Get These EOS Tools for Banking

In the last article, we covered the basics of EOS (HERE), the Entrepreneurial Operating System, and how some banks use it to improve productivity. EOS is a comprehensive business system that empowers a leadership team to run a more successful bank. EOS comprises a series of tools and concepts that guide leaders in managing and optimizing their operations. One of the framework’s strengths is the robust tool kit available to bankers. While a bank may not want to adopt all of EOS, many use part of the system and use some of the tools. In this article, we break down some of the more popular tools and talk about how to use these tools to boost productivity.

Basic EOS Tools – The Scorecard

The Scorecard is a tool that helps banks track key performance indicators (KPIs) that give a pulse on the bank’s health. These numbers are the weekly measurements that let you know, at a glance, how each section of the bank is doing and the whole organization. Metrics should be waiting to include a heavy dose of “leading indicators” that foreshadow the probability of obtaining the objective. It’s not about delving deep into the minute details of every aspect of the bank, but instead, it’s about having a high-level view of the critical metrics that matter most.

As discussed in the last article, the key is to tie each of the bank’s objectives to a global set of KPIs and then ensure each department, division, product line, function, and other unit has KPIs supporting the bank. If “service” is a differentiating factor, each business unit should have a service measurement.

Here are reasons banks use an EOS Scorecard:

- Predictive: The Scorecard allows the bank to predict issues before they become significant problems, such as credit, liquidity, or poor service. This will enable you to take corrective actions promptly and avert potential issues.

- Accountability: The Scorecard assigns each metric to a team member, enhancing accountability. It allows for visibility into who’s responsible for what, fostering an environment of ownership and responsibility.

- Consistent Tracking: The Scorecard provides a consistent, objective, and simple way to track your bank’s health weekly. It helps to bring focus to the team’s work and maintains everyone’s alignment with the company’s goals.

- Data-Driven Decision Making: The data accumulated through the Scorecard allows leadership teams to make more informed, data-driven decisions. Having weekly data supports experimentation so that banks can try new products and programs to see if the new initiative improves the scorecard.

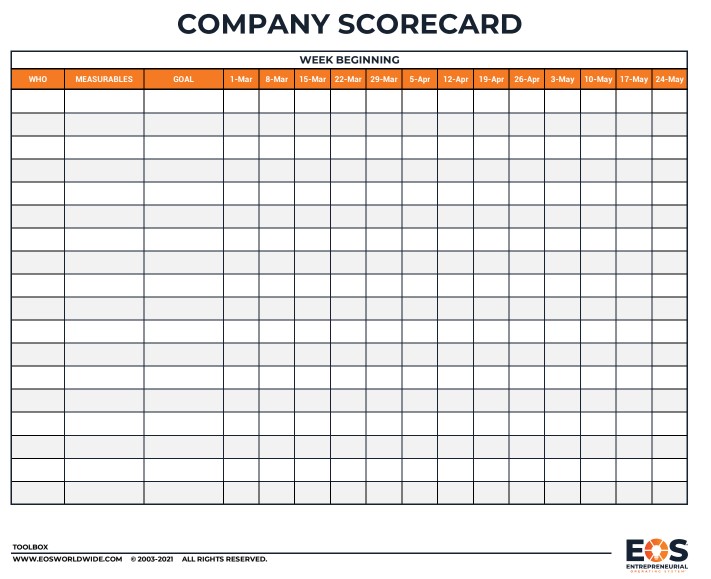

The format of a Scorecard typically includes the following:

- The name of the function/department.

- The person is accountable for that function.

- The weekly numbers/goals to hit for that function.

- The actual results for those numbers/goals.

- A record of the results from past weeks to track progress.

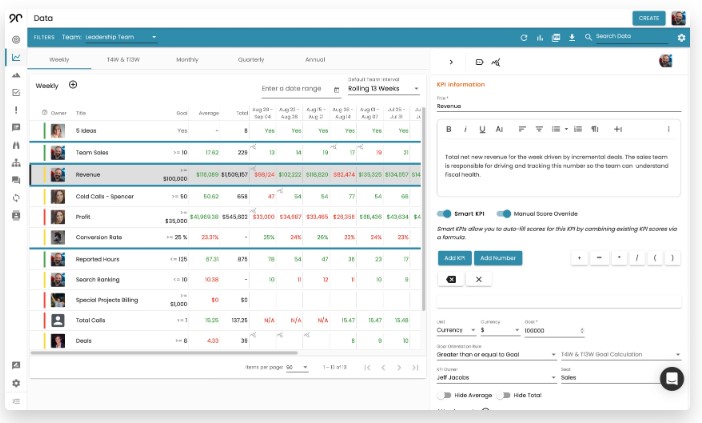

Banks can use the generic one like the one below or can subscribe to software such as Ninety that handles a more advanced version like the second graphic below.

The key to a good Scorecard is to identify the vital numbers that give you a quick, accurate impression of the health of your business. These numbers will vary from company to company, depending on the industry, business model, and organization’s specific goals.

Conducting an Effective Meeting – The L10

You have undoubtedly been bored on a Zoom call and counted up the cost of an internal meeting. It is staggering how much banks spend. According to the last Readytalk survey, bankers spend an average of 33% of their time in meetings having 62 meetings each month for 31 hours of questionable productivity. This average cost is $338 per meeting for a $ 1B asset-sized community bank. Part of the problem is that 63% of bank meetings are conducted without an agenda or set of objectives.

