Randolph-Brooks Federal Credit Union has a blueprint for grabbing credit card market share from one of the largest banks in the country. The big question is whether other credit unions will follow its lead.

At the onset of the coronavirus pandemic, the Live Oak, Texas-based credit union determined it needed to quickly pivot its marketing to better reflect members’ concerns about job security and the economy.

“People were scared and looking for every way that they could save money for their household,” said Blake Lyons, vice president of marketing and business development at the $13.2 billion-asset institution. “We said, ‘OK, we’re going to pick on one of the big boys.’ ”

The resulting campaign, known as “Chase away high interest rates,” utilized RBFCU’s own data to determine which members were making credit card payments JPMorgan Chase, based on the frequency and amount of those transactions. It then targeted about 2,000 members with ads encouraging them to switch to the credit union’s own low-rate card.

Lyons mentioned the program during the Credit Union National Association’s online Governmental Affairs Conference earlier this month as part of a broader discussion of how the industry is

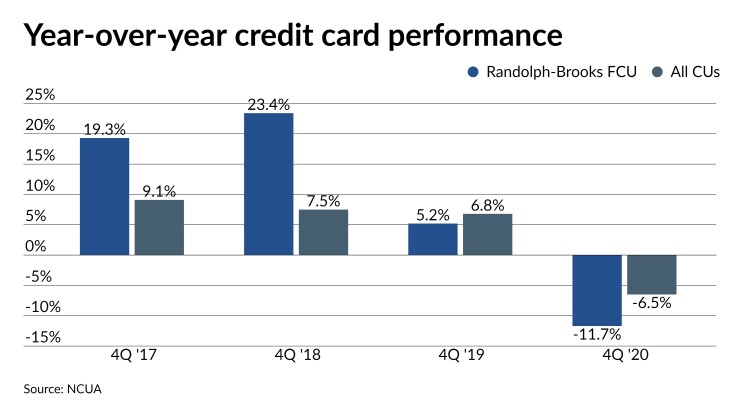

So far, Lyons said, the campaign has resulted in 165 new cardholders with spending limits totaling $1.3 million. However, that won’t be enough to make up for a slowdown in credit card lending last year. RBFCU finished 2020 with $475.5 million in outstanding credit card balances, a decline of nearly 12% from where things stood at the end of 2019. Industry-wide credit card balances were down 6.4% at the end of the year, according to

Despite those declines, Randolph-Brooks remains the one of the industry’s biggest players in the credit card space. The NCUA ranked it as the 11th-largest credit card lender and 10th-largest credit union by asset size at the end of the third quarter, the most recent information available.

Some industry observers suggested RBFCU’s model could work for others in the industry. Most credit unions already have the ability to determine how members are making payments outside of their own institution, the latest Nilson Report on payments showed the nation’s eight largest banks currently account for 75.8% of all outstanding credit card debt.

“So it’s a huge population to go after,” said Tony DeSanctis, senior director for the consultancy Cornerstone Advisors.

"It’s a go-forward strategy that every community bank and credit union should be actively leveraging to steal market share," he added. “COVID has given credit unions the confidence to go after them.”

In the past, many smaller institutions believed they couldn’t compete with the rewards the big banks offered, many of which were centered around travel. But the pandemic put a halt to travel for most people, and those rewards are now less important, he said.

“No one cares about Delta miles — and, if anything, they’ve come to appreciate how much less valuable they really are longer-term," DeSanctis said.

Rather than travel rewards, credit unions historically tried to leverage their higher-touch banking relationships with a card that offered perks such as cash back. And that flexibility might be more attractive going forward, he said, in part, because many travel cards carry high fees. For example, the Chase Sapphire Reserve has an annual fee of $550. And the biggest value to such cards are the travel benefits that come with them.

“So if you’re not travelling, that card becomes less and less valuable,” he said.

Some megabanks, including Bank of America, have also become more flexible about their card rewards programs, DeSanctis said, adding that Chase and American Express have also pivoted away from rewards focused on travel.

Lyons was quick to say he is “in no hurry to pick any fights with the large bank down the street,” but said RBFCU wants to alert members of situations where it can offer lower-cost products and services. He said Randolph-Brooks has multiple marketing campaigns running at any given time, including for customers of some of the other "big box" banks. "So it's certainly not isolated to Chase," he said.

Randolph-Brooks has two consumer credit card offerings. One of those offers unlimited 2% cash back and the other is a low-rate card aimed at consumers who are more concerned with their monthly payment.

But not everyone agrees with the strategy of targeting big bank customers.

The rewards play for interchange income from frequent users is the right approach with long-term, loyal customers, said Tim Scholten, president of the credit union consultancy Visible Progress.

He said smart consumers are leveraging loyalty rewards for the things they want, such as cash back and travel points. Those consumers tend to use their card for practically everything and then pay the balance down monthly.

For many consumers today, Scholten added, are more concerned with a card’s benefits than the interest rate. And with rates forecasted to rise, high-balance cards will be the first to show signs of delinquency.

"It’s not where I would look for growth at the moment," he said of the Randolph-Brooks approach.

Some large card issuers have also been expanding credit lines as the economic recovery continues, a possible indication of growth opportunities in that space. For example, Capital One Financial in February began to increase

Lyons from Randolph-Brooks agrees that growth in that line could be coming.

"Hopefully we will start to see a light at the end of the tunnel," he said of the pandemic. "I hope that includes things like family trips, and a consumer credit card option has been a staple in those things."