CRE risk management: Navigating hazards and opportunities

Abrigo

DECEMBER 18, 2023

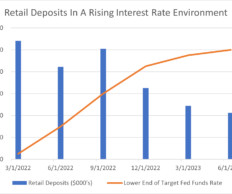

Takeaway 2 Advisors recommend that financial institutions look behind some of the headlines and examine their own markets before ruling out CRE altogether. Takeaway 3 Loan-level stress testing can help assess repricing risk, while capital stress testing helps clarify the impact of CRE loan losses on capital. Morgan data.

Let's personalize your content