The report: Banks Can Deliver Both Social Impact and Profits, Here’s How [November 2023]

Source: Boston Consulting Group (BCG)

Why we picked it: Environmental, social and governance (ESG) policies are coming under increased scrutiny among bankers, as the cost of such programs continue to escalate despite often underwhelming results. In this report, BCG runs against the tide, arguing unequivocably (per the report’s title) that “banks can deliver both social impact and profits.” What do they see that ESG’s critics are missing?

Executive Summary

Financial institutions may have a significant opportunity to expand their business while addressing social issues. In fact, BCG argues that banks can best accelerate social agendas by leveraging their core businesses: Across the globe, more than 1.5 billion people lack access to a bank account, while 2.8 billion are underbanked with limited access to financial services. BSG found that institutions that perform strongly on ESG metrics — particularly in social — also generate higher shareholder returns and lower cost of capital.

Yet, while many financial institutions are eager to implement social agendas, they face challenges in measuring value and defining goals. To seize the opportunity, banks should refine their focus on the most impactful issues, create a social agenda role, and seek outside partners.

Key Takeaways

- Banks typically act on social issues to strengthen their reputation, reinforce the institution’s mission, and align the institution with the priorities of their employees.

- There are major differences across regions on how banks approach their social agenda, reflecting different socioeconomic conditions and regulatory environments.

- Despite their ambitions, many banks still struggle with social agendas, including difficulty in measuring value (56%), measuring impact (46%) and a lack of defined goals (34%).

What we liked: Based on a survey of 360 executives from 40 banks in 33 countries, the report focuses on strategic and business rationales that should drive banks to act on social issues.

Things that made us go “hmmm”: The report sometimes obscures (or perhaps avoids) what seems to be the one striking implication of its research: That it’s a mistake for banks to treat ESG as a single, intertwined agenda. BCG draws many distinctions between social issues (such as inclusion and equity) on the one hand and climate issues on the other, both in terms of the forces driving banks to address these issues and their relationship with banks’ own strategies and priorities. The clear, if sometimes understated, message is that banks should approach the “E” and the “S” in ESG differently.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Different Dynamics Shape the Social and Climate Agendas

Drivers and motivations: The factors driving action on social topics are different from those propelling climate initiatives. Strengthening a bank’s reputation, reinforcing the institution’s mission, and aligning with the priorities of its employees — all core business priorities — are drivers of action on the social agenda. For climate action, on the other hand, the primary drivers are external: regulation and risk. Notably, more than half of survey respondents said that financial inclusion as a social goal could simultaneously drive commercial benefits while creating positive impact.

Seven out of 10 stakeholders cited regulatory requirements as a top-five motivator for their position on climate issues, while only 35% said regulations impacted their social agenda. And while respondents ranked employees as the third most significant driver of social issues, they said they were much less influential for climate action.

Goals and impact: Conversely, the survey’s respondents reported that climate targets and goals are often clearer than those associated with social issues – perhaps because policies such as “net zero” are set outside the industry, by governments and regulators.

The tide is turning: While regulation and risk are not seen as major drivers of social action today, that may change. For example, the European Financial Reporting Advisory Group (EFRAG) is soon expected to require large companies, including financial institutions, to report on the social impact of their activities along the value chain.

The European Commission also proposed a new due diligence directive that will require companies to identify negative human rights and environmental issues. In India, regulations require banks to have 40% of their loan portfolio in priority sectors, including small businesses and women entrepreneurs. The growing global scrutiny across bank value chains is leading banks in many countries to broaden the lens through which they drive social impact.

“Banks have a major opportunity when it comes to social impact. They can not only address critical issues — such as financial inclusion, human rights and the advancement of a just climate transition — but also expand their business.”

Barriers to action: In addition to the oft- cited challenges of in measuring value (54%) and measuring impact (42%) of social inititiatives, many respondents said they needed better data on social impact outcomes, while others said they lacked defined goals on social issues (34%).

The social competitive advantage in Latin America: One outlier in the social impact element is Latin America. Because these banks operate in developing countries with large, underserved populations, there’s often a win-win for social responsibility and the financial success of the bank. More than half (54%) of banks from Latin America ranked improving financial performance as a top-five motivator for social impact, compared to only 25% across other regions.

