In 2021, banks placed an emphasis on basic digital capability expansion. The focus landed predominantly on new payment options, better integrating uneven customer touchpoints, and simplifying at least initial online applications for improved convenience.

These priorities signaled banks recognizing vast mobile and web experience gaps left unfilled during the 2010s for most legacy organizations. But these banks and credit unions still failed to grasp the personalization amplitude consumers already enjoyed with tech titans. Financial institution initiatives mostly addressed discrete pain points instead of complete digital customer journey intimacy.

Change has continued and the financial services industry has been playing the challenging game of ‘catch up’. The Digital Banking Report has tracked the changes in trends and priorities for more than 2 decades. While the trends, strategies and challenges have evolved, the importance of understanding the changes and adjusting business models to reflect marketplace movement has been a constant.

The speed of change is making the process of catching up harder than ever.

2023 Trends: Recognizing the Loyalty Imperatives

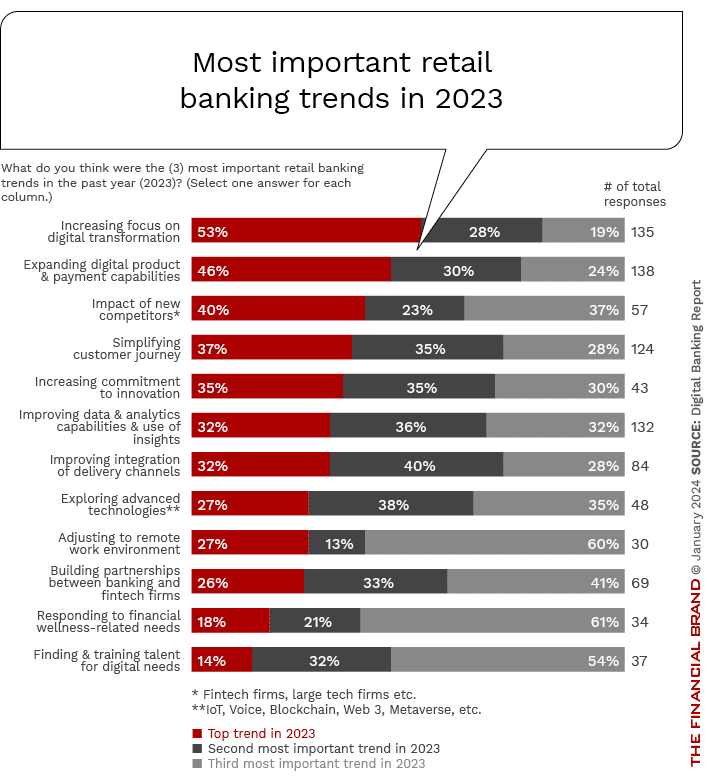

Last year’s Retail Banking Trends and Priorities report found that competitive pressures clearly compounded exponential consumer desire for digitally-native, customized money interactions. Appreciating the stakes, banks and credit unions rushed to map more complete journey experiences, prominently boosting commitment to longer-term innovation.

But these efforts remained hampered by ineffective foundational analytics. Few banks yet understood purchase preferences, behavioral signals across platforms, and emotional context clues essential to prevent churn.

Siloed legacy systems also obstructed crafting contextual insights from fragmented data, creating hurdles for banks wanting to create consistent omni-experiences.

