This year set the stage for disruptive changes to come in the banking industry.

Mobile banking efforts ramped up, building on the rapid advances seen at the onset of the Covid-19 pandemic. Big tech encroached, with Apple and Twitter in particular getting a lot of attention, Apple for making moves and Twitter for just raising the possibility. And Web 3.0 advanced.

Tech themes like these were well represented in the most popular articles of the year.

The biggest banks in the country, Bank of America and JPMorgan Chase, generated heavy interest too, with articles detailing their retail banking strategy. The two megabanks have very different approaches, with Chase counterintuitively blanketing the country with new branches.

Check out The Financial Brand’s top 10 articles for 2022 and make sure you didn’t miss any of the biggest news.

(The titles below are hyperlinked to the original articles.)

10. Four Essential Digital Trends for Banks in 2023

Digital banking transformation is a priority for the majority of financial institutions, but actual progress lags at many of them. In this uncertain economy, banks and credit unions must redouble their commitment to strategies that will generate positive results quickly and at scale.

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences. Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Are You Ready for a Digital Transformation?

The unfair advantage for financial brands.

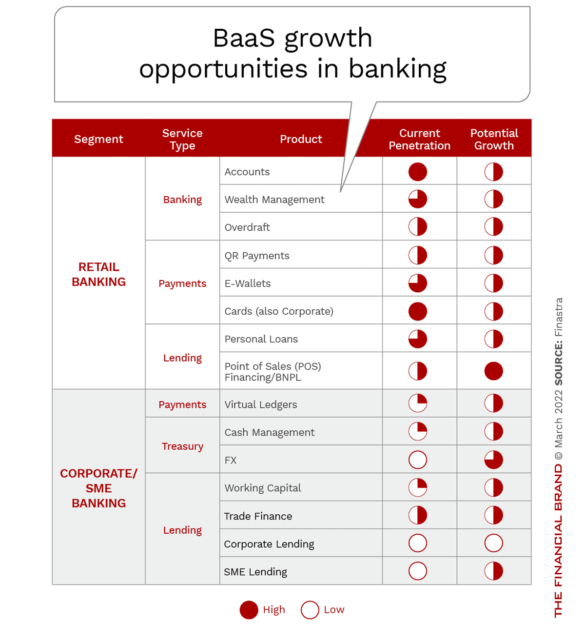

9. The Future of ‘Banking as a Service’

Banking-as-a-service, or BaaS, is becoming increasingly attractive to banks as they seek new revenue streams and feel intensifying pressure to grow for the sake of greater efficiency. A cadre of tech middlemen are emerging to help banks with this strategy. And the types of clients interested in becoming BaaS users is expanding.

One analyst estimates BaaS could be a revenue opportunity worth up to $50 million to a bank. But more regulatory scrutiny is on the way.

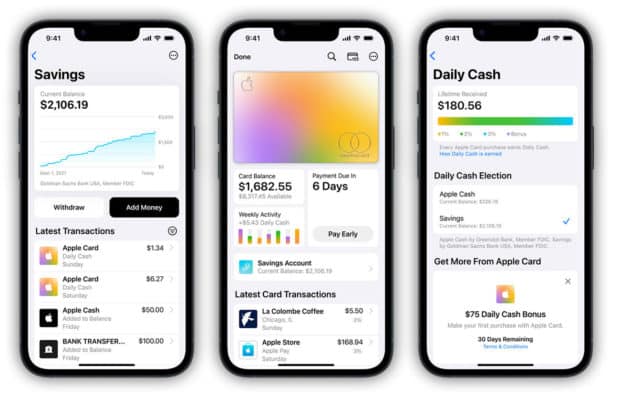

8. What the Apple Card High-Yield Savings Account is Really About

Don’t think of the new Apple Savings account as a standalone competitive banking product. Analysts say it’s one more brick for building a “walled garden” of financial and other services for iPhone users that will drive growth of Apple Pay, Apple Card and more of the tech giant’s offerings.