Social impact meets climate action: Nine in 10 (89%) respondents said it is important for banks to consider the potential social impacts of their climate activities. However, less than a third (31%) said social impacts are almost always integrated into their bank’s decisions regarding climate activities. There are also notable regional differences. For example, half (47%) of respondents in Latin America and 37% in Asia-Pacific factor social impacts into climate decisions, compared to only a quarter of banks in Europe and North America.

Departmental roles: There are also regional differences in how various business units can shape a just transition. While respondents globally said corporate and investment banking units had the most significant role, Latin American respondents ranked retail and small and mid-sized banking as more important. Most respondents also note one of the most important elements of success will be breaking down siloes to integrate climate and social into one strategy.

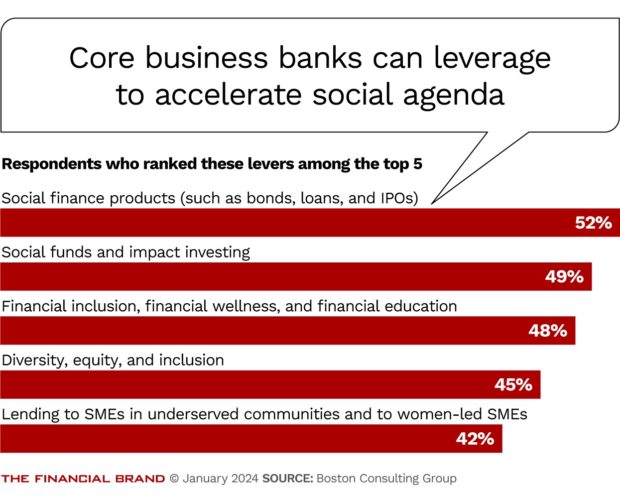

The right social topics: Prioritizing the topics on which banks can act is complex. BCG asked respondents to select up to 20 special topics to address. Depending on their objective, financial inclusion ranked highly in managing risk, driving commercial benefits and creating positive impact. Data security and privacy topped the list in reducing risk, while responsible selling practices were deemed important or both managing risk and driving commercial benefits.

Learn more:

- CEO Survey Finds ‘Cautious Optimism’ Among Banking Leaders

- How Bank of America Plans to Get a Jump-Start on EV Lending

Seizing the Social Opportunity

BCG notes a sound social strategy can deliver real value for banks. As financial institutions develop and refine their strategy, there are several things they should keep in mind:

- Mounting criticism and regulatory requirements around banks’ records on social issues will require them to focus more on the actions of their clients and their clients’ value chains.

- The systemic risk of inequality in the financial system will become more apparent, requiring banks to factor it into risk management and address any ingrained biases in their business practices.

- Efforts to address climate change and deliver social impact will become increasingly intertwined, forcing banks to break down organizational siloes and integrate climate and social strategies.

- As the demand for socially oriented products grows, banks should embed their social efforts more directly within the core business and ramp up product innovation.

To take the lead on social impact, banks should think creatively and consider several actions:

Think with your head, not heart: Banks must realize they cannot do everything. They should avoid impulse “feel-good” issues and instead zero in on topics where there’s a business case for action and where they can have an impact.

Create a social agenda role and hire social experts: While many banks now have a climate chief, they often manage social efforts across multiple departments with little coordination. Banks should identify a head of social impact with strong expertise on social issues, good relationship-building skills and an ability to manage complexity. They may also look outside the industry to hire niche social experts where needed.

Think horizontally and break down siloes: Certain social topics may be addressed better through more than one business unit. For example, while financial inclusion is often thought of in the retail business, the wholesale unit can play a role by financing an intermediary such as a community development finance institution. Asset management can also invest in startups and solution providers that focus on financial inclusion. Banks should identify where climate and social goals conflict or complement each other and break down siloes between the two to maximize impact in both areas.

Think outside the walls on DEI: While many banks still think of DEI as a workforce topic, it is a critical driver of business value. Strong DEI efforts can not only strengthen employee retention but also build a workforce that better matches the profiles of their users.

Collaborate and seek partners: More so than with their climate goals, banks need to collaborate to maximize their social impact. One way is to partner with nongovernmental organizations on financial wellness efforts or with other institutions that are looking for private capital partnerships to scale their own social programs.