Banking a niche comes with certain advantages. It usually offers an institution reduced competition, lower acquisition costs, and greater loyalty, albeit with a smaller group of account holders. But what happens when an institution needs to achieve scale? Must it give up those strengths?

Chicago Patrolmen’s Federal Credit Union, founded in 1938 to serve Chicago police officers and families, faced that challenge 10 years ago. But, instead of moving on from its niche, it has showcased how to successfully focus on a unique membership as a path to scale through expansion from one urban area to a national footprint.

The now nearly $600 million credit union offers a compelling case study for institutions looking for scale in a segment. Chicago Patrolmen’s has creatively personalized banking products and services through branding and messaging, but it’s also gone far beyond that to launch truly unique police officer products.

That personalization has powered Chicago Patrolmen’s into new relationships with individual officers and their families, as well as their academies, unions and fraternal organizations. And it has transformed the organization into the largest police credit union in the country by geographic reach.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Serving Unique Challenges for Police Departments

Conversations on scale, and how to balance it with a focus on membership, started in 2011, chief executive Scott Arney tells The Financial Brand.

The Great Recession landscape helped shape the urgency about scaling the credit union’s footprint, Arney says. Banking became much more regulated and technology-driven, which added significant new operating expenses for all financial institutions. And, Chicago, like numerous cities and municipalities around the country, struggled economically and that in turn limited the city’s ability to hire police officers.

Executives and the board at Chicago Patrolmen’s knew they needed diversification, even as they remained true to “the blue.” But, a leap straight to national from municipal would have been too large a first step, Arney explains.

Executives and the board at Chicago Patrolmen’s knew they needed diversification, even as they remained true to “the blue.” But, a leap straight to national from municipal would have been too large a first step, Arney explains.

Fortuitously, Chicago Patrolmen’s had launched a subsidiary — a credit union services organization — to originate mortgages for police families in 2008. It aimed to answer the question every police officer must consider: What happens to my family if I were to be killed in the line of duty?

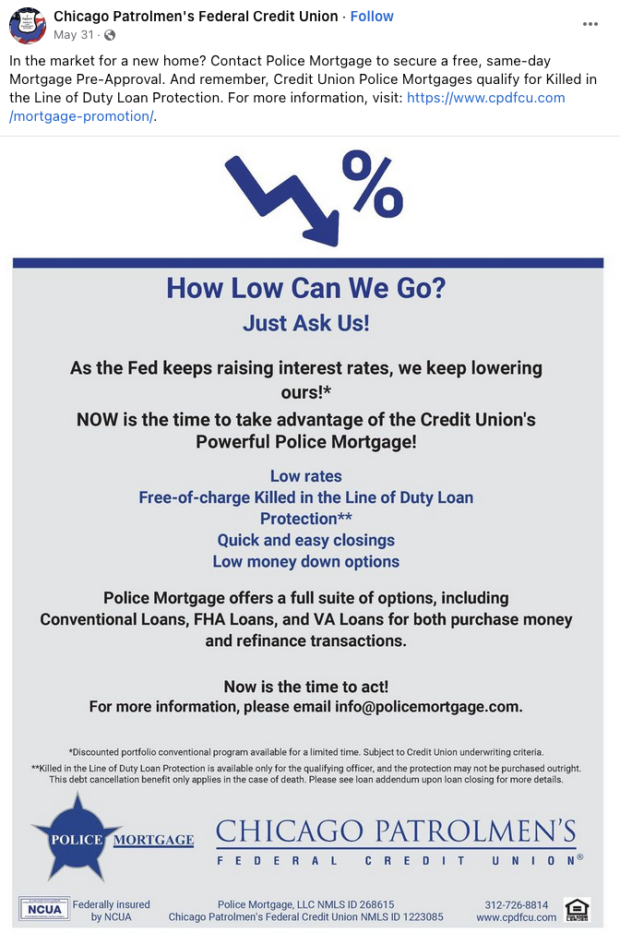

The CUSO had a very compelling answer: mortgages built for police officers. It is the only national lender to offer sworn police officers “Killed in the Line of Duty Loan Protection” for mortgage loans, Arney says. The program can cover up to $850,000 of loan forgiveness — sweeping away the mortgage and most other debt — should a police officer perish while on the job.

The idea originated from executives’ discussion with the other roughly 70 police credit unions nationwide, John Aretos, CEO of Police Mortgage, tells The Financial Brand. “We buy this coverage on the officer’s behalf. The rest of the time they’re on the job, they’re covered,” he says. “It brings them that peace of mind.”

Support from the Beginning

Everyone needs to borrow money for something during their lifetime, but police officers have a few more opportunities. Entering the academy is one example. Increasingly, cities do not provide cadets with equipment such as a firearm, handcuffs, a bullet-proof vest, or — upon graduation — their dress blues free-of-charge.

Enter Chicago Patrolmen’s “Uniform Loans,” through which cadets can utilize up to $5,000. And, because of this new loan type, lack of funds is no longer a barrier for people who want to become public servants. While these are just personal loans for a purpose unique to police officers, the credit union brings its mission through in another way:

“We will automatically approve them for that loan,” Jim Bedinger, president of the National Police Credit Union, a division of Chicago Patrolmen’s, tells The Financial Brand. “And we’ll do it even if they have poor credit.”