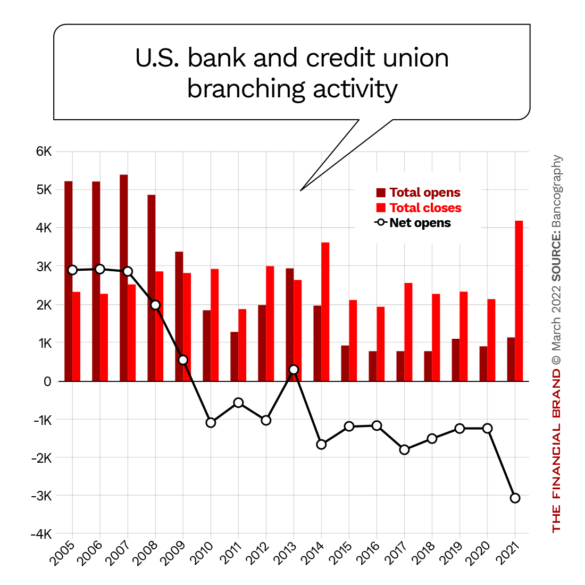

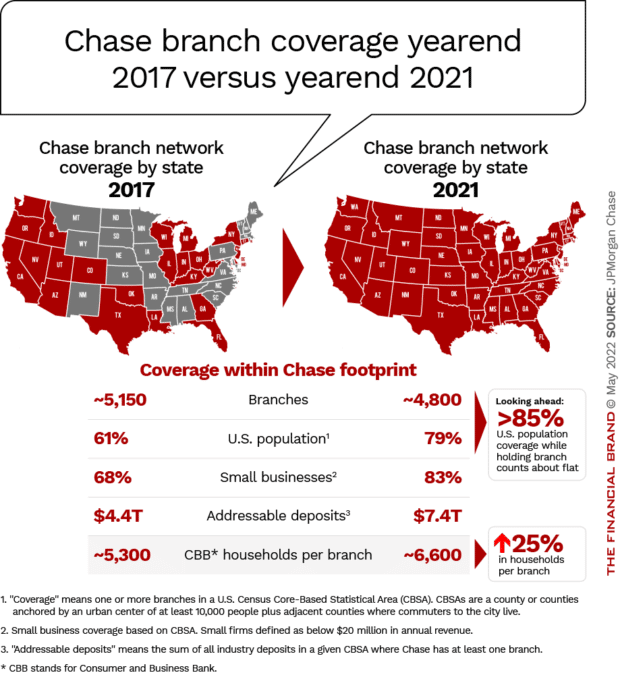

7. Chase Reveals Its Strategy for Dominating Retail Banking

Digital evangelists say the future is about clicks not bricks, but the biggest U.S. bank loves branches. Chase continues to build new branch locations, while it also rolls out digital products at an accelerated pace. It is a two-prong strategy to fuel deposit growth.

(Separately, we also covered the changes both Chase and Bank of America have made to speed up digital transformation efforts.)

6. Nine Digital Banking Stats from BofA That Should Worry Every Bank

Bank of America’s investments in digital channels are paying impressive dividends and extending their competitive edge. The widening digital gap between BofA and other institutions should concern leadership teams throughout the banking world. These nine datapoints illustrate the importance of leveraging digital channels to reduce costs, increase engagement and remain competitive.

Holly O’Neill, president of retail banking at Bank of America

Here’s just one: More than 6 million of its customers have created a “Life Plan.” The digital Life Plan tool, inspired in part by a BofA focus group, helps customers prioritize their financial goals, understand the steps necessary to achieve those goals and track their progress. The ability to create and deliver customizable advice based on financial goals, transactional activity and insights from outside Bank of America creates a level of engagement — and loyalty — that is far beyond transactional banking.

According to Holly O’Neill, president of retail banking at Bank of America, all of the digital efforts incorporate the strategic use of human intervention. Balancing digital and human is the foundation of great customer experiences, she says, adding that the bank is also investing in soft skills because the goal is for everyone across the organization to be able to lead with empathy.

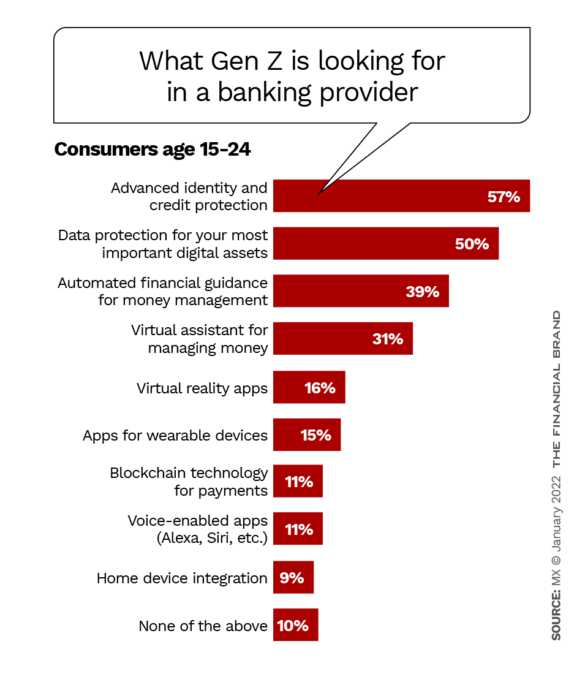

5. Top Gen Z Trends Impacting Banking

Gen Z’s habits have already been heavily studied, yet their attitudes toward finance have changed significantly since the Covid-19 pandemic. Learning how they think about money now will inform the strategy for any financial institutions battling it out in the New Year.

