Steal This 5-Step Banking Innovation Playbook from Gentle Monster

For inspiration in banking innovation, we often look to other industries. Honkook Kim and his Gentle Monster Brand is a perfect example. With financial hardship, competition from dominant players, and a startup budget, Gentle Monster faced many of the same challenges as a community bank. Instead of thinking traditionally, Gentle Monster pursued a strategy of innovation and creativity to become the hottest sunglass company globally, creating a company currently valued at $900 million. This article highlights Gentle Monster’s five-step process that might change how you look at the future.

Gentle Monster Background

Founded in 2011 by Kim, Gentle Monster initially struggled to break through against large brands like Luxottica which controls an estimated 30% of the US market, and is behind almost every single designer eyeglass brand you can think of, including Ray-Ban, Oakley, Armani, Ralph Lauren, Chanel, Prada and many more. Gentle Monster struggled for shelf space, struggled to get recognized, and struggled with unit economics. Being months away from bankruptcy, Kim launched a bold five-step plan driven by a strategy around innovation.

The Banking Innovation Playbook – Step 1: Find a Niche

Kim looked at the market and knew he needed traction in at least a single segment where he could create a brand and a following for Gentle Monster. He chose to compete in the women’s luxury segment and looked for a gap in the market. At the time, Luxottica was taking advantage of the small glasses trend, as seen in the picture on the left. Almost all their product were focused on either normal-sized functional frames or small fashion-forward frames. Gentle Monster bet women will want larger frames to create the illusion of a smaller face (right). Leveraging social media, Gentle Monster started to get traction.

How Banks Can Leverage: Niche markets abound in banking, and community banks are in the perfect position to create a following on a national level should they desire. Banks have successfully done this in the past, catering to small businesses (Live Oak), the military (USAA), HSA accounts (HSA Bank), political campaigns (Chain Bridge), or doctors (Physicians Bank). Companion accounts for seniors, payments, college athletes, high-risk industries, and many other profitable niches are untapped in banking. Find the gap in one segment and build success from there.

Step 2: Finding the COI

Gentle Monster wanted exposure, and celebrities, they determined was the fastest way to do this. While many brands direct message celebrities wanting exposure and get ignored, Gentle Monster went after centers of influence (COIs) as a side door. It told its story and provided samples to movie stylists, wardrobe coordinators, agents, friends of celebrities, and personal trainers. The tactic worked – in 2013, Gentle Monster’s oversized glasses were used to portray the main character of a huge Korean drama show. The brand became a global hit as a result, and soon, every fashion-forward woman wanted a pair of Gentle Monster sunglasses.

How Banks Can Leverage: While not exactly a banking innovation, banks can better allocate capital to COIs. Banks know how to target COIs well, but banks underestimate their COIs’ influence and often under-resource the effort. COIs routinely provide 25x the profitability of a profitable account, yet their allocated marketing budget is usually a fraction of what it is for other segments. COI marketing for banks should always be a top priority. Banks should extend their elite accounts, provide events, and conduct campaigns to tell the story of the bank and its capabilities to accountants, lawyers, tax professionals, trade association officials, and other groups rather than provide an outsized influence on a target customer segment.

One of the best tips we ever received was to target retiring executive managers from companies and trade organizations and offer them part-time work to advise and introduce the bank to their network. Pair the newly hired COI with an organized banker and the new accounts will follow. This tactic has paid off multiple times during our banking careers.

Step 3: Expand the Product Line and Capture Attention

Once the Company had firm traction in the female sunglass market and was profitable, it expanded to men’s wear. The Company then started to produce an array of innovative and experimental designs solely designed to capture attention, the most valuable commodity on earth. It worked.

These striking designs paid for themselves in media exposure. Many went viral on social media, which then captured the attention of A-list celebrities such as Beyonce, which further brought the brand to new heights.

Not only did these avant-garde styles capture free media, but they also served as product testing. Several designs, such as the “jelly” line (second from left above), were so popular that they were then mass-produced.

How Banks Can Leverage: The banking innovation here is prioritizing attention when creating marketing campaigns, partnerships, and new products. What is your bank’s research and development budget for new products? Likely, you don’t even have a line item for the expense. Banks are perhaps one of the slower industries that introduce new products, but it doesn’t have to be like that. The first question is, what must you change to provide innovative products – talent? A modern core system? A budget?

As a long-term strategy, banks should consider how they will be able to deliver new products faster in the market and then work backward to see what they need in place today.

NuBank, out of Brazil and one of the hottest banks in the world in terms of new customer growth (Our previous playbook HERE), introduced 23 new products last year. Some of these products include: A Braille debit/credit card for the visually impaired, insurance with 24-hour support, a lending line secured by a pension, a credit line collateralized by safe deposit box & lock box contents, a verified call feature that confirms when a bank is calling and not a scammer, free toll tags for high-net-worth customers and more.

NuBank has generated unprecedented customer growth on the back of their marketing, customer experience and new product design strategy. None of their products are all that innovative but together they deliver incremental improvements that capture various market segments.

