Concerns around credit quality are on the rise as financial institutions across the country look to understand how work from home, high inflation, and rapidly increasing interest rates have impacted the portfolio. A key component of understanding and reacting to these concerns is the loan review function. Acting as the last line of defense, it is crucial to have an effective process in place.

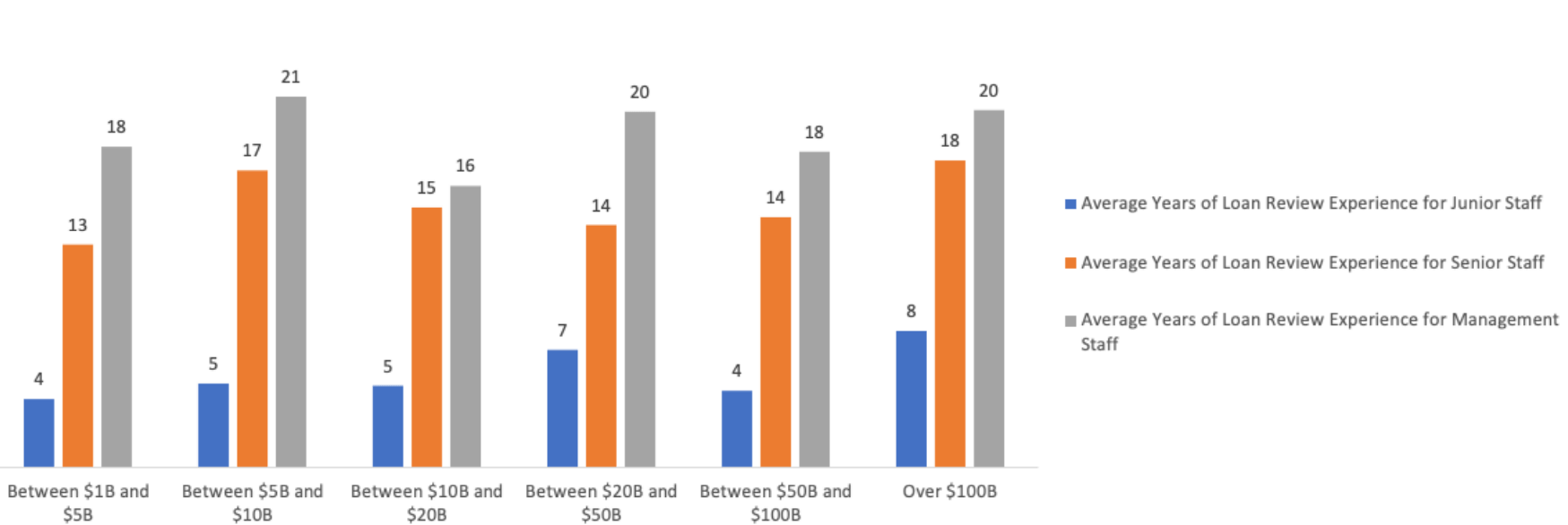

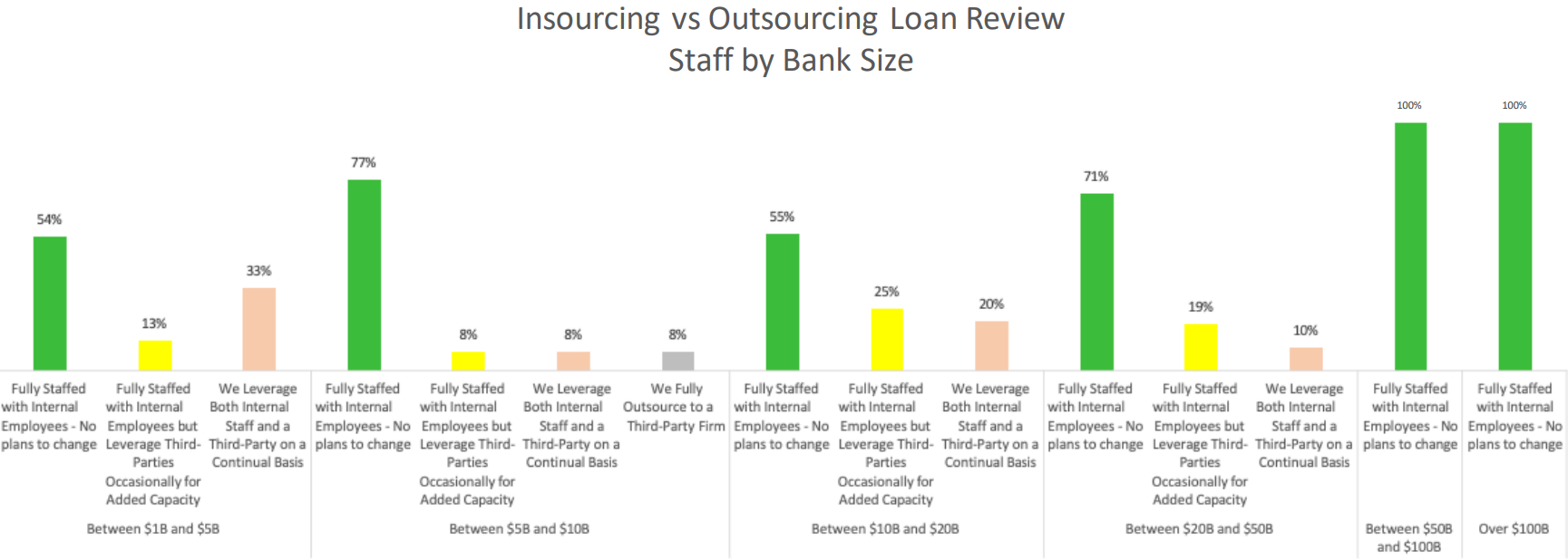

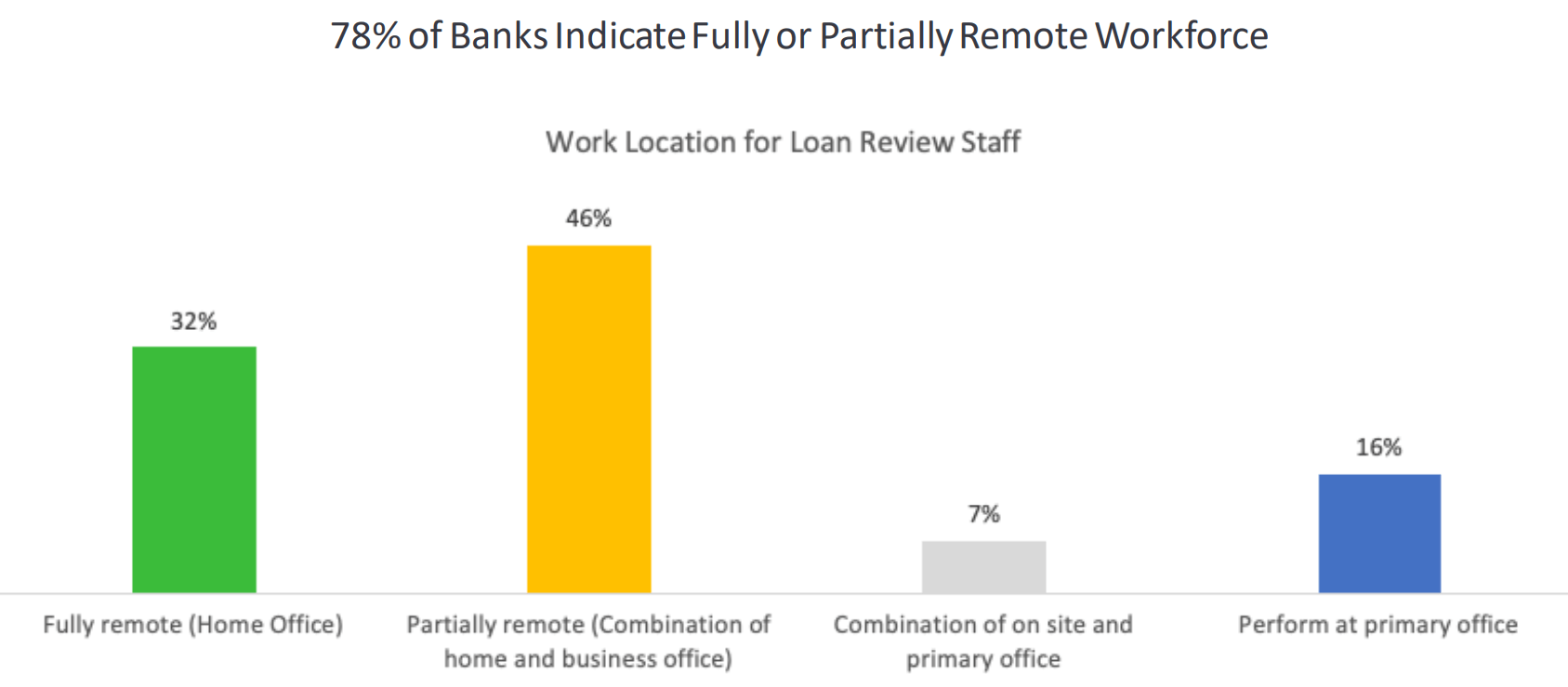

