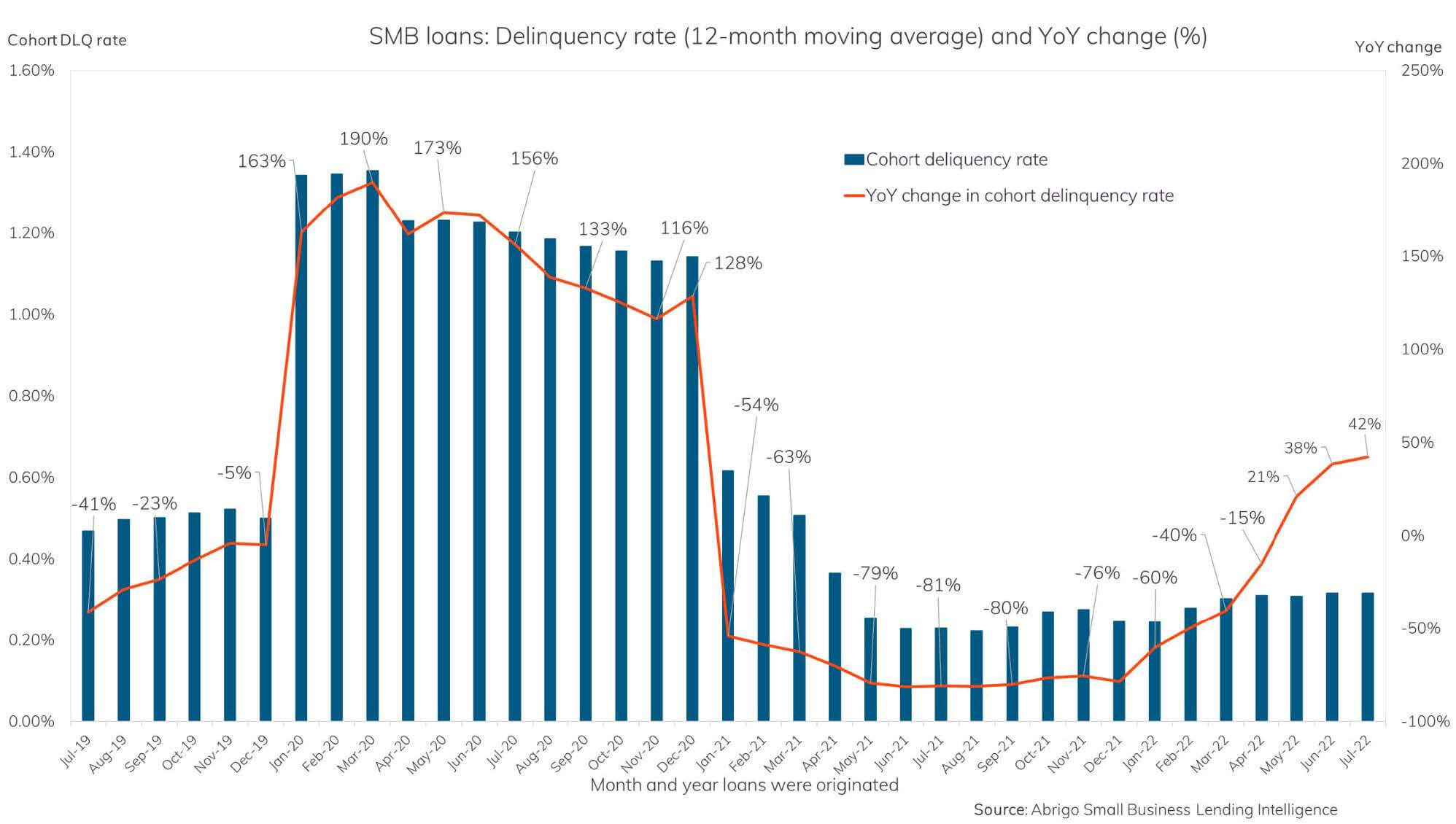

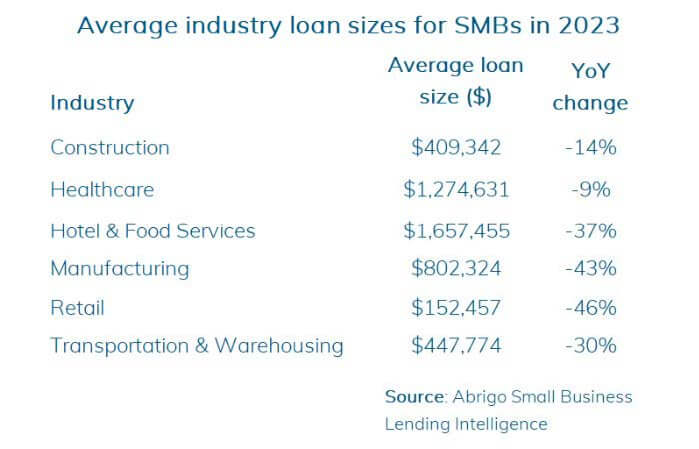

SMB Lending Insights is a snapshot of current financial trends and metrics that impact small and medium-sized business (SMB) lending and financial institutions.

The report is based on data from Abrigo Small Business Lending Intelligence, a lending decision and monitoring engine powered by Charm Solutions. Abrigo Small Business Lending Intelligence uses observations from Abrigo's client base of over 2,400 U.S. institutions to provide a comprehensive representation of the banking and financial sector. Data in this report is current as of Q2 2023 and is representative of market trends and conditions at the time of publication. The average size of loans examined here was $637,000.