The Federal Reserve Board recently released hypothetical scenarios for 2023 capital stress tests on banks subject to Dodd-Frank Act Stress Test (DFAST) requirements. However, community banks can also leverage the DFAST stress test scenarios to benefit their planning, strategy, risk management, and communications with regulators and investors.

Purpose of Fed stress tests

The purpose of the Fed’s stress tests is to assess the ability of large banks to weather economic shocks and ensure they have enough capital to continue operating in a difficult environment.

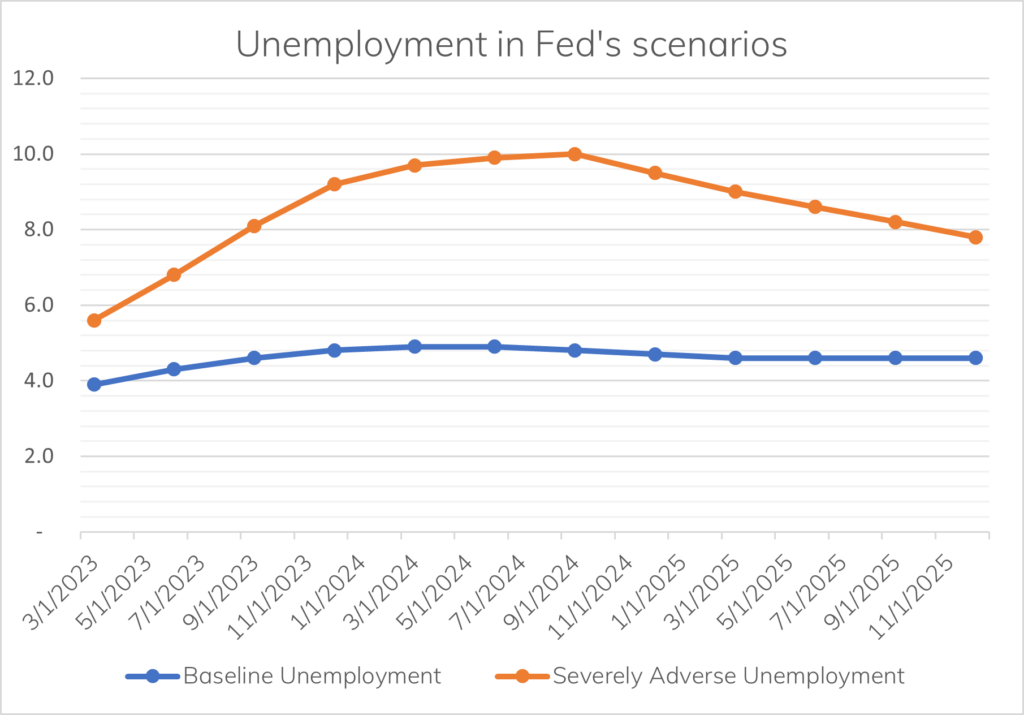

The economic stress tests evaluate banks by estimating losses, net revenue, and capital levels under hypothetical recession scenarios extending two years into the future. The results are crucial in determining the adequacy of large banks’ capital planning processes. They’re also vital to ensuring the stability of the U.S. financial system. Finally, this capital stress testing using these Fed scenarios helps ensure that large banks can continue to lend to households and businesses even in a severe recession.