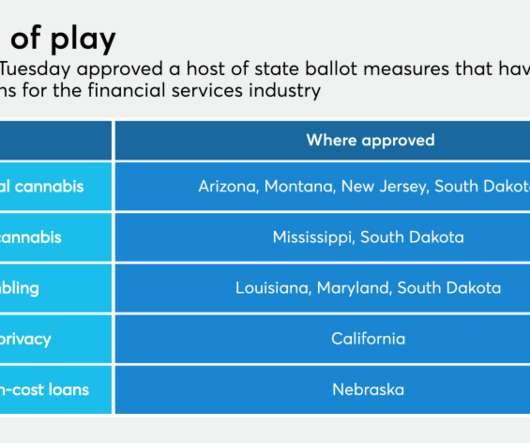

South Dakota Regulator Requires BSA/AML Compliance for Money Lender Licensees and Non-Residential Mortgage Lenders

CFPB Monitor

FEBRUARY 12, 2024

The South Dakota Division of Banking issued a Memorandum notifying all licensed money lenders and non-residential mortgage lenders of their Bank Secrecy Act/Anti-Money Laundering (“BSA/AML”) obligations under a 2020 Final Rule published by the Financial Crimes Enforcement Network (“FinCEN”).

Let's personalize your content