Capital One Launches Savor Card For Foodies

PYMNTS

OCTOBER 17, 2017

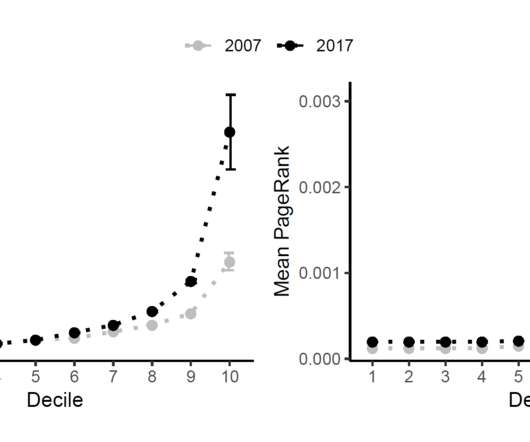

17) Capital One announced news of its Savor Card , a cash back credit card that gives foodies cash back rewards on dining, groceries and general retail purchases. Card at Capital One. Since 2007, restaurant spending has increased by 59 percent. . In response to growing consumer food and dining spending, on Tuesday (Oct.

Let's personalize your content