Consumers want more options—payment choices included

As consumers experience economic turbulence due to inflation and rising interest rates, they want to be able to pay anywhere, anytime, anyhow.

For banks to stay ahead of an increasingly complex payments game and meet these evolving consumer expectations, they will need to innovate and seize emerging opportunities. One opportunity we’re watching closely is BNPL (buy now, pay later).

Our 2022 Global Consumer Payments Survey—of which this report is an extension—found that consumers, on average, expected to double their usage of BNPL for online payments in the next three years. Further, four in 10 would be more willing to adopt BNPL if it were provided by their primary bank.

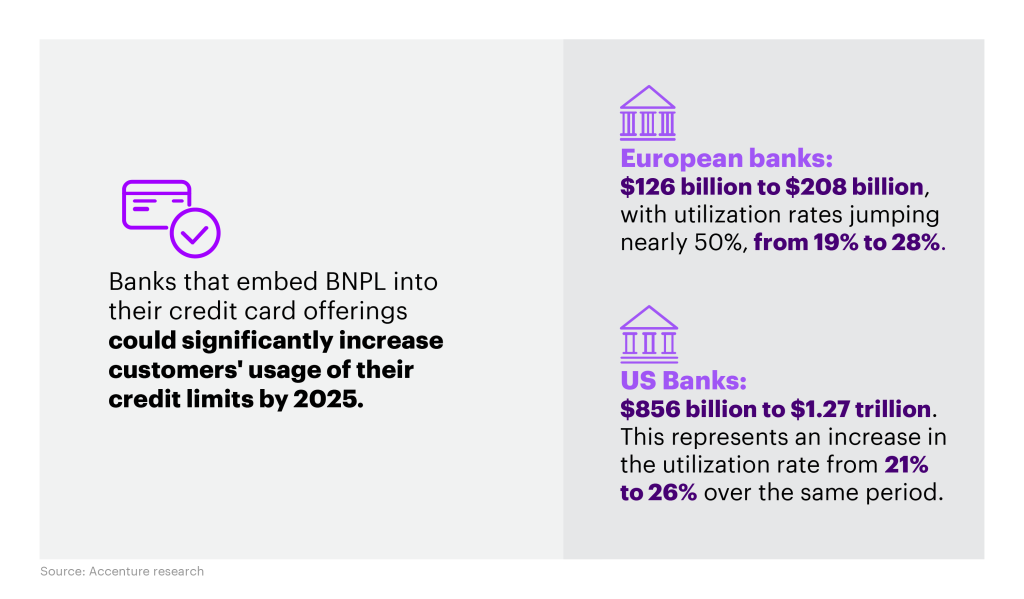

In addition to helping banks defend their consumer finance and credit card businesses from new competition, BNPL could offer banks a significant growth opportunity.

Where can banks offer value in the BNPL space?

Banks can emulate the "anywhere, anytime" experience offered by independent players and offer customers a more frictionless experience with instant approvals and added convenience.

When offered by the consumer’s trusted financial institution, BNPL could represent a convenient alternative financing option, with the ability to trace transactions and manage repayment more easily through banks’ existing financial wellness tools. The use of data, cloud and artificial intelligence in this space will empower banks to go beyond today’s offerings and comfortably manage any regulations, should that become necessary.

Two scalable BNPL plays for banks

Success in the BNPL boom will require banks to evolve and embed BNPL into their existing propositions and platforms to capitalize on the issuing and acquiring opportunities.

There are two strategic plays for banks to consider:

- Follow the customer: The cardholder or borrower decides with which merchant they want to use BNPL.

- Follow the seller: The proposition is aligned to a single merchant or category.

In exploring strategies now for BNPL success, banks can chart their paths forward to create multi-dimensional value. Attention and effort should focus on creating lifetime value and becoming a more important financial partner to both the customer and the merchant.

BNPL stands for buy now, pay later. It’s a short-term financing option that enables customers to make instant purchases and pay for them over time, usually in fixed payment installments and often interest-free. BNPL loans are also called point-of-sale (POS) installment loans. Compared with credit cards and lines of credit, BNPL loans are often easier for consumers to get approval for. If approved for BNPL, shoppers typically make a small down payment up front, then the remaining payments over time.

There were an estimated 360 million users of BNPL in 2022. We estimate that a large US bank with total assets of $3–4 trillion could boost its total credit card income by 10% in 2025 by embedding BNPL into its cards. A large European bank with total assets above $2 trillion could benefit from a ̴16% uplift in credit card income in the same timeframe. Incumbent banks have the potential to grow BNPL beyond what fintechs ever could. 40% of our survey respondents said they would be willing to use BNPL if it were offered by their primary bank

Banks can leverage their existing capabilities to grow credit card utilization and their consumer finance business overall. Banks will benefit beyond the immediate potential boost in card income. When integrated with a credit card, BNPL becomes a flexible product that can be offered at different moments in the customer journey. It can be tailored to different customer segments to optimize credit limit usage, customer acquisition and customer loyalty.

As part of a credit card proposition, BNPL can be linked to a bank’s loyalty program to attract mass-market and affluent customers. Banks could consider launching bundled offers tailored to a time of resurgent inflation and interest—for example, short-term interest-earning deposit accounts bundled with new BNPL offers.

Banks have proven systems and processes to score credit and assess affordability for BNPL users.

Embedding BNPL into cards could be an opportunity for banks to promote financial wellbeing and help their customers optimize their finances through responsible lending. A responsible BNPL model, embedded into a bank's credit offering, would allow both the consumer and the financial institution more visibility into the consumer’s full financial picture. Consumers can view transactions and manage repayments via their bank's financial tools, enabling them to better manage their financial health by borrowing and spending more prudently.