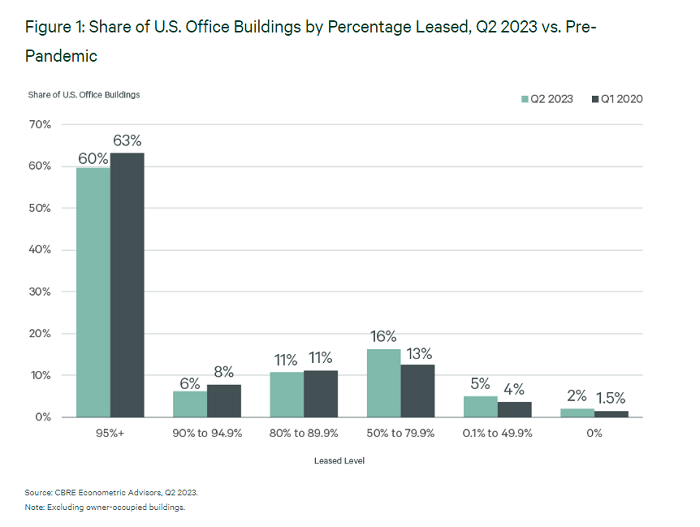

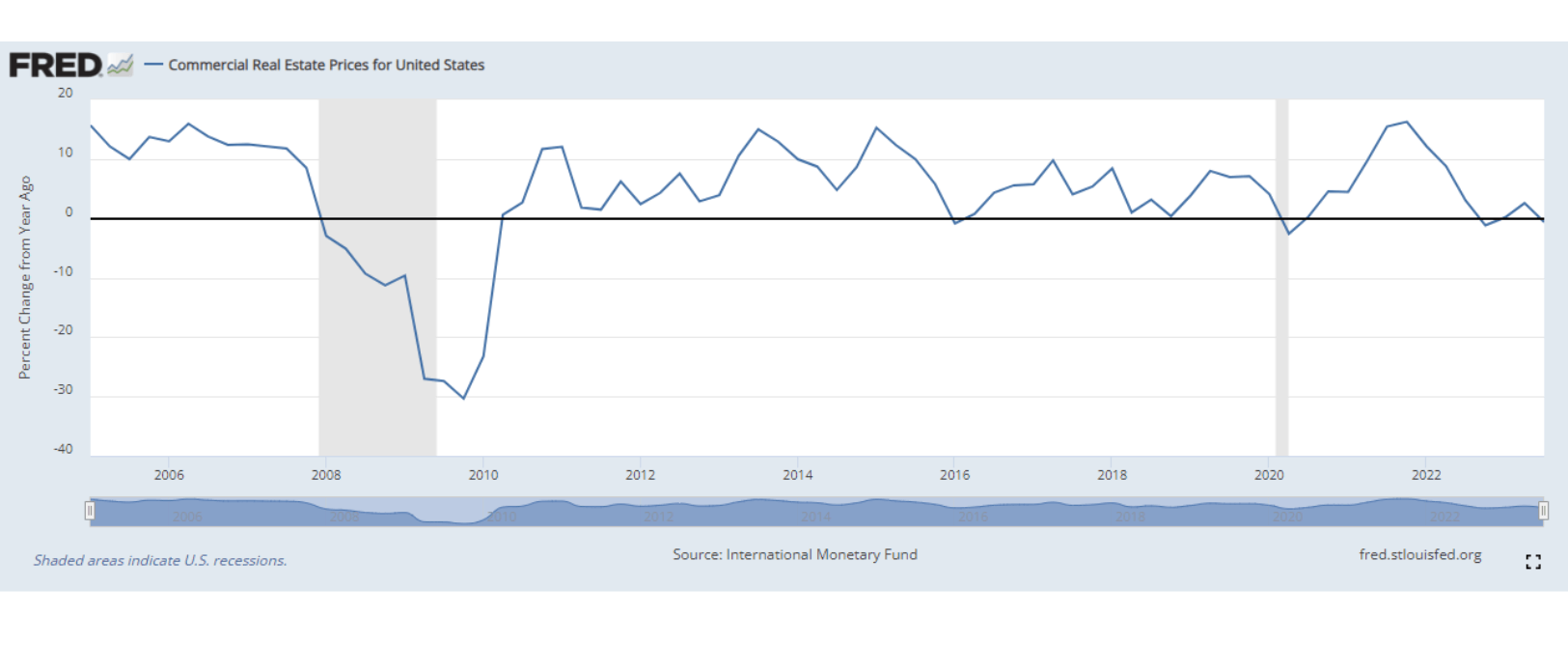

The commercial real estate (CRE) landscape is in constant flux, but in recent months, several indicators signal shifts in risk and opportunity for financial institutions.