4. Four Big Banking Industry Trends & Challenges

The year has already brought multiple challenges for banking: interest-rate increases and inflation, the necessity of replacing noninterest income as overdraft fees erode, and the question of how to allocate delivery channel resources. Here’s what else bankers should look for, including key growth opportunities.

3. Trends for 2022 Reflect a New Era in Banking

Financial institutions can no longer plan for the future by looking at the past. Given the outlook for the banking industry in coming years, two of the most important trends on their radar should be the ability to innovate quickly and at scale, and to humanize digital experiences.

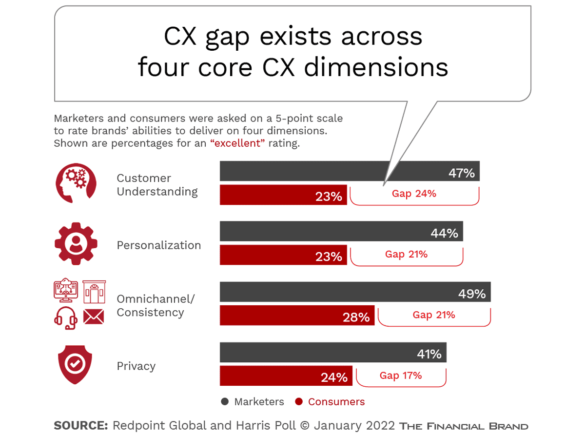

2. Banks Not Delivering The Experience People Demand

Research shows that financial marketers are missing the mark on what consumers want, focusing on product and price as opposed to genuinely understanding the needs of customers. This mismatch in perceptions impacts priorities and performance.

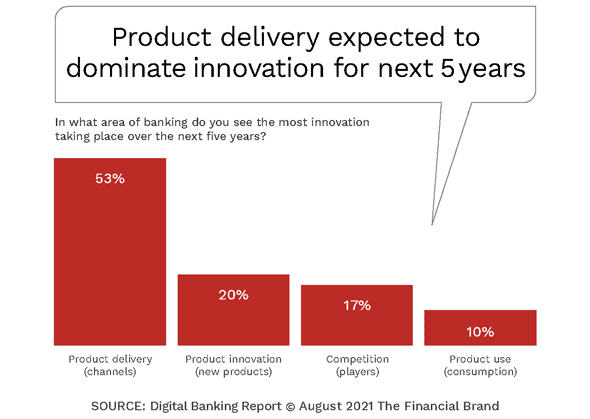

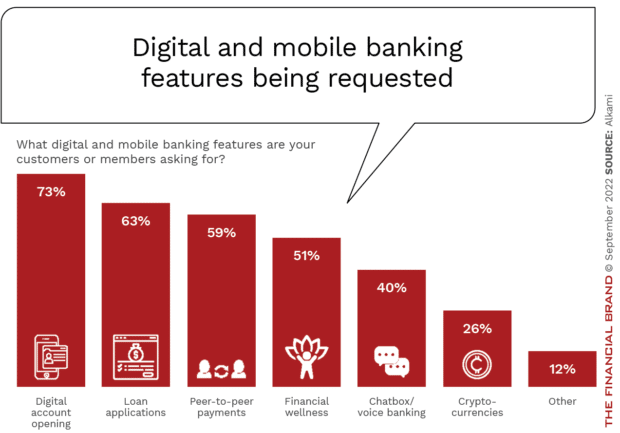

1. Five Banking Innovation Trends To Watch in the Next 3 Years

To become future-ready, banks and credit unions must possess the speed and agility of a fintech startup. They also need to build the cultural and operational capabilities to drive innovation and digital banking transformation at scale.

Honorable Mention: An Interview with ChatGPT

ChatGPT, the artificial intelligence chatbot, impressed us in a discussion about its abilities and its perspectives on the future of banking.

A nonprofit called OpenAI developed the chatbot, and it is free to use at this time. It reached 1 million users in the first week after its release.

Check out our interview with ChatGPT to find out what it says when asked how it can help financial marketers or improve innovation at banks. You might just be tempted to give it a try.