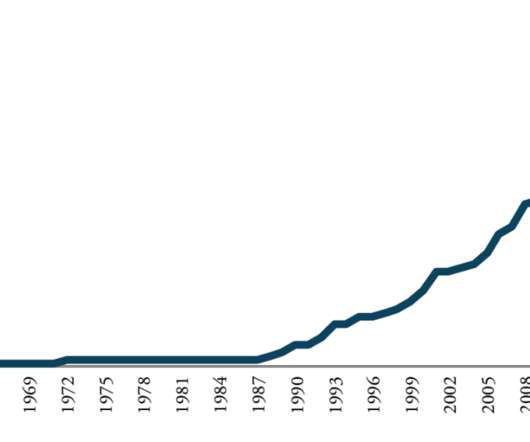

Banking regulator Sam Woods: ‘This is the most intense period since the 2008 financial crisis’

TheGuardian

SEPTEMBER 23, 2023

In an exclusive interview, the head of the Prudential Regulatory Authority talks about Credit Suisse, the gilt market meltdown – and stress-testing banks for the climate crisis • ‘Terrible climate events happen all the time’ Sam Woods’s 20th wedding anniversary was more eventful than he’d expected. Continue reading.

Let's personalize your content