10 Bank Technology Trends to Follow for 2024

While technology has always been important in banking, it has yet to drive the essential functions of banking. Up to this point, if you could speak to a human, banking was easier. In the last year, this has started to change. With the rise of data, generative AI, personalization, instant payments, embedded banking, and traditional AI, the customer experience in banking is now often better through digital channels. We tracked almost 100 banking technology trends throughout the year and now bring you the top ten, in order, based on our view of long-term strategic importance.

Coming Up with Our Top 10 Bank Technology Trends List for 2024

To come up with our Top ten list, we fed the content from multiple conferences (Money 20/20, AFP, ABA, Natcha, BAI, American Banker, etc.), notes from conversations with bankers and webinars and fed all 3GB of output into a generative AI (Gen AI) model and came up with the below word cloud based off-topic mention. There were almost 100 material trends to consider.

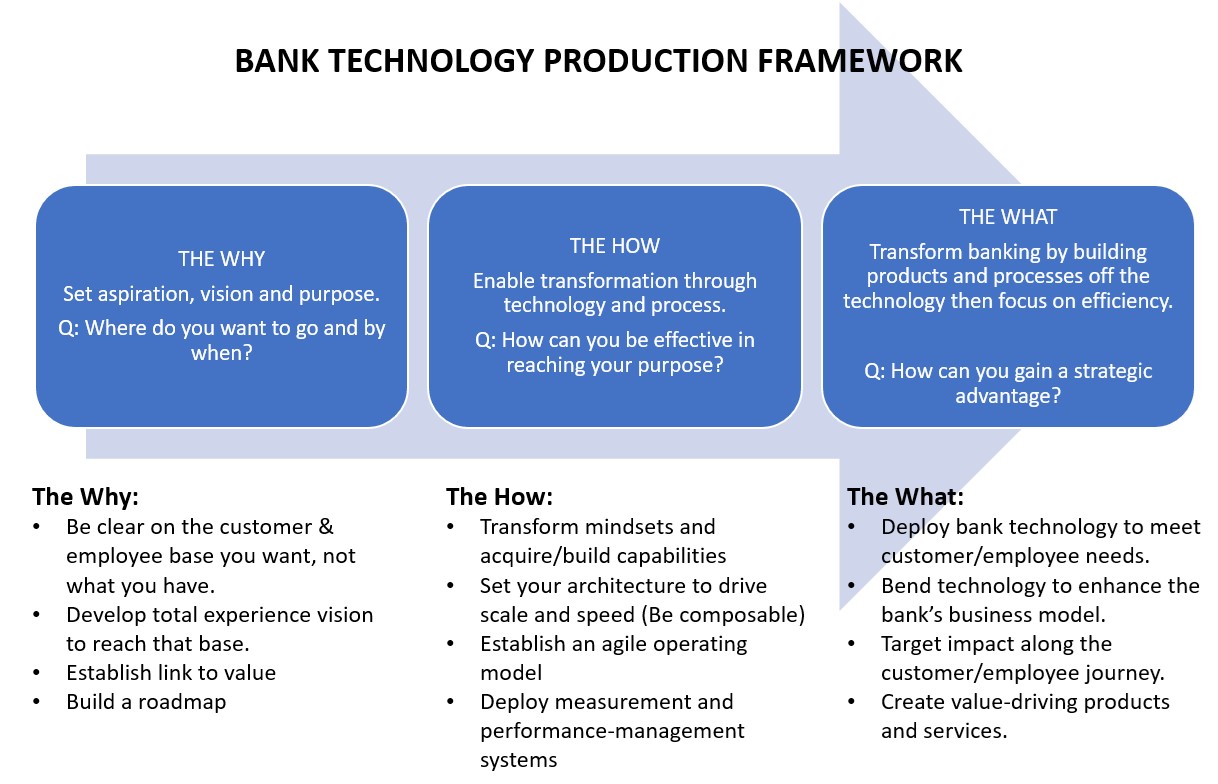

From the topics, we apply our core framework (below) of technology enablement to improve the total experience, either for the customer or the employee. It is essential to point out that the list was derived based on the effectiveness of pleasing the customer or employee while boasting profitability and not efficiency. Being effective has much more sensitivity than efficiency when trying to improve earnings, so we chose to focus on those trends that are the most effective in accomplishing the common goals of enhancing the total experience, improving earnings, minimizing risk, and increasing franchise value.

