Perficient Included in IDC Market Glance: Lending Digital Transformation Strategies

Perficient

MAY 5, 2022

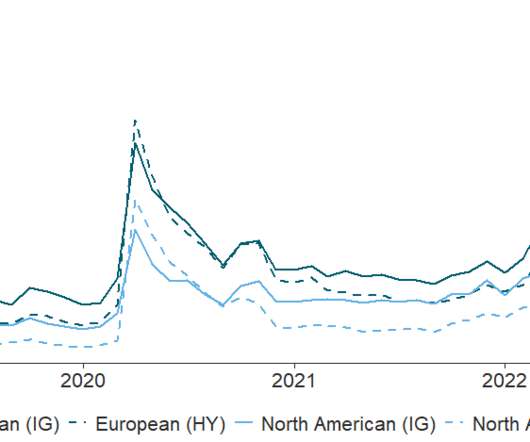

While it was once expected and acceptable for lenders to enforce standardized payment due dates and policies, COVID-19 brought the impracticality and ineffectiveness of a “one-size-fits-all” approach to credit and lending to light. The IDC Market Glance offers an overview of the landscape for consumer and small business digital lending.

Let's personalize your content