2024 Trends: Embracing the Data-Driven Mandate

2024 Trends: Embracing the Data-Driven Mandate

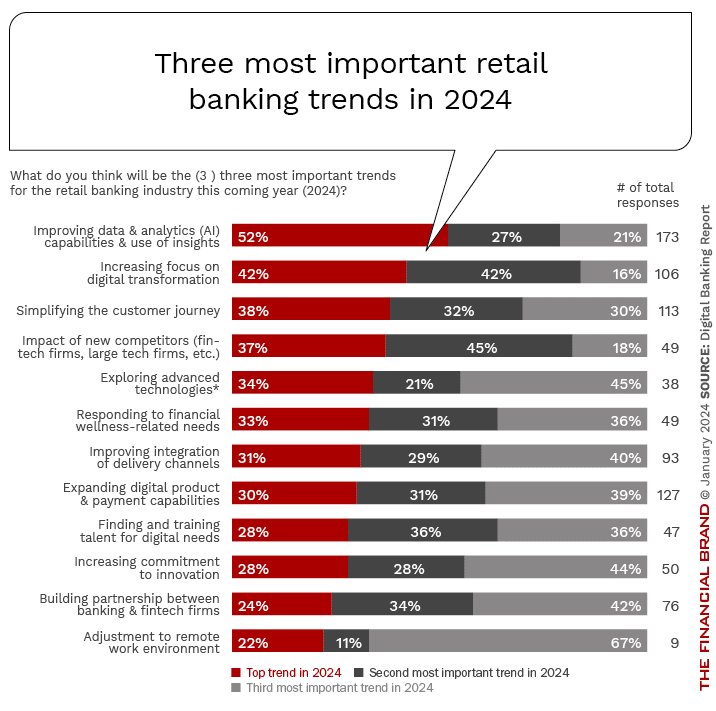

The 2024 Retail Banking Trends and Priorities report, again sponsored by Q2, finds a strategic priority spike for improved data and analytics capabilities, demonstrating acute acknowledgement that personalized emotional connections now determine consumer lifetime value more than rates or fees. Disrupters keep raising expectations with predictive engagement reflecting the impact of the beginning of the Fifth Industrial Revolution, where embedded personalization and contextual recommendations create value beyond price and experience.

This retail banking trend shift demands enterprise analytics engineering urgency to consume purchase transactions, interactions, declared and implicit preferences in unified profiles. Only then can AI recommend fit-to-purpose solutions in anticipated moments that resonate trustfully.

With consumers seeking guidance aligned with complex financial lifestyles, investment priority shifts to data confidence signify comprehension that only modern intelligence engines generating extreme customization at scale earns relationships in the future. Lagging banks must now sprint to regain lost ground.

Download Report: 2024 Retail Banking Trends and Priorities Report

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

An Incongruous Response to Defining Trends

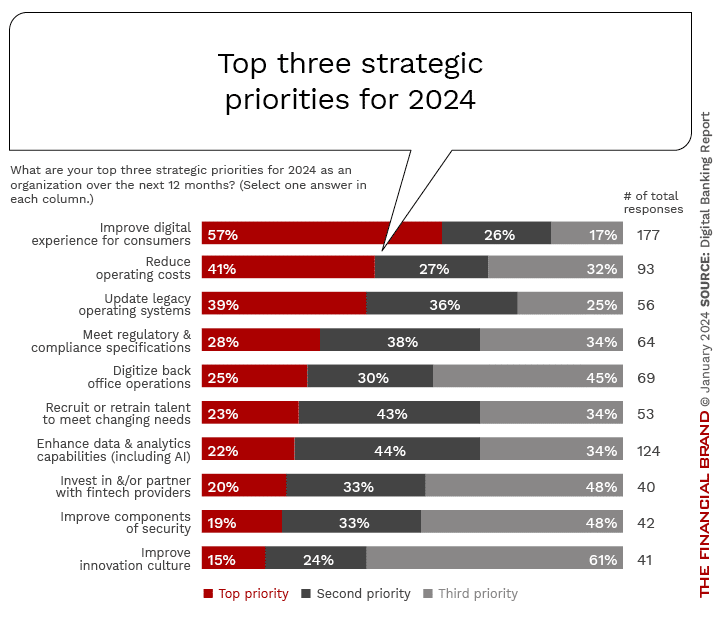

Despite strong consensus that optimizing data and AI now represents ubiquitous banking imperatives in 2024, survey responses reveal worrying inconsistencies between these acknowledged forces shaping competitiveness and actual strategic priorities reported globally.

Just over half of financial institutions anticipated improved data/AI capabilities and leveraging actionable insights as the most impactful trend this coming year. Alternatively, only 22% of global financial institutions list enhancing analytics and intelligence as their top priority focus areas for 2024. (Note: This strategic priority did receive the second most organizations listing this as a priority)

This alarming disconnect illustrates potential denial or lack of cultural readiness to undertake required enterprise analytics foundations enabling personalized engagement at scale using AI despite confessions it defines market futures.

Several hypotheses may explain gaps between confessed urgency and response prioritization:

- Budget Reallocation Difficulty – Funds remain locked in outdated systems without growth impact as legacy debt obligations recur before modernization.

- Skill Set Shortages – Analytical talent wars limit abilities to build data engineering, data science and UX design teams rapidly to inform personalization initiatives.

- Lack of Leadership Conviction – Overly risk-averse executive culture skews against investment cases perceiving AI as unproven despite obvious consumer adoption signals.

- Irrational Legacy Biases – Emotional ties to branch distribution weight strategic discussions even with contradictory branch usage data ever-present.

Over half of institutions expect to still rely predominantly on legacy providers resistant toward disruptive models that compromises cloud-native, composable agility digital known to enable scale advantages with consumer data leverage.

