Data, a term that holds various interpretations across different individuals within a financial organization. Often, it seems like a soccer ball, constantly being kicked around but seldom reaching the goal.

This is why we are aiming to simplify and clarify the complex world of data for you, so that you can seize a swift win with your data, fully utilizing one of your most vital pieces of digital assets, consequently enhancing your loans and deposits.

The top 3 insights from this article:

- The importance of owning your digital real estate and data: While renting digital real estate (like running ads on third-party sites) can be an option, the rapidly evolving landscape of digital privacy, coupled with the rise of ad-blockers, make it an increasingly challenging avenue for growth.

- The value of "thick data": Qualitative insights that help understand the motivations and emotions of people. This humanized approach to data will lead to more effective marketing and customer engagement.

- A step-by-step approach to optimizing your digital presence using data: These steps include integrating a marketing automation platform to your website, segmenting data, gathering thick data through interviews, creating targeted ads, and optimizing digital real estate with personalized user experiences.

Enhance Your Bank’s Digital Real Estate with Data

Just as with physical real estate, the relationship between digital real estate and data can be considered in two ways: ownership and rental.

You can own your digital real estate and data, as exemplified by your public website, online banking, mobile banking platforms, and core data. Alternatively, you can rent digital real estate and data, such as running digital ads on third-party websites.

However, akin to physical real estate rentals, the owners can increase the rates or change the terms at their discretion. There may be times when renting digital real estate is a viable option, as it might provide opportunities to direct traffic from third-party websites to your own platform. Yet, with the extinction of third-party cookies—where user behavioral data was stored— and the increasing importance of data privacy, as well as the rise of ad blockers, reliance on third-party cookies and ads on rented digital space is no longer a sustainable strategy for growth.

Related Content: Third-Party Data: A Future Without Cookies

The fundamental issue lies in the fact that individuals need more than just ads to navigate the intricacies of procuring a loan or opening an account. Money matters are complicated, and individuals are seeking trusted entities that can guide them from confusion to clarity. Successful financial brands will differentiate themselves by prioritizing assistance over sales.

Thick Data vs. Big Data and DNA Behind It

Empathy, as opposed to narcissism, is a critical ingredient in marketing for financial brands. Many brands mistakenly believe they are effectively communicating with their customers when they are, in fact, predominantly promoting their offerings.

Empathy involves putting ourselves in others' shoes, an old saying that remains true. Creating consumer personas enables us to understand others better.

People are not seeking products but solutions to their problems. To construct accurate consumer personas, one must ask potential customers within the target market segment about their concerns, aspirations, and future goals. The responses provide insights into the data of individuals visiting your public-facing website, a valuable piece of digital real estate.

Related Content: 5 Ways Your Consumer Personas Are Failing Your Financial Brand

Data must not be viewed as mere ones and zeros. The key to augmenting loans and deposits lies in first aiding customers and selling later. Every data point is a person with unique questions, concerns, and aspirations.