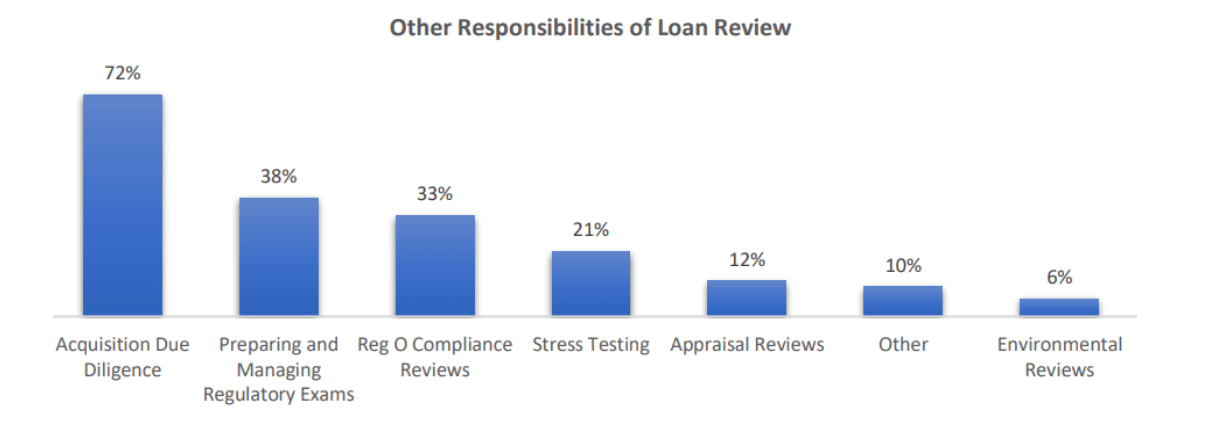

For over a decade, DiCOM Software, now Abrigo, has surveyed loan review professionals to uncover challenges they often face. Recent trends highlight four critical areas that banks and credit unions can evaluate to gauge the efficiency of their loan review departments: staffing, collaboration practices, job responsibilities, and talent development. Examining these areas is a good starting point for your financial institution to optimize its processes and maximize existing resources.