While some of these banking technology trends are nothing new, the rise of Gen AI will cause many old initiatives, such as data/analytics, to go through a resurgence in popularity and investment.

-

Enterprise Continuous Threat Exposure Management

While many banks are advanced in managing their ongoing exposure management, the pace of change is causing banks to rethink their cyber defense. Understanding the line of business attack vectors, factoring the IT assets that support that business surface, and then reprioritizing the risk will continue to be an ongoing effort of banks in 2024.

Once the residual risks are understood, then banks will relook at the new likelihood of attack. Checks, for example, as we wrote about HERE, will continue to undergo record attacks. Banks will need to reassess the risk and pour more resources into this area. The underlying point here is that banks have traditionally used fraud data on an ad hoc basis. Now, the concept is to leverage this data across the enterprise and make both the analysis and response more real-time and continuous.

Equally important is for banks to either use a single set of fraud management tools across the organization or at least orchestrate the various fraud tools into a comprehensive unit. At present, many banks utilize a variety of fraud and security tools that both overlap and have gaps in coverage. Fraud management in checks is different from fraud management in account opening, which is different from fraud management in instant payments. Likely, banks look for fraud during business hours but not after hours or on weekends. The pace of fraud is now moving too fast to allow the criminals a potential three-day head start. 2024 will see more banks develop a comprehensive, 360-degree fraud policy and the tools to support that policy to deliver real-time information plus action.

Cloud security, ransomware attacks, insider theft, privacy, network/endpoint protection, and general fraud remain one of the most significant investments in bank technology. This is an investment to continue to protect the value of the bank. AI and generative AI will continue to help banks get better at threat management, but it also opens another attack surface for criminals. Look for banks to continue evolving perimeter and zero trust security while exploring tokenization, homomorphic encryption, the expanded use of AI in threat detection, and developing the extended detection and response platforms will all take bank resources in 2024.

In a recent Gartner study, the research firm found that banks that focus on upgrading their continuous threat exposure management are three times less likely to have a successful security breach.

-

Development Democratization

This trend is about making it easier for developers and pushing developer tools down to customers and the business lines. It starts with banks having open application programming interfaces (APIs) wrapped in a developer portal so commercial customers and partners can easily access various banking services (see banking-as-a-service and open banking below). Then, this trend is about exposing common tools so employees, customers, and partners don’t have to reinvent routines and code every time they want to do a common task.

Composable “microservices” can be in the form of identity and KYC during the onboarding process. This standardization can be used for a variety of products inside the bank, from account opening and loans to payments. Outside the bank, partners can call on these routines to leverage the bank’s KYC and onboarding procedures to help with integrating their own products into the bank. Thus, a provider of 401k or health savings account switch kits can call on their services to onboard customers according to the bank’s workflow and specifications. This dramatically shortens the time to market while creating scale. Access management, privacy, identity, credit, account opening, document management, data storage, and risk scoring are just some of the many routines that are becoming popular.

Creating reusable processes enhances the developer and product designer experience because it reduces the cognitive load and reduces complexity, making them more productive. The interesting aspect from the bank side is that instead of thinking of a single product, banks will put more energy into bundling their products at scale. Its the difference between selling a single ingredient versus selling a complete meal. Instead of selling just payments, banks can sell payments, account onboarding, and identity verification.

-

Digital Employee Experience (DEX)

The employees of banks face a myriad of challenges every day. The answers to help meet these challenges can be supported by data. In 2024, we will see the rise of digital employee experience platforms to help bankers pull in disparate data, add a layer of generative AI, and produce output to help bankers make more informed decisions. A DEX platform is a combination of data, “connectors” (technology that allows better integration), and generative AI to help interpret the information. At present, bankers have access to a steady stream of data, but often, that data is without context.

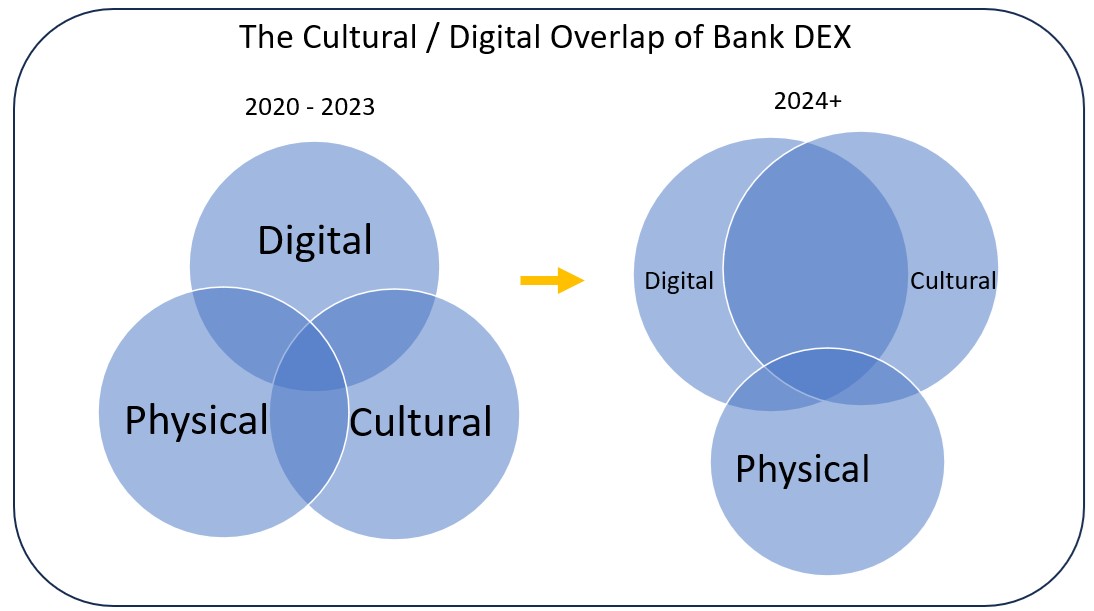

The realization that banks will have to continue with a hybrid, in-office, and remote workforce will be the catalyst for banks to seek platforms that help meld the digital and cultural aspects of the Company. DEX platforms will handle everything from human capital functions to finance, IT delivery, and customer information.

Platforms like Workday will step in to solve some of these problems. For example, bank finance teams spend an inordinate amount of time gathering information, reconciling transactions, and producing reports. DEX platforms will help quickly identify financial patterns, trends, and anomalies—enabling teams to complete the financial close process and performance analysis more rapidly and efficiently.

-

Payments & ISO 20022

The introduction of FedNow in 2023 ushered in a new focus on payment technology. While no other single product made our list, payments are worthy. Until now, many banks rationalized that their customers were not asking for faster payments – ACH was sufficient. In 2024, you will see customers realize that the ability to both receive AND send payments 24/7/365 instantly, with rich data and to always be reconciled is critical.

As customers realize the efficiency and convenience of instant payments, banks will reassess their position on the product and move to implement the rails. Speed of adoption will increase as some banks, driven by the need to reduce fraud and cost, will start to move their customers off checks and onto these new payment rails.

-

Open Banking

The trend for banks to allow their customers and partners to connect to their APIs to access their products and services will continue. More processes, services, and products will be available via API at banks. As mentioned above in Development Democratization, banks will continue to invest in more open banking standards and allow their clients to handle greater orchestration and customized product design to meet their needs. Customers may want to access a bank’s open banking portal to open accounts, conduct payment transactions, complete KYC, or check balances and interest rates.

Available open banking products and services will then give way to integrated banking platforms.

-

Integrated Banking Platforms

While many banks have leveraged banking-as-service and have used open banking architecture to go after fintechs, recent regulatory, business model, and economic headwinds refocus the effort, so banks build out these platforms to handle the industry niches of commercial customers and service them with a broader number of products. Banks will start this effort next year, with some evolving into industry-specific platforms to target healthcare, education, municipalities, shipping, manufacturers, and others.

-

Embedded Banking

As some banks evolve their open banking and integrated banking platforms, embedding banking services in enterprise resource platforms (ERP) and accounting systems will become more popular. Why make the customer go into their banking application when payments, account balances, inter-account transfers, and problem resolution can all be made natively in their SAP, Kyriba, Zen Books, QuickBooks, or similar platforms.

-

Data and Analytics

While data and analytics in banking are nothing new, the technology will see a resurgence in banking fueled by generative AI and the ability to unlock the potential of the data. Look for more investment in data lakes, data warehouses, and third-party systems to help clean, manage, and display bank data. As we move forward in 2024, integrating natural language processing (NLP) and automated insights will enable bankers to interact with data more efficiently. This trend will simplify extracting information for business line users, thereby providing the catalyst for further investment.

Another aspect of this trend will be “continuous intelligence,” or the ability for banks to harness data in real time. This trend will enable banks to respond to evolving opportunities and changing circumstances in areas like credit and deposit pricing.

-

Machine Learning (Traditional AI)

While 2024 will be the year of generative AI for banks, machine learning will garner a resurgence because of the rapid growth of Gen AI. Banks will start to leverage traditional AI models either directly or through partners to make cash flow forecasting more accurate, investments more optimized, product suggestions, lower fraud, and better risk scoring. The possibilities are endless, but up to this point, you need a data scientist to help produce and interpret the information. Now, look for bank applications, such as WatsonX, that will connect to data sources, automatically test various models in a low or no-code environment, produce output, and then make suggestions from that output.

-

Generative AI (Gen AI)

For all the hype around generative AI, we are not sure it is enough. Bankers who still think of Gen AI as a fancy search will come to realize the game-changing power of this technology in 2024.

For starters, more enterprise applications such as core services, Salesforce/nCino, Adobe, Service Now, and others will come with their own Gen AI. Banks will have to adapt to this multimodal, multimodel environment. Over the next five years, almost every dollar of bank technology spent will have an AI component to it. Bank technology, risk, and compliance teams will have to understand the opportunities and limitations of each application to get the most out of the platforms. Banks will have to understand which Gen AI tools get integrated where.

Beyond platform management, banks will be exploring and implementing generative AI in an array of functions. You likely understand how generative AI chat the new user interface will be, replacing dashboards, website pages, and customer service platforms. As discussed HERE and HERE, generative AI will also boost banker productivity and be used throughout the bank. By 2028, we surmise banks will hire more AI agents than people.

Regarding technology, generative AI excels as it has been trained and can reference vast depots of code. Banks, for example, have many legacy systems with legacy code that can now be efficiently converted and updated. Changing COBOL, Objective-C, Perl, or Ruby to refactor it into Python will happen seamlessly by next year with fewer bugs and fewer vulnerabilities than banks currently have in their code base.

In the coming year, generative AI will understand a bank’s architecture better so that it can propose solutions at a much faster pace and with greater accuracy than the current process. Banks will describe the desired outcome of the technology, and the AI agent will deliver back the optimal solution architecture.

The other significant change in Gen AI that banks will see is more applications will be self-prompting, making it even easier to ask questions. At present, the accuracy of your output from a Gen AI application is based on the quality of your prompt. To increase accuracy, we predict by next year, many applications will be asking questions back to you or prompting the context before delivering answers.

Finally, banks will see the marriage of robotics process automation (RPA) and Gen AI to create even more powerful automation.

Brave New World

For 2024, banks will continue much of their cyber defense, move-to-cloud, and digital transformation initiatives that they have been working on for the past several years but with added resources in some of the above areas. In a forthcoming article, we will cover bank technology budgets and highlight some lesser-known initiatives that are in the experimental phase but will likely have an impact in future years. All these technology projects will take place against a backdrop of greater M&A activity, so look for that all-too-familiar disruption. Of course, the only constant for next year is that bankers will once again feel that they are under-resourced and new technology challenged.