Managing Interest Rate Risk With a Bank Loan Term Sheet

We recently reviewed a loan term sheet from a national bank for a $13mm commercial real estate (CRE) loan. The bank offered a 25-year amortizing loan with a ten-year term and required the borrower to hedge its interest rate risk. The borrower was provided options on the type of hedge and when to execute. The language from the term sheet appears below:

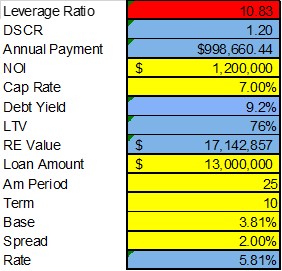

Borrower will be required to hedge the floating interest expense by entering into an interest rate swap or interest rate cap (“Hedge”) with Bank (or other counterparty acceptable to Bank), contemporaneously with or before the closing of the Loan (specifically Phase I). Bank and Borrower estimate that the notional amount for the Hedge shall be up to $13,000,000. Bank is willing to provide this Hedge to Borrower upon mutually agreeable terms. Assuming that an interest rate swap was executed with Bank at today’s rate, the interest rate swap fixed rate would be 3.81%, and Borrower’s synthetically fixed rate for the loan would be 5.81%.

Hedge Requirements Within a Bank Loan Term Sheet

The loan term sheet language dealing with hedge requirements raises the old question of how to allocate interest rate risk (which can translate to credit risk – as we have seen over the last 12 months) between the borrower and the lender. This particular national bank has the ability to offer the borrower an interest rate hedge or an on-balance sheet fixed-rate loan. However, the borrower’s rate would be higher, and the prepayment penalty would be onerous with an on-balance sheet fixed-rate loan. The interest rate hedge requirement decreases the borrower’s all-in rate and provides the borrower with a symmetrical prepayment provision instead of a Treasury make-whole penalty.

Further, this CRE financing is a high-leverage loan (see table below for financial underwriting ratios). An interest rate hedging strategy, specific hedge duration, amortization term, capital infusion covenants, and other loan structure requirements become more critical with higher leverage loans. CRE loans are almost always highly leveraged, and this loan is no exception. This loan was underwritten to 1.20X debt service coverage ratio (DSCR), 76% loan-to-value (LTV), 9.2% debt yield, and the CRE capitalization (cap) rate is 7.00%. The loan leverage ratio is 10.83 (total debt divided by net operating income (NOI)).

While the loan underwriting is squarely in most banks’ policy guidelines, the loan is highly leveraged, and any increase in expenses or decrease in revenue will create credit stress for the lender and default risk for the borrower. The requirement for interest rate hedging is a risk mitigation step to stabilize the borrower’s largest expense – senior debt payments. Further, the bank is not allowing the borrower to carry the loan as a “naked floating rate” just because the market expects short-term rates to fall in the next 12 months. The loan’s contractual life is 10 years, and interest rates over the long term are unpredictable.

As typical for senior debt analysis, the higher the loan leverage, the harder it is for borrowers to absorb rate hikes and revenue shocks. Real estate loans typically are structured at high leverage (above 6X debt to NOI). To underwrite this loan to below 6X leverage ratio, the loan would need to be adjusted to 42% LTV and show over 2.0X DSCR.

The bank is also prohibiting the borrower from finding the best entry point for the interest rate hedge, which must be in place at or before the loan closing. Borrowers cannot predict the direction of interest rate movements, much less absolute interest rate levels. Instead, banks advise borrowers to set funding objectives, risk tolerances, and hedging parameters and accept the final market interest rate at closing (assuming the underwriting parameters are met).

Conclusion

Borrowers and lenders often harp on the uncertainty of market movements (interest rates, cap rates, rents, etc.). When dealing with long commitments and high-leverage loans, that uncertainty is magnified. Most national banks require stabilization of P&I payments through on-balance sheet fixed-rate loans, or some form of interest rate hedging. Community banks should understand what the national bank competition is offering to be able to compete more effectively for profitable relationships.