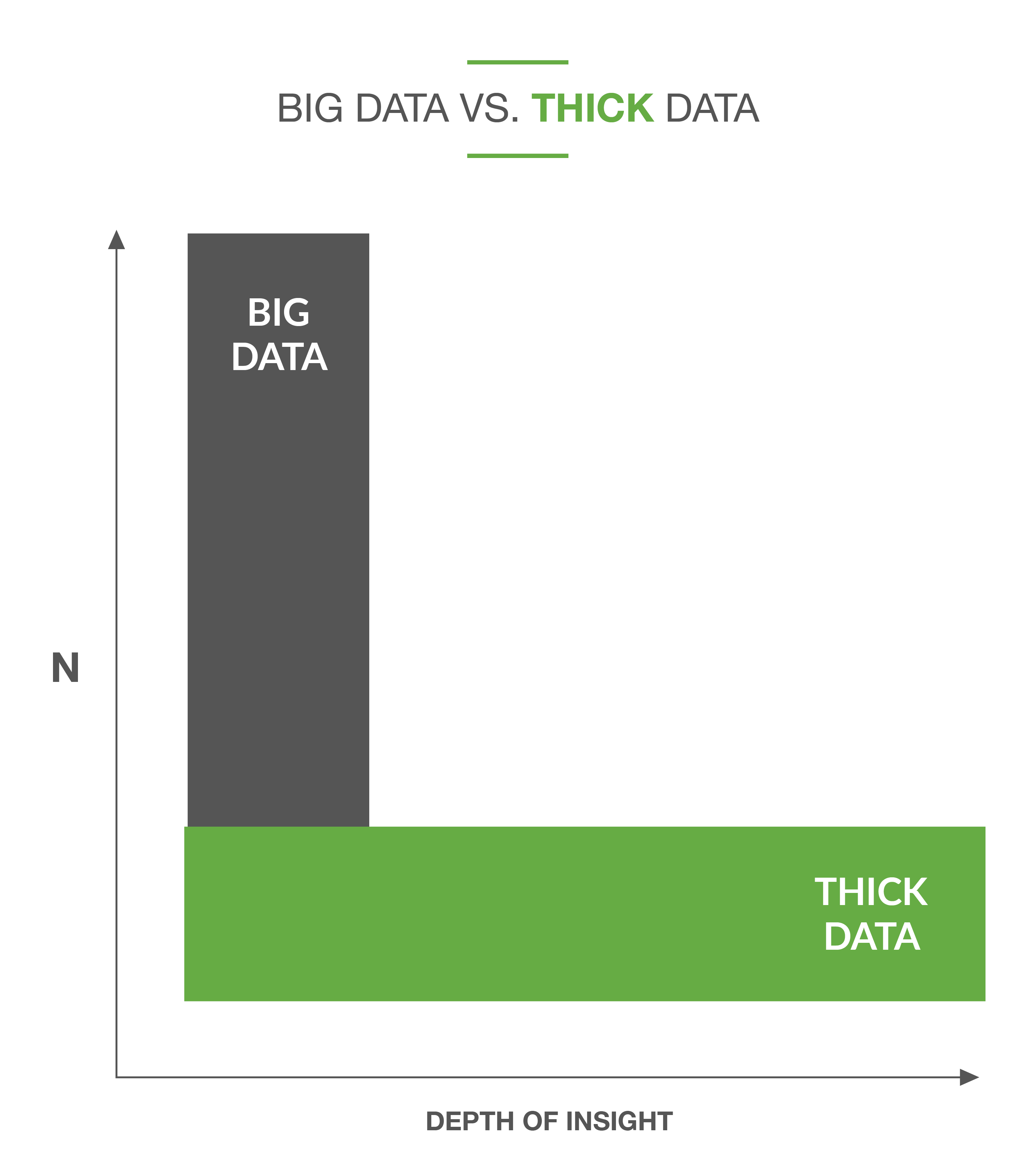

There are two kinds of data: big and thick.

Big data is collected from large datasets, internally or externally, and helps us understand trends and patterns among groups of people.

However, the real value lies in thick data—qualitative insights from a subset of people that help us understand their motivations and emotions. This does not need to be extensive; even insights from a small group can be valuable. The most significant growth potential comes from understanding human behavior.

The real value of data lies in the stories it tells—the DNA behind the zeros and ones. These stories form the narrative of the personas and provide emotional context to why people behave the way they do. The demographic data, which often appears as ones and zeros, becomes much more meaningful when personas are created.

Related Content: Consumer Personas: Obtaining Executive Buy-In on Niching

These personas, created using a model we call the 'Consumer Persona Canvas', give insights into people's hearts and minds. The first step is demographic data (big data), followed by an in-depth understanding of account holders' present realities and future aspirations through thick data. This includes understanding their present concerns and fears and their future hopes and dreams.

These insights provide an opportunity to identify solutions and guide people towards a better future. The thick data—why people do what they do, and feel what they feel—gives us the chance to find a path that can guide people beyond their current situation.

5 Steps to Optimize Your Bank or Credit Union’s Website Using Data

By following this simple five-step process, you can leverage both big and thick data to revolutionize your financial brand's digital real estate and make a tangible difference to your company's bottom line.

Step One: Integrate a marketing automation platform into your website, allowing you to convert anonymous web traffic data into identifiable user information, thanks to first-party cookies.

Step Two: Segment this data into groups based on user behavior and interests, you gain a more granular understanding of your potential customers and their needs. Start with a single product line, learn from it, and then move on to the next. This will give you invaluable insights into the customer buying journey.

Step Three: Now that you've segmented your audience, resist the temptation to start bombarding them with ads right away. Instead, schedule interviews with a small sample from each segment. This thick data gathering exercise will help you understand the motivations behind their behaviors, giving you a deeper insight into their questions, concerns, hopes, and dreams.

Step Four: Use these insights to formulate a series of targeted ads tailored to the different stages of the consumer buying journey. Keep in mind that your primary goal should be to assist, not to sell. The series of ads should guide the user from awareness to consideration and finally to the purchasing stage.

Step Five: Optimize your digital real estate. With a nuanced understanding of your customers' buying journeys, you can replace generic rotating banner ads on your homepage with targeted content specific to each customer's journey stage. By personalizing your users' experiences, you can drive engagement, increasing conversion rates for loans and deposits.

As we move deeper into the data-driven world, it's essential to remember that behind each data point is a real person with real concerns and aspirations. If we keep this fact at the forefront of our minds, we can ensure that our data strategies are always human-centered and aimed at helping our customers realize their dreams.

Take Action Today:

- Invest in a marketing automation platform: By incorporating a marketing automation platform, marketing leaders can convert anonymous web traffic data into identifiable user information through first-party cookies. This enables them to better understand who their audience is and how they're interacting with the website.

- Focus on empathetic, persona-based marketing: Rather than just promoting the brand's offerings, leaders should strive for an empathetic approach to marketing. They can achieve this by creating consumer personas based on both big data (demographic data) and thick data (understanding the motivations, emotions, and behaviors of the target audience). These personas should be constructed based on potential customers' concerns, aspirations, and future goals.

- Optimize the digital real estate with personalized content: The leaders should move away from generic rotating banner ads and instead use targeted content specific to each customer's journey stage. This can be done by understanding customers' buying journeys and personalizing the users' experiences, which can ultimately drive engagement and increase conversion rates for loans and deposits. This optimization should be seen as a long-term growth strategy rather than a short-term sales push.

Together, we can drive the financial sector forward into a brighter, more data-informed future.

or more about financial transformation, reach out to James Robert Lay at the Digital Growth Institute.

This article was originally published on August 2, 2023. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.