The pro-cyclicality of capital ratios and credit supply, a tale of two sizes

BankUnderground

APRIL 28, 2023

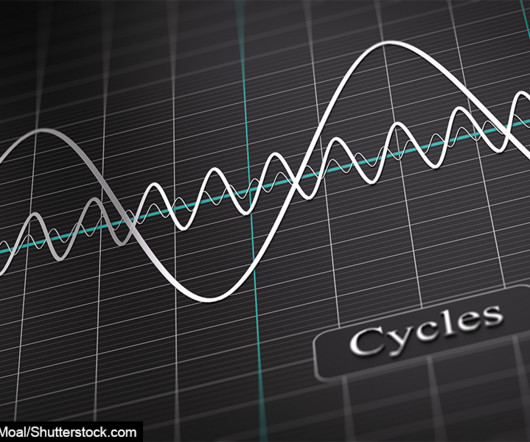

This post investigates whether large and small banks in the UK and US differ in the cyclical patterns of capital positions and credit provision. The reforms aimed to ensure that banks have sufficient capital resources to absorb losses and reduce the cyclical effects of bank capital (and regulation) on the supply of bank credit in stress.

Let's personalize your content