6 Concepts Borrowers Must Understand About The Lending Curve

Most borrowers have a rudimentary understanding of interest rates, the yield curve, forward rates, and forward premiums. Commercial bankers are trusted advisors and have a unique opportunity to understand their client’s specific financial and personal situations, explain the basic concepts of capital markets, and offer prudent and objective advice to help customers reach their goals. Commercial lenders should not try to help their clients predict future interest rates because that is impossible and does not create value for the relationship. But, lenders should be able to show borrowers the current state of the market and the market’s expectations about the future and explain the variability around future expectations. There are six concepts that commercial lenders must be able to convey to their borrowers to help them make the correct financing choices.

The Concepts

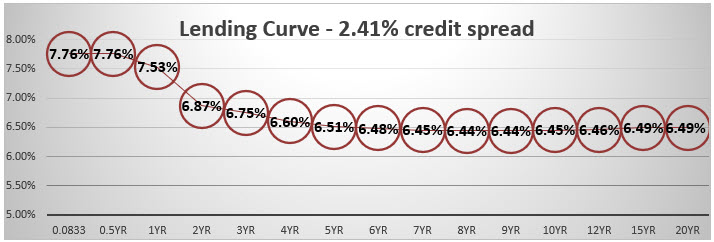

- Lending Curve: A yield curve shows interest rates associated with different contract lengths for a particular interest rate instrument. There is much discussion about how the yield curve’s shape predicts the economy’s future strength. While economists may use the shape of the yield curve to gauge future economic strength, bankers should pay particular attention to the lending curve. The lending curve shows borrowers’ loan coupons for different terms. The lending curve is currently highly inverted and strongly determines borrowers’ demand for loan structures. Bankers who understand how the lending curve drives borrowers’ motivation can gain an advantage relative to the competition. The graph below shows the lending curve from one month to 20 years. It shows the average commercial loan rates for different terms. While individual commercial loans are priced non-uniformly depending on credit quality, loan size, cross-sell opportunity and overall relationship, the curve below assumes a $1mm, bankable credit, with the current average community bank credit spread of 2.41%.

Commercial bankers should be able to show a graph similar to the one above or some other format to help borrowers understand the shape of the lending curve. Our capital markets team can build this curve for our commercial borrower.