Step 4: Use Partnership to Expand

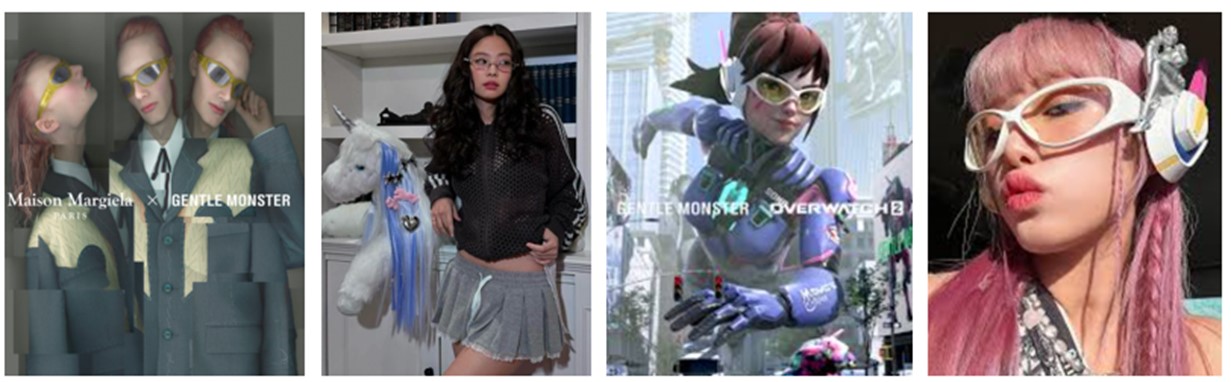

Then there are Gentle Monsters’ collaborations. This is another pivotal way that the brand expresses its creativity and energy. They partner up with everything from big fashion houses like Maison Margiela of Paris to video games like Overwatch to celebrities like Jenny from the music band Black Pink. For Overwatch, Gentle Monster produced only 300 pairs (bottom right images) that sold out in 15 seconds.

Gentle Monster uses partnerships to get exposure to potential customers, produces a limited supply of creative products, and then uses the lack of supply to create demand for more mass-produced and profitable products.

How Banks Can Leverage: Many banks would scoff at such expense of going through the trouble of a partnership and new product production for such limited qualities. However, Gentle Monster uses the tactic to showcase its unpredictability and when combined with limited supply of the partnerships, the tactic creates its own hype cycle. For a $1mm investment, Gentle Monster gets an estimated $5mm in value.

Banks could explore creative ways to produce financial products in conjunction with companies, municipalities, celebrities, and local organizations. Teen banking app Step did it successfully with Charli D’Amelio, Klarna did it with Snoop Dogg to result in 16 million new borrowers, JP Morgan Chase did it with Square, and American Express Bank has a whole division devoted to partnerships and collaborations.

Step 5: Create Experiences

While most banks worry about their branch layout to optimize traffic flow, Gentle Monster took a whole different approach and optimized their branches for attention. Each store is closer to an art exhibit than a retail outlet. Each one of their stores explores a different theme designed to provoke an emotional response. In Los Angeles, it’s about the “Harvest” with sculptures of hay, dirt, and wood. In New York, it’s “The Visitor,” where a life-size robot of an old woman takes shoppers on a journey through her memories. The robot appears half asleep, moving between dozing off and waking up. The installation is brilliant, which is why it is routine to see lines around the block. Not only have Gentle Monster stores become “must see” attractions, but each store provides the perfect social media post to further spread the brand.

Gentle Monster employs 100 people just focused on store design. It’s amazing how the Company chooses creativity and storytelling over the rules of what a retail experience should be. Usually, brands will prioritize the efficiency of the shopping experience to maximize sales whereas Gentle Monster prioritizes the experience. You leave the store feeling changed and emotionally closer to the brand even through you may know little about the product. Now compare that to other luxury brands, where they pretty much kick you out if you’re not going to buy anything.

How Banks Can Leverage: Banks already think they spend too much on branches. Should a bank pour another $10mm into each branch? Maybe.

Consider that it is common for a Gentle Moster store to have an average foot traffic of 1,600+ guests per day. Suppose a bank converts 400 of those customers into new accounts with an average profit of $230 per year (considering all their retail accounts). In that case, that is a return of $92,000 per day or a breakeven period of 4.7 months, including an annual operating cost. Add cross-selling, the value of current customer retention, and social media, and this might be your new branch model.

The banking innovation here is to prioritize the emotional connection to the bank’s brand instead of hitting customers with product attributes. Creating experiences pays off if done correctly. Banks are good at creating an intellectual connection with their customers but notoriously poor at generating emotional bonding.

Putting This Into Motion

If you think that this approach can’t work for banking, you should also know that Kim has taken this approach with success in other industries including a cosmetic brand called Tambourines and a dessert company called Nudake (@Nu_dake on IG). At Nudake, the cashier will often challenge you to a game of rock-paper-scissors. If you win, you get your pastry for free. That small act generates more foot traffic and shareable content than its cost by a factor of five.

The overarching key takeaway in this article is for banks to use creativity to garner attention. Gentle Monster understands the power of the experience. They packaged those Jelly sunglasses above in an oversized bag of gtype candy bag as they shipped them to influencers. The packaging itself went viral.

To sum Gentle Monster’s tactic up – don’t be boring. Find a practical gap for your product and gain traction. Create content that tells a story in a creative way and make the message about the experience. Gentle Monster’s marketing is more about being thought-provoking than it is about promoting any products. As a result, their content gets so much further in reach. Ironically, by NOT talking about your product and spending your marketing dollars creating an emotional connection with the bank’s brand, customers will get much more interested in the products.

Banks need to get their target customer audience involved with their brand. Gentle Monster constantly looks for ways to activate their customer base.

If you are wondering how you will find the creative talent to pull this off, consider that Kim was once asked about his goal for Gentle Monster. He said he wants the Company to be publicly traded on the stock market, but not for the reason you might think. He wants to go public because he wants his employees who own shares in the Company to share in the success of Gentle Monster. He wants every employee to take their equity in the Company and buy a house. It is hard to fail when you have culture, talent, and creativity.