Bank Value: Here is a Better Way to Calculate and Manage

Ask a banker about the value of their bank, and they will either talk about some derivation of book value or earnings multiple. While these bankers are not wrong, they are not exactly right. While both valuation methods provide everyone with a nice, tidy sum of value, the data could be more actionable. You might find out that your low cost of funds or higher-than-average net interest margin likely drives the bulk of your bank’s value, but then what do you do? Do you reduce your cost of funds? Do you increase your loan spreads? If you do either of these two things, they will likely result in less value and not more. The problem isn’t in the concept but in the process. This article examines why the standard way to value a bank is flawed and how to have a better methodology.

The Better Way to Calculate Value: Customers and Product

If you lower deposit rates in this market, you will likely lose customers to competition that may be paying 5% or greater. Suppose you institute floors for your loans or increase the credit spread. In that case, your bank will likely get adversely selected and unknowingly take on riskier customers, which will likely cause problems during the next credit downturn.

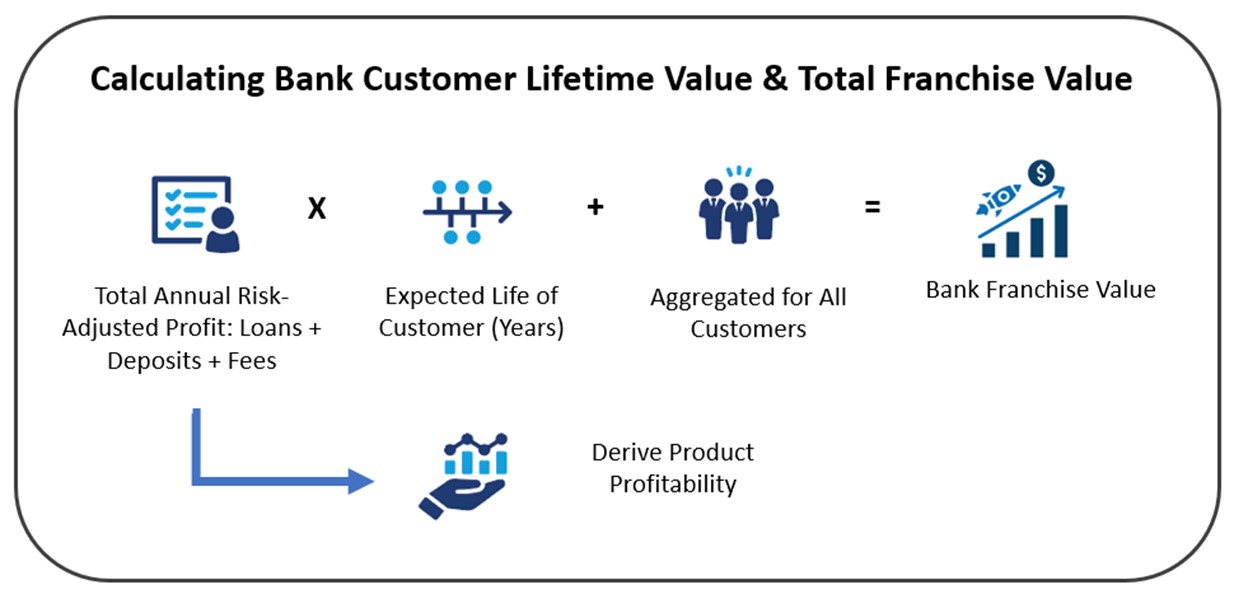

All customers are not the same, nor are all products. The better way to increase franchise value is to look at your bank as a portfolio of customers and products. Those are the only two items for strategic and tactical decisions. If you know the cumulative lifetime value of each customer and each product, you are on the precipice of having one of the most profitable banks in the market.

Creating Bank Value – The Interplay Between Customers and Deposits

If you want a more profitable bank, go after more profitable customers. If you want more profitable customers, have more profitable products that attract those profitable customers. Thus, you arrive at a formula that has never failed to produce a top-performing bank:

Selling more profitable products to more profitable customers is hyper-common sense. Unfortunately, like the old adage – common sense is not so common. Banks often don’t know who their most profitable customers are, and if they do, they ignore the basics of targeting those customers and prospects with marketing, sales, and product management.

For example, many banks don’t risk-adjust their loans using a risk-adjusted return on capital model such as Loan Command. They tend to price all loans equally despite the loans having radically different structures and credit risks. Many banks allocate marketing dollars evenly across all customer deciles of profitability. These banks pay people and marketing agencies to bring them unprofitable customers. Still, other banks will think nothing of raising the rates on their certificates of deposits, likely their least profitable product, while not investing in payments or treasury management, two of the most profitable products a bank can own.

We discussed many of these machined-learned bank marketing insights in our “5 Lessons Using Bank Customer Lifetime Value Data.” Now, we want to add another layer.

