We Need a New Funding Strategy

Jeff For Banks

MAY 30, 2024

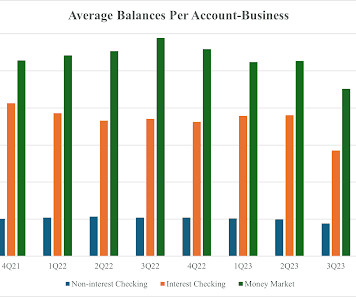

trillion in domestic deposits, according to the FDIC's Statistics at a Glance. As far as community banks, I look to data gleaned from all of the banks where my firm does profitability outsourcing because we have a level of granularity that the FDIC and most readers do not have. Maybe it's 50 basis points.

Let's personalize your content