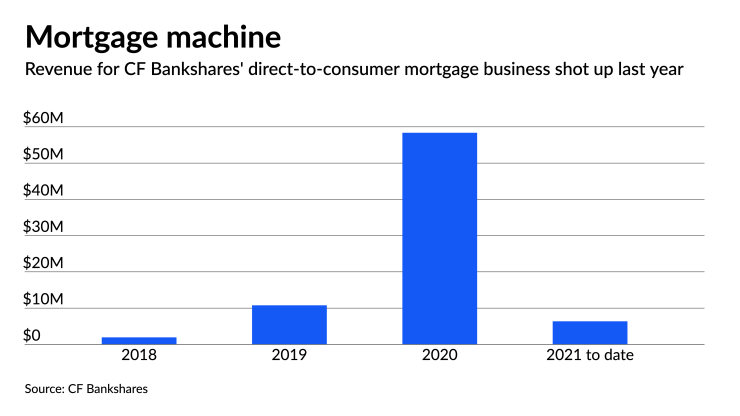

At its annual meeting last month, CF Bankshares in Columbus, Ohio, spotlighted the “extraordinary” earnings lift generated by its three-year-old national direct-to-consumer mortgage lending platform — more than three-quarters of its total revenue for 2020.

Then last week, the bank announced plans to exit the business.

According to CF, the holding company for 129-year-old CFBank, shrinking margins, tougher competition and heightened price volatility drove the decision to bail from the predominantly online channel.

“During 2021, the mortgage lending environment in our opinion, and in particular DTC, has changed substantially,” CEO Timothy O’Dell wrote Tuesday in an email to American Banker. “Our mortgage-lending focus go-forward will be on more traditional retail loan originations,” such as business from brokers and word-of-mouth referrals.

In 2020, CF’s net gains from selling mortgage loans totaled $58.37 million on originations topping $2 billion. Though the proportion of loan sales to total revenue fell to 37% in the first quarter from 66% in the fourth quarter and 76% for the full year 2020, mortgage lending’s contribution remained significant, with net gains on loan sales totaling $6.36 million in the three months that ended March 31.

There’s no question the move will produce a near-term drag on earnings. Indeed, the $1.6 billion-asset CF said Thursday that its second-quarter results would include about $2.5 million in after-tax losses associated with DTC mortgage lending.

Brendan Nosal, who covers CF for Piper Sandler, termed the exit decision “an abrupt about-face in strategy” in a research note Thursday. In a follow-up note Friday, Nosal slashed his second-quarter earnings estimate by 37% to 51 cents per share.

“This may understate the magnitude of the second quarter DTC loss,” Nosal wrote. He reduced his full-year 2021 estimate 26% to $2.28 per share. CF reported net income of $6.4 million, or 96 cents per share, for the quarter that ended March 31, and $29.6 million, or $4.47 per share, for 2020.

O’Dell declined to provide additional details on the exit decision’s impact on earnings, or whether CF has plans to replace direct-to-consumer mortgage lending with another business line. He cited the quiet period in advance of its second-quarter earnings report, which is set for release Aug. 4.

At the same time, O’Dell expressed confidence that the company’s expanding core banking business would quickly fill any earnings gap. Enhanced cash-management capabilities — paid for in large part by mortgage profits — have led to a doubling of noninterest deposits, while commercial loan pipelines are at all-time highs, he said Thursday in a press release.

CF entered the Indianapolis market in the first quarter, hiring veteran local banker Dan Cobb to recruit a team of lenders. The bank says it is on a path to reach $1 billion of assets in each of its four major markets, Columbus, Cleveland, Cincinnati and Indianapolis.

“DTC mortgage lending was a strong fee income contributor during these past couple of years, enabling us to accelerate the investment in and growth of our core banking franchise,” O’Dell wrote in the email.

CF’s move away from direct-to-consumer mortgage lending comes as the post-pandemic housing boom, which pushed the dollar volume of mortgage originations to a record $3.8 trillion in 2020, appears to be fading. In its most recent Mortgage Finance Forecast, the Mortgage Bankers Association projected a 9% decline in origination volume for 2021 followed by a steeper drop next year.

Meanwhile, lenders’ net gain per loan, while still substantial, has

MBA declined to comment on CF’s decision, citing a policy against commenting on the business activities of individual lenders.

Nosal says the decision to get out of the direct-to-consumer mortgage lending will be seen as a plus — eventually.

“As mortgage grew as a percentage of the top and bottom lines, earnings exhibited material seasonality, as well as cyclicality,” Nosal wrote in the follow-up note. “The exit of the DTC business will provide far more earnings visibility coupled with less volatility. We view this as a key positive.”

As part of its plan to wind down direct-to-consumer mortgage lending, CF suspended new rate lock commitments on June 30. The company said in its press release that it would close out its existing pipeline “in the next few months.”