Because of the uniform loan, Chicago Patrolmen’s relationship with members starts at the academy door. “We help recruits when they’re coming on, then we can help them throughout their financial lives… using our other products and services designed with them in mind,” he says.

Explore other interesting unique loans:

- The 0% Loan: Why a Dozen Lenders Are Leaning into the Novel Idea

- How Bank of America Plans to Get a Jump-Start on EV Lending

That trust in members continues with the credit union’s “Write Your Own Ticket” auto loan, where it provides officers a blank check worth up to $49,999 to take with them when they’re vehicle shopping. Officers apply before they start shopping for a vehicle and must have a credit score above 700.

“We will automatically approve them for that loan. And we’ll do it even if they have poor credit.”

— Jim Bedinger, National Police Credit Union

If it sounds like a simple vehicle loan, consider the rearrangement of steps in the loan process and the impact on the experience. Members feel trusted by their credit union. How much more fun is it to go car – or more likely truck – shopping with a “blank” check? Additionally, Chicago Patrolmen’s get their foot in the door on member auto loans too; the member might otherwise have obtained financing at the dealership.

“As a police officer, you prefer to be the one asking questions,” Arney says. “If we can do something that puts our members in a position where they have a little more control over the [financing] process,” officers appreciate it.

Branding on other products follows the same theme: the credit union calls rotating loan and savings specials “High-Speed Chase” and “High Caliber.” The credit union also publishes the “Patrolmen’s Dispatch,” which provides financial news, information and resources curated exclusively for law enforcement families.

Promoting Financial Wellness to Police Officers

In today’s short-staffed departments, unlimited overtime comes with the territory, John Gordon, director of training and business development, tells The Financial Brand.

“We try to preach that overtime money and that side job money… you can’t be too dependent on that,” he says. “Policing is a risky profession, and overtime can vanish with even a minor injury.”

Financial education is an increasingly growing focus for the institution, says Gordon, who comes from a police family. This is because extra income from overtime, accompanied with the stress and risks of the job, can lead officers to spend – and borrow – at their capacity. To help them navigate their financial decisions, Chicago Patrolmen’s doubled down on financial education programs, both within the branch and at the academy.

“Police officers love toys, so auto loans, motorcycle loans, boat loans. It can become a ‘live for today’ approach to existence. We want to develop their understanding of how and where they spend money,” Gordon says. “We talk about budgeting, the importance of your FICO score, how to borrow money, mortgages and retirement planning.”

Read more:

- Can Banks Deliver the Personalized Financial Wellness Tools Consumers Crave?

- 4 Ways to Ensure Your Financial Wellness Marketing Pays Off

Following a Common Thread

Alongside its innovation and education initiatives, Chicago Patrolmen’s has developed its reach through strategic partnerships and CUSOs (The Financial Brand recently covered one of those CUSOs, Structure First.) It has even shared branch arrangements with other credit unions to reach members in markets where it has no physical presence.

“Chicago has a big police force. There are a lot of families, a lot of annuitants or retirees,” Arney says. “But police officers and families have lives and needs with a very strong common thread to other police officers and other police families across the country… there are about a million families and easily about three million accounts. We want to bring our services to the places that don’t have them.”

In 2011, the NCUA approved the credit union’s application to add departments in Chicago’s suburbs to its service area. The credit union made inroads with organizations that serve ethnic- and racially-diverse officers, such as The Emerald Society (for Irish-American police), NOBLE (the National Organization of Black Law Enforcement) and the Shomrim Society (the Fraternal Organization of Jewish Police Officers); these initiatives fostered greater reach.

“We want to bring our services to the places that don’t have it.”

— Scott Arney, Chicago Patrolmen’s Credit Union

Then came the partnership with the Chicago Lodge of the National Fraternal Order of Police (NFOP), with offices across the street from Chicago Patrolmen’s headquarters.

The NFOP is not a police union, but a professional organization serving sworn police officers nationwide through local chapters it calls lodges. It provides police officers with a host of advocacy services and products, among them financial products. Chicago’s FOP is the largest lodge in the country, and opened the door to serving the national organization.

“It was through their connections that we were able to get NCUA approval to serve what is now a membership of roughly 370,000 members,” Bedinger says.

With new reach, Chicago Patrolmen’s launched their national brand — the National Police Credit Union — and the widespread marketing of products developed specifically for the needs of sworn police officers. Members located in markets other than Chicago can access products and services digitally or avail themselves of in-person assistance through a co-op shared branching network of credit unions across the U.S.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Chicago Patrolmen’s Delivers Value Nationally

Chicago Patrolmen’s now has members in all 50 states. They’ve blanketed Arizona and have a healthy presence in Texas, but don’t plan to encroach upon the police credit union serving Houston, Arney says. Hawaii, California and New York are likewise well-served by existing police credit unions.

Not every police officer in the country can join Chicago Patrolmen’s. They must be a member of one of 359 organizations – fraternal orders or an employee of a police department – that already has a relationship with the credit union.

Growth will come from providing officers and their families with viable financial alternatives, Arney says. “We want to go where police officers aren’t currently being served by a dedicated credit union.”