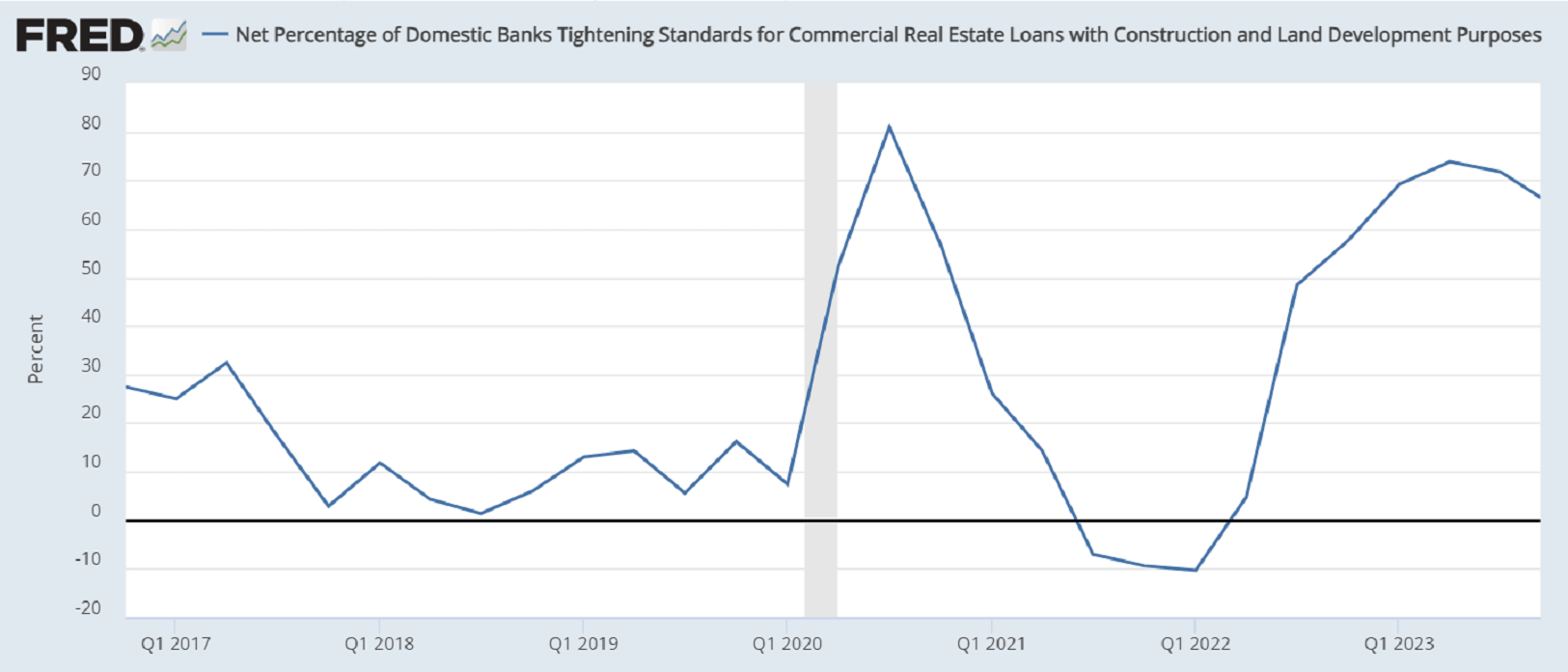

Effective CRE risk management at a bank or credit union involves a dynamic approach that adapts to changing market fundamentals. This approach to managing commercial real estate risk prudently includes setting and periodically adjusting concentration limits for different products and markets.

Reducing exposure levels may face resistance from managers and loan officers concerned about short-term earnings. However, when CRE lending is a significant revenue source, failure to adjust concentration levels amid warning signs can lead to excessive loan losses. The severity of these losses depends on loan underwriting quality and the depth of the downturn in the CRE market or specific segments of it.