The pro-cyclicality of capital ratios and credit supply, a tale of two sizes

BankUnderground

APRIL 28, 2023

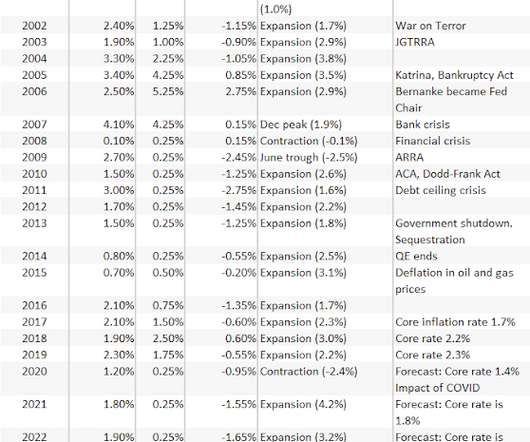

First, analysing years up to 2009 can be used to measure the cyclical patterns in a less regulated environment, providing evidence on whether Basel III needed cyclical components. Second, expanding the analysis beyond 2009 provides evidence on whether Basel III addressed the pro-cyclicality of bank capital and lending.

Let's personalize your content