Bank of America plans to expand its retail banking network into seven new U.S. markets — including New Orleans, Milwaukee, Madison, Wisconsin, Birmingham, Alabama, and Boise, Idaho — even as it continues to reduce its total branch count.

The nation's second-largest bank by assets currently operates in 83 of the top 100 markets, and it plans to increase that number to 90 by the end of 2025, said Aron Levine, the company's president of preferred banking, in remarks Monday at an industry conference.

Levine did not name two of the seven markets that BofA plans to enter, and a BofA spokesperson declined to comment.

Over the last eight years, Bank of America has

"So that's one part of our strategy … grow in the expansion markets," Levine said, while also suggesting that BofA can expand quickly in new markets despite opening only a small number of branches. "And we do it very efficiently."

In Milwaukee, U.S. Bank has the largest deposit share at 41%, according to data from the Federal Deposit Insurance Corp. In Birmingham, locally based Regions Financial holds first place at 33%. And in New Orleans, Capital One Financial is the top choice for deposits at 29%.

BofA appears to be targeting expansion in places "where their presence doesn't match what they feel potential is in the market," said Dave Martin, a consultant who specializes in retail banking strategies.

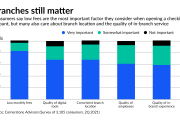

Even though digital banking has led to net branch closures across the industry, it's also made it easier for banks to enter new markets, said Martin, the founder of the retail bank performance company bankmechanics.

"You do not need the massive branch network you once needed to truly compete," he said. "Each individual bank branch now has a larger service area and target market than it once did."

JPMorgan Chase is also eyeing growth opportunities in U.S. markets where it operates a relatively small number of branches.

The nation's largest bank has entered 25 new states since 2017, but it has 500 fewer total branches than it did six years ago, Jennifer Piepszak, co-CEO of consumer & community banking at JPMorgan Chase, said Tuesday at the Morgan Stanley conference.

"Retail banking is still a very local business, and you can have a different density of footprint, much less dense than you would have needed 10 or 20 years ago, because of the complement of digital," Piepszak said.

For its part, BofA is planning to reduce its total branch count from around 3,800, in part by integrating digital banking services.

"We have a strategy of identifying areas where we can close two, open one," Levine said. "You'll see a net reduction, but it's more gradual than it has been."

As more aspects of daily banking moves online, BofA has reconsidered "the nature of why a financial center exists," Levine said. Customer and client interactions have gone from "transactional" to a "more sophisticated set of conversations," he added.