Unless courageous leaders challenge these inconsistencies obstructing market reality acknowledgements internally, many banks will find time has run out to traverse their wide digital divide as early movers consummate power through intelligence.

Current Use of AI Needs to Progress

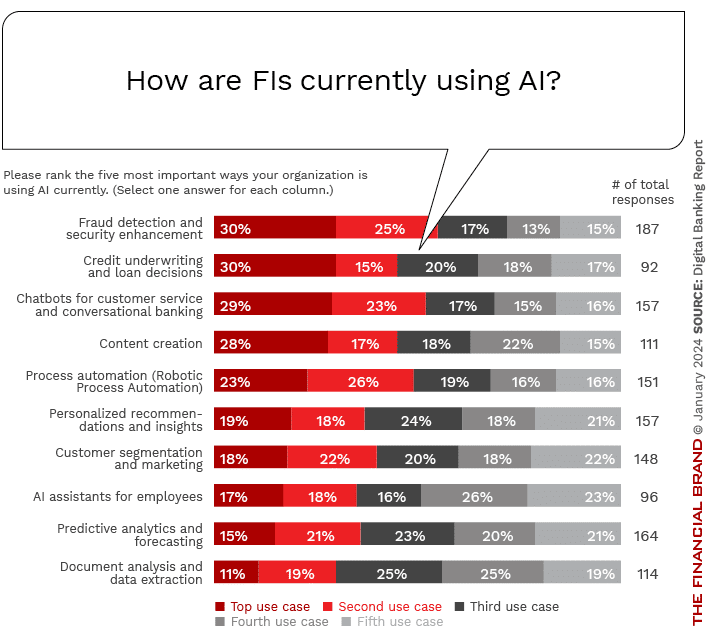

Financial institutions are leveraging data and AI in a variety of ways, though many current use cases are still focused on risk management and cost savings rather than advanced customer engagement. Some of the key ways financial institutions are using data and AI include:

- Risk Modeling and Fraud Detection: Banks are using machine learning models trained on large datasets to better detect fraud, assess risk, and make lending decisions. This allows them to avoid risk more efficiently.

- Process Automation: Many repetitive back office tasks like loan processing and compliance checks are being automated using robotic process automation and AI. This provides cost savings through efficiency.

- Chatbots and Virtual Assistants: Banks are deploying conversational AI chatbots and robo-advisors to handle basic customer inquiries and services. This provides more convenient self-service options for customers, though the level of “intelligence” is still fairly basic.

- Customer Insights: Some institutions are doing more advanced analytics on customer data to understand behaviors, anticipate needs, and provide personalized offerings. However, this is not yet widespread.

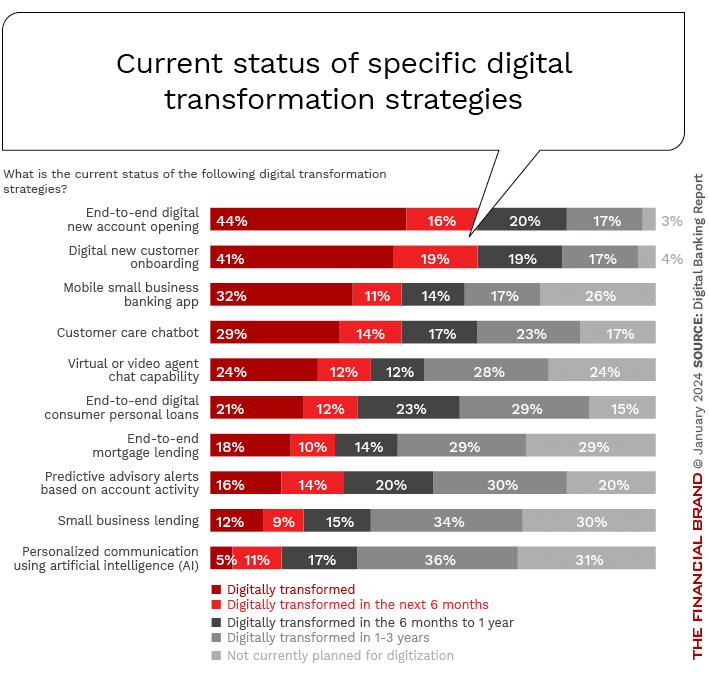

As for future prioritization, financial institutions should look beyond risk and cost focused use cases and pursue customer-centric AI that provides true personalization, predictive insights, and value-added services. The chart shows that most organizations are not yet embracing some of the more advanced use cases:

- Predictive Life Event Marketing: Use data to anticipate major customer life events like marriages, births, new jobs, etc. and provide tailored product offers.

