FDIC’s New Banker Engagement Site (BES): Improving CRA & Compliance Exam Communication

Perficient

SEPTEMBER 11, 2023

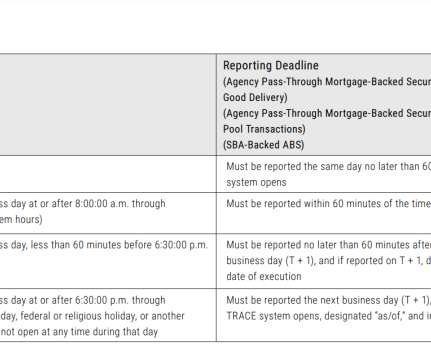

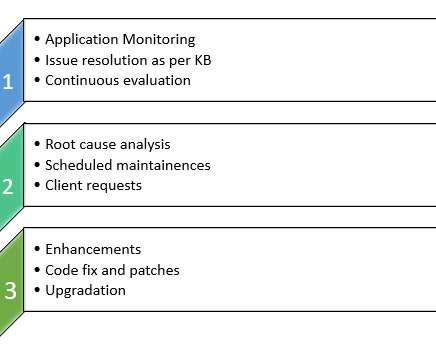

Already reviewed by Perficient, BES provides a secure and efficient portal to exchange documents, information, and communications for consumer compliance and Community Reinvestment Act (CRA) examinations. The list was referred to as a first day letter.

Let's personalize your content