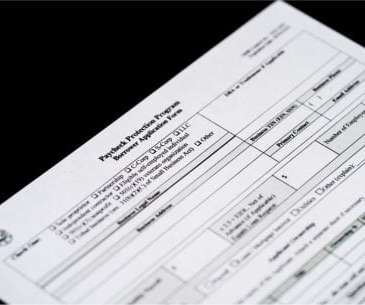

Spotlight on lending: Preparing for Q3 bank reports

Abrigo

OCTOBER 27, 2014

bank and credit union, on total loan growth quarter over quarter paint a picture of the state of bank lending leading up to the third quarter. Over this four-year period, the data showcases a steady increase in bank lending. Bank loans in 2014 have seen some fluctuation, with Q1 lending down from the previous quarter (to $7.65

Let's personalize your content