- Intelligent Advisory Services: Provide specific and tailored financial advice similar to a dedicated personal advisor using all available customer data.

- Advanced Alerts and Notifications: Notify customers of unusual account activity, optimal timing for transactions/payments, personalized deals, etc. using predictive analytics.

- Hyper Personalization: Serve up the right content, products, perks to customers at exactly the right time without any requests.

Pursuing more advanced use cases like these focused on individual customer engagement and value will require investments in cutting edge AI but provide great opportunities for differentiation. The key is having the right customer data foundation.

Download Report: 2024 Retail Banking Trends and Priorities Report

The Long Road for Digital Transformation in Banking

The banking industry understands the critical importance of digital transformation. In a world where fintech disruptors and big tech firms are luring away customers with superior digital experiences, traditional institutions face existential threats without modernization. However, the current state of transformation across banking reveals the long road still ahead.

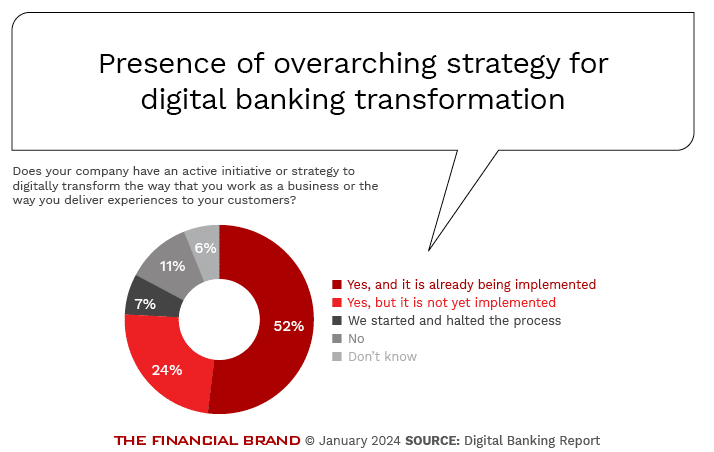

According to our research, only 9% of banks globally are fully digitally mature today. Alternatively (53%) are still developing digital capabilities or are in the very early stages of digital transformation progress. 38% believe they are at the ‘mid-point of progress’. This indicates that despite an almost universal understanding the need for digital transformation, most banking institutions are still in relatively early stages of implementing comprehensive change.

The Struggle Behind Banking’s Digital Divide

This divide separates not just maturity, but future success and relevance. Banks unable to digitally transform risk extinction within 10-20 years. Those embracing disruption will solidify market positions for decades ahead. So why the uneven progress?

Banks face tougher barriers than most industries in delivering enterprise-wide digital transformation. The foremost obstacle is overcoming extensive technology debt accumulated over generations before cloud, mobile and APIs existed. Core banking systems designed piecemeal since the 60s remain key transactional backbones. Massive legacy investments delay modern integrations.

Equally challenging are organizational and cultural hurdles. Leadership misalignment around transformation stalls direction. Unable to attract digital talent, skill deficits slow execution. Outdated management practices hinder agility. Together, these barriers span people, processes and technology – a difficult combination requiring multi-year change management.

Despite present struggles, the impetus for change remains unavoidable. The digital maturity gap projection shows laggard banks significantly underperforming leaders on customer satisfaction, revenue growth and other metrics within a few years. Even today, the bottom 25% of performers lag toppers by nearly half in key productivity and economic return rates.

This reckoning will only intensify as both big tech and fintech upstarts keep delivering innovations setting ever higher consumer expectations.

At some point, banks must deliver the pace of rapid improvements customers already experience daily from Netflix, Amazon and Apple. The economic opportunity cost also becomes too large to ignore. To leave such value unclaimed while combatting attrition is irrational long term.

The Digital Imperative Has Never Been Greater

As daunting today’s challenges appear, the imperatives for digital transformation will only grow more intense. Big tech and fintech alike will raise expectations higher through relentless disruption. The stakes now center on banks securing positions to still thrive serving digital generations ahead.

Fortunately, the necessary pillars for digital success are well understood by industry leaders even if long term commitment is required for progress. The capabilities not only to digitally transform, but perennially refresh experiences abound in modern architectures. The larger question is whether boards and leadership teams summon their own transformation ability to execute on this vision before time runs out. That digital clock ticks louder every passing day.