The Hallmarks of a Profitable Customer in Creating Bank Value

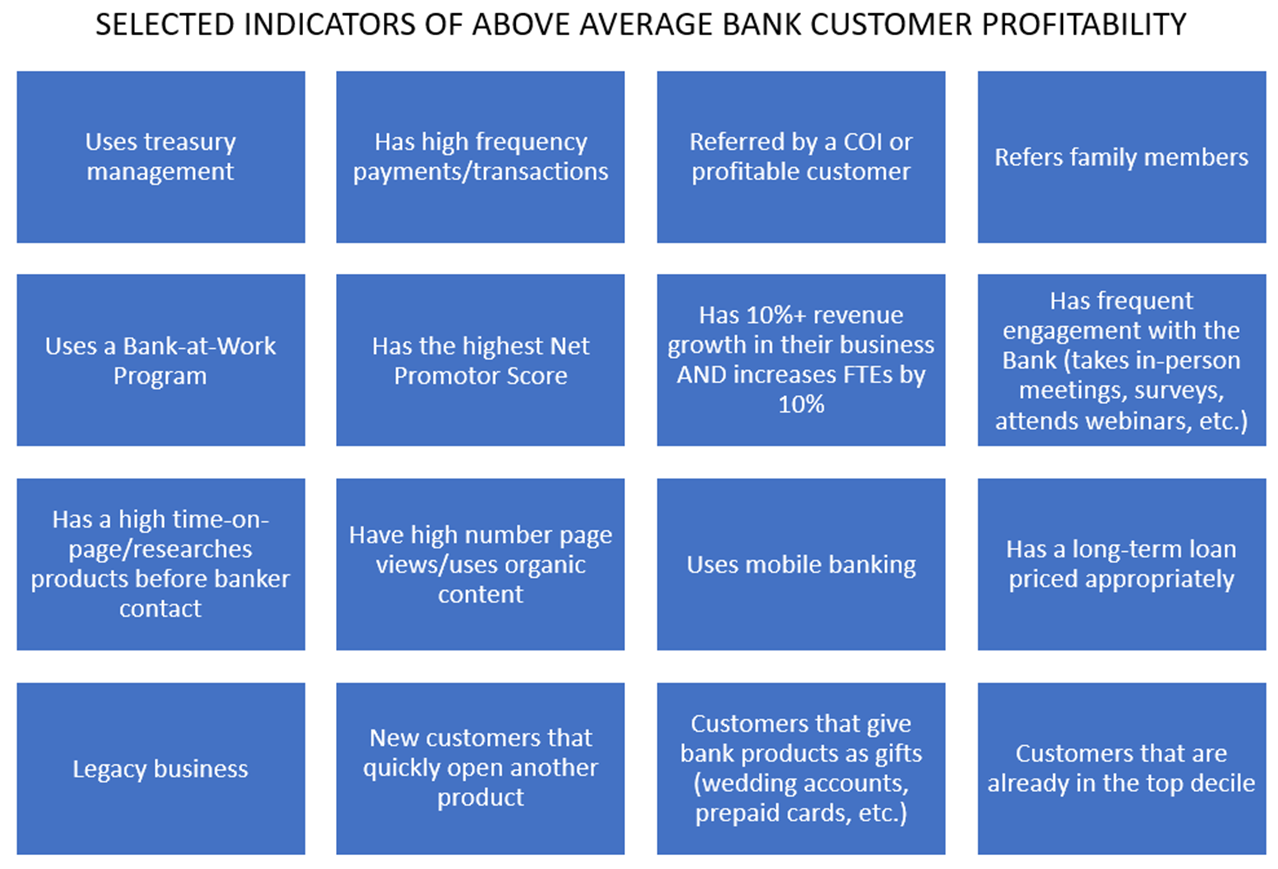

While not all high-value customers are the same, they share many attributes that can help bankers better acquire these customers. The below attributes are just some characteristics of high-value customers. These will not be the same for all banks but are extremely common. We also point out that we are not here to suggest a causal relationship (although many are), only that these attributes correlate with above-average profitability.

As we have written about before (HERE), your average treasury management customer has a balance of $900,000, or 31% above the average non-treasury management commercial customer. This equates to a 63% risk-adjusted return. As such, a bank should allocate greater sales, marketing, and product dollars to this effort. The same goes for payments and companies that will take a bank-at-work program where the customer is a client and promote the bank to employees.

Customers who tend to take long-term commercial loans out with the bank also tend to be above average in profitability. Long-term fixed-rate loans, for example, often (and should) have prepayment provisions, so a customer that takes a ten or 15-year loan out not only usually doubles their expected life with the bank because of the product but also sends the signal that they believe in the bank’s brand and will stay with them well into the future. This loyalty usually manifests itself in greater product use and balