Customer Game Theory – Picking Halloween Candy and Loans

Many parents have dealt with the issue of how to divide Halloween candy among siblings. It takes work. If all houses gave out the same candy, it wouldn’t be a problem. But houses give out different sweets. Further, trick-or-treaters have different preferences. Whatever the case, candy, and preferences are not all the same. As a result, candy is distributed unevenly, forcing parents concerned with equality to employ some game theory. While helpful in Halloween, the clever methodology we bring you today is also applicable whenever there is a finite set of options and a competitive system for choosing each option. This applies to candy or marketing for commercial loans in your market.

The Problem Explained

To better understand the problem, let’s say there are four loans, each with a different profitability. Four banks are going after these loans, each with a different preference. How can a bank allocate and optimize its finite marketing and sales resources to get the loans it wants?

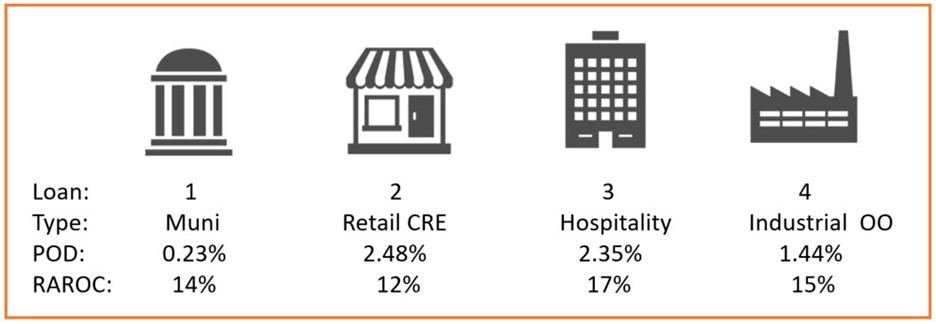

Let’s take four loan choices:

These are all real-life examples, actual probabilities of defaults (PODs), real risk-adjusted returns on capital (RAROC), and represent actual choices banks had to make. Let’s denote the banks as Bank A and Bank B. While banks can compete on more than one loan, we will assume that banks have limited resources and can’t throw their entire sales and marketing effort behind every loan to keep things simple. We will also stipulate that banks know their market and understand the competition, so information is free-flowing, and each bank’s strategy is somewhat transparent, given past marketing moves.

Each bank has different preferences due to its risk tolerance, structural capabilities, and portfolio. For example, Bank A, below, likes credit stability among all else, while Bank B prefers the highest return.

These preferences break down as such:

Bank A: Muni > Industrial Owner Occupied (OO) > Hospitality > Retail.

Bank B: Industrial > Hospitality > Muni > Retail

We will assign “utility points” based on preferences to keep track. Each bank will get four utility points for their first preference, three points for their second, two points for their third, and one point for their least favorite. Thus, we take their preference above and assign points:

Bank A: Muni (4) > Industrial (3) > Hospitality (2) > Retail (1)

Bank B: Industrial (4) > Hospitality (3) > Muni (2) > Retail (1)

The Common But Sub-optimal Strategy

The first lesson here is that if you don’t have a relationship profitability pricing model and a portfolio strategy, your bank will lose this game most of the time. You will be at a loss for which loans you want, how to price to win, and how to structure the loans to win. In Halloween candy parlance, you will end up with the fruit and the nuts handed out – a mix of Halloween booty that no kid wants.

This is why we write about credit portfolio strategy and give our relationship profitability model, Loan Command, away at our cost so all banks can effectively compete in their marketplace. For the sake of this example, let’s assume both banks have a clear strategy, as detailed above, and a loan pricing model.

Bank A goes after the Muni loan and wins it (getting four points). Bank B goes after the Industrial loan and wins it (getting four points). So far, so good.

Knowing Bank B has a signed commitment letter on the Industrial loan, Bank A goes after the Hospitality loan and wins it (getting two points). In response, Bank B goes after the Retail loan.

Bank A now has six points, which isn’t bad, but it isn’t optimal. Had the bank had a better strategy, they could have done better.

Customer Game Theory – Optimizing Strategy

Bank A should have focused resources on their second choice first and won the Industrial loan. That would have given them three points of utility. Bank B would have then taken their next best alternative and gone after the Hospitality loan. This allows Bank A to go after and focus on the Muni loan, their favorite, and gain four points. This would have given Bank A seven points of utility instead of six – a better strategy.

Bank A knows Bank B doesn’t have the expertise to structure muni deals, so why put maximum resources there? By considering customer game theory, Bank A can allocate resources to their two favorite relationships by tracking and understanding their market. Game theorists will recognize this problem as part of the Nash Equilibrium, and the quick practical summation of the strategy is this:

Another way to think about this is that if you discover a profitable customer type or loan structure that other banks don’t know about and are not competitive with, a little marketing and sales focus will go a long way. However, suppose you are trying to go after medical professionals, multifamily, or the hundreds of other hyper-competitive customer types. In that case, you will have to spend sales and marketing dollars to differentiate your bank. In addition, you need to develop products such as long-term fixed-rate loans and cash management services that set your bank apart.

We hear you if you read this as said – OK, but my market is more complicated than competing against another bank. We used to have to compete for Halloween candy against much older (and bigger) siblings and their friends. You know what? Your odds of optimizing a strategy go up, not down. This is counterintuitive, but customer game theory becomes even more critical in multi-player games where competitors have a more significant relative advantage.

Putting Customer Game Theory Into Action

The takeaway here is this – Without externalities, you would focus capital in alignment with your priorities. However, because you have externalities like competition and different, non-homogenous markets, you should focus resources where you can get the best overall return, not where your priorities are. Your strategic priorities should influence, but not dictate, capital allocation.

Remember that capital allocation is a means to an end, not the end itself. Thus, lay your strategic priorities out and then allocate capital where it can have the most significant overall impact on your collective priorities.

The secondary takeaway is this: The more you differentiate in the market because of your brand or products, the less energy you need to spend competing. Thus, bank executive management needs to balance both short and long-term strategic and tactical priorities and then determine how to invest capital to achieve both short and long-term goals.

There are many areas where inefficiencies create opportunities for banks. As we pointed out last week on our 15 Favorite Deposit Campaigns (HERE), instead of applying your resources to certificates of deposits where many banks compete, allocate resources to marketing products like treasury management, payments, business savings, cross-selling, and specialty accounts.

Happy Halloween, and we will keep our eye on our favorite candy – the Twix Bar.

PS Actually, it’s the Three Musketeers bar. We didn’t want you to pick it up first in case we ran into you trick-or-treating.