I find it interesting as we move towards Open Banking and Open APIs through regulations at both the UK and EU levels. The push is for data sharing with trusted third parties with user consent. All well and good, you would think, but several surveys point to it not being quite so rosy.

The typical report cites consumer lack of trust as the issue, and that they wouldn’t feel secure having their data used by any third parties, even ones the banks trust. This was documented in The Telegraph where some discussions of their recent future of FinTech conference is covered (I chaired the session on Open Banking).

According to the newspaper, two-thirds of consumers in the UK say they won’t share their financial data with a third party, and more than half (53%) say they would never change how they bank. This is a fairly luddite view, and reminds me of people who say they would never use mobile payments but are happy to have Apple in-app and iTune purchases run away on their phone, or paying by credit card for their Uber rides. These are mobile payments, but you just don’t see it this way.

Similarly, consumers will enjoy the ease of use of Open APIs to live their lives without cash and coins. They just won’t realise that they’re using Open APIs when their Facebook marketplace purchase is checked out with a swipe or their online donation to charity is made through Stripe.

However, there is a serious point to this, which is that (some) consumers are really nervous about money and wouldn’t enjoy their bank exposing them to risk. This is why some don’t even use online banking, let alone mobile banking.

For example, in the UK, Lloyds, Barclays and the Royal Bank of Scotland (RBS) have around 8 million, 5.7 million, and 4.2 million mobile banking customers each, respectively. However, between them, they serve almost 80 million accounts and so 18 million mobile banking customers is around 25% of the customer base. This means that 75% of UK consumers still don’t trust mobile banking, even though it’s been around over five years. The first mobile banking app was launched by Barclays in 2012.

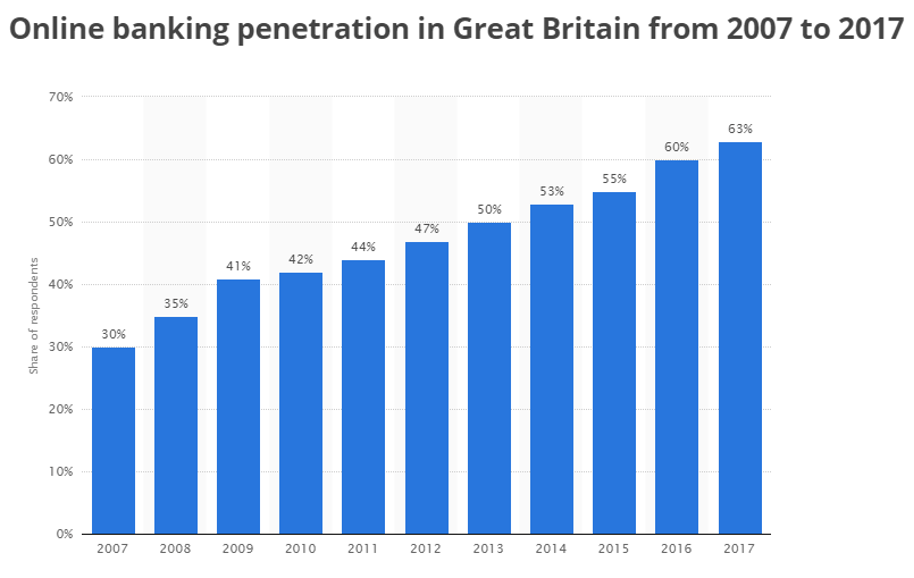

Even more notably, a third of UK bank customers don’t even use online banking today.

What I often feel is that the technologists believe far more in banking technologies than the users. Yes, there is a large crowd of people who like the FinTech start-ups such as TransferWise, Atom and Monzo. But there are a far larger crowd of people who don’t, and it’ll take time to educate them to change before they do.

This is why it is imperative for financial pundits to show people the benefits and incentives for switching to new technologies and trusted third parties, rather than just sitting and waiting. Rolling out new apps is all well and good, but if the majority of customers miss the point, then things will stay the same.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...