The L10 Meeting is a core part of the EOS. “L10” stands for “Level 10,” suggesting the aim to make every meeting a 10 out of 10 in terms of effectiveness. The basis of the L10 is a project or staff meeting, but the format can be adjusted to handle almost any type of meeting.

The structure of an L10 Meeting is as follows:

- Segue (5 minutes): Opening, setting the tone, sharing good news, stating the objectives, and providing meeting background.

- Scorecard Review (5 minutes): Review your team’s or project’s scorecard, and if any metrics are off-track, drop them down to the issues list.

- Big Rock Review (5 minutes): Review your team’s “big rocks” (quarterly goals), and if any are off-track, drop them to the issues list as well.

- Customer/Employee Headlines (5 minutes): Share any critical news or updates about the project, customers, or employees. Add any issues to the issues list.

- To-Do List Review (5 minutes): Review the last meeting’s to-do list, check off those completed, and move any incomplete items to the issues list.

- IDS (Issues Solving) (60 minutes): “Identify,” “discuss,” and “solve” (IDS) the most critical issues from the issues list. The majority of the meeting time is spent here.

- Conclude (5 minutes): Recap your to-do list, rate the meeting, and end on time.

Banks and financial institutions, like any other organization, can use the L10 Meeting structure to make their meetings more productive and efficient. Specifically, this can be the benefit:

- More focused discussion: The L10 format allows for a more streamlined and concentrated debate, reducing the chances of meetings veering off-topic.

- Action-oriented: The to-do list review ensures that action items are remembered, improving accountability within the team.

- Problem-solving: The IDS process encourages problem-solving at the root cause, which could be particularly beneficial in risk management, addressing customer complaints, or improving operational efficiency.

- Team alignment: Regular updates on “Big Rocks” (primary goals) ensure everyone knows the priorities and how the team is progressing.

- Efficient use of time: With time allotted for each section, meetings are more likely to stay on schedule and end on time.

By using the L10 Meeting structure, banks can work through issues more effectively, keep everyone on the same page, and continuously improve their operations. It can be beneficial for managing various departments within the bank, from customer service to risk management, ensuring that everyone is aligned with the bank’s objectives and is working effectively towards them.

The Accountability Chart

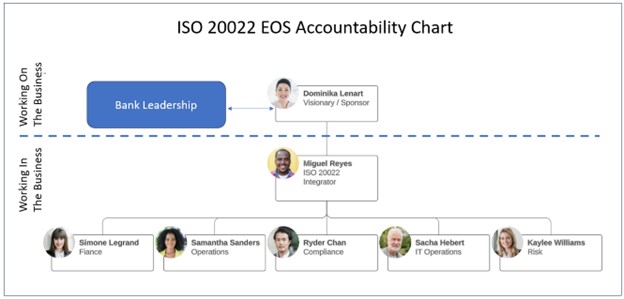

While every banker is familiar with an org chart and with the concept of assigning accountability, few put it on a single chart for an initiative. As a result, teams are often unclear about who is responsible for what when it comes to a product, process, or project. Take the recent Libor-to-SOFR index conversion effort or the integration of the new ISO 20022 standard. Since both these initiatives cut across multiple departments, accountability can be murky – is it the head of the line of business? The project manager? The COO?

An accountability chart solves this problem by showing the ONE person who is responsible for a specific function.

Strategic Planning: V/TO

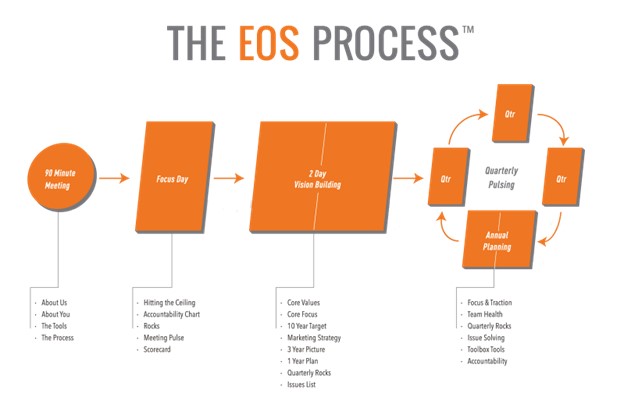

In EOS, a standard procedure is the annual two-day strategic planning offsite. Here, most banks are used to a strategic planning process. However, an EOS strategic planning session differs in several ways:

- The planning process is built around the Vision/Traction Organizer (V/TO), a two-page updated business plan for the bank (A Google Doc template can be found HERE).

- The planning process includes a one-year, three-year, and ten-year time horizon. This forces participants to think both in the short and long term.

- The process forces the prioritization of initiatives.

- The process includes a marketing strategy.

Putting These EOS Tools into Action

EOS serves as a dependable framework for bank growth and performance. Like any other framework, EOS takes time to learn, understand and develop. EOS must be ingrained in the whole bank’s culture for it to be truly effective, and it requires everyone in the organization to want to improve and be vulnerable to constructive criticism. Some banks are not built for this.

Bank culture must evolve into an organization that consistently simplifies and prioritizes. There needs to be a need to systematize what you can and undergo constant process improvement. Leaders need to focus on managing the process and the structure and then step out of the way to let staff create and execute.

This commitment does not guarantee a smooth process; it requires the alignment of all stakeholders, which may trigger disputes. Thankfully, the EOS methodology underscores the necessity of identifying and addressing such challenges, providing tailored solutions for these inevitable occurrences.

To learn more about EOS, check out the foundational book and best-seller: Traction.