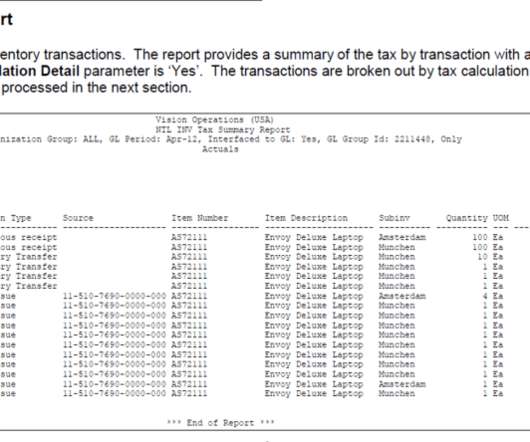

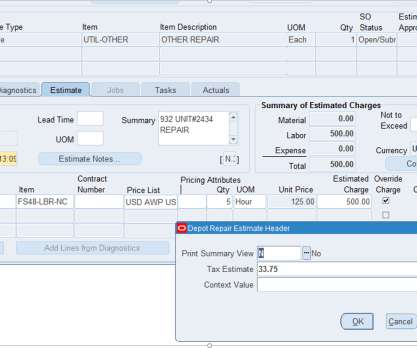

Use Tax on Oracle EBS Inventory Transactions

Perficient

MARCH 22, 2021

Do you struggle to determine and accrue the Consumers Use tax liability that is due on inventory removal transactions and transfers to other locations? If you are reading this blog, you probably already know that Oracle EBS does not support tax calculation for Inventory transactions. If so, we may have a solution for you.

Let's personalize your content