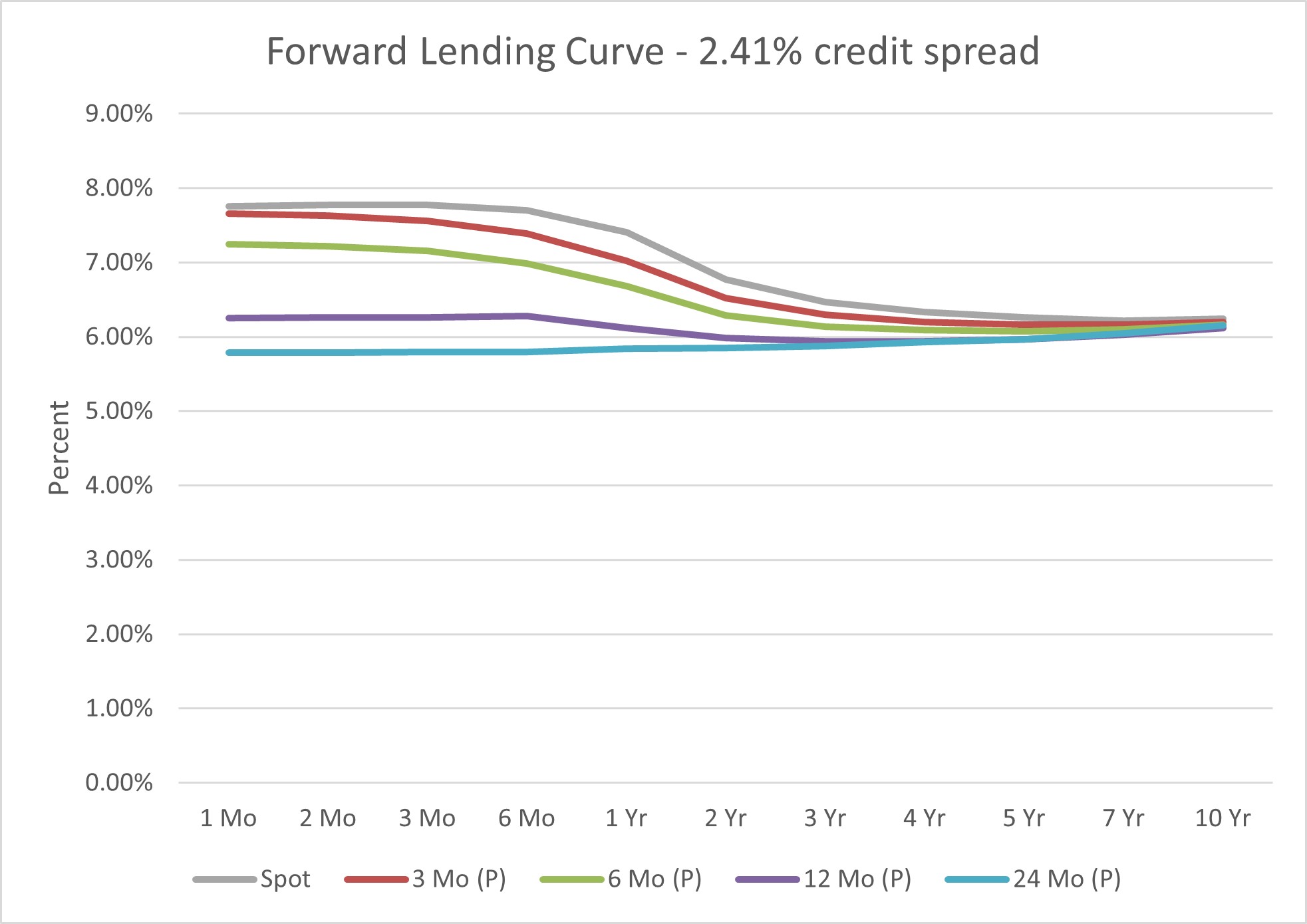

2. Forward Lending Curve: The lending curve can also be constructed for a forward period based on the market’s expectations. Therefore, while the lending curve shows the borrower’s loan rate for various terms today (based on a stated credit spread), the forward lending curve is the market’s expectation of the borrower’s loan rate for multiple terms in the future. The graph below shows the forward lending curve from one month to 10 years using the same assumptions we made for the spot (current) yield curve. This graph shows the borrower’s loan rate, based on the market’s expectations, 3, 6, 12, and 24 months out.

The graph above shows that the market expects interest rates to decrease in the next 12 to 24 months and remain relatively steady. Again, commercial bankers should be able to show a graph like the one above to help borrowers understand the market’s future expectations of interest rates. And again, our capital markets team can build and send this curve to you to share with your commercial borrower.

3. Locking forward rates: Commercial lenders with access to a hedging program can lock forward rates for borrowers. This would be advantageous where borrowers need financing in the future and find the lower forward rates compelling. This is especially useful for construction-through-perm loan structures, forward refinancings, and step-up loan structures (as detailed HERE) for current low-coupon fixed-rate loans.

4. Market’s prediction of future rates: No person can predict the future path of interest rates. The market is the best predictor of future interest rates, but it generally gets it wrong, especially during inflection points – before or after a recession or when the Fed Reserve is actively managing monetary policy. Lenders should be able to explain that forward rates can be locked today, but the actual forward interest rate environment is unknown. Lenders should be able to calculate the cost of financing based on the forward market and show borrowers a what-if analysis with the cost of financing if rates are higher or lower – because either outcome is equally possible by definition. Being able to show DSCR or advance rates for LTV with various dispersion in interest rates allows borrowers to make more informed decisions. Almost all borrowers make more money when the cost of financing decreases, but many borrowers become unbankable if interest rates are substantially higher. The best position for lenders is to offer different financing options that cater to the borrower’s balance sheet instead of the bank’s balance sheet. The option that reduces the borrower’s cash flow risk and increases profitability is probably best.

5. Lender as a trusted advisor: Lenders should resist predicting future rates as tempting as it may be. Lenders do not need a crystal ball to be valuable, trusted advisors to their customers. Instead, lenders need to be able to show current rates, the market’s expectations for the future, and analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future. The lender’s primary focus should be eliminating the borrower’s financing and credit risk. Lenders should also focus borrowers on the correct timeframe for making financing decisions. If a borrower has financing needs for the next three to ten years, then making financing decisions based on predicted interest rates for the next 12 months is not very useful for the borrower.

6. Lending curve and extreme events: The market is especially poor in predicting extreme events. These events are unforeseen by their nature – the market did not expect the great financial crisis and the pandemic. Extreme events, or even a plain run-of-the-mill recession, are challenging to identify and price into the forward lending curve. Most borrowers who try to outsmart the market by taking a view on extreme events or the timing of recessions are more often wrong than right, but many borrowers get a thrill in trying to out-predict the market’s forward view. Lenders should always point out that in a recession, liquidity is scarce, cash flow is compromised, and credit spreads widen. Trying to outwit the market by predicting extreme events is usually not a good strategy for borrowers.

Conclusion

There is a substantial amount of discussion about what interest rates and loan rates may do in the next 12 months and what the yield curve may or may not be portending for the economy. While that debate continues, bankers should pay attention to the lending curve because its shape drives borrower demand. Banks that have lending products that can satisfy borrowers’ needs for five to ten years will have a competitive advantage and will be able to generate higher profits. Commercial lenders that can master and visually demonstrate the six concepts discussed above may provide better service to their customers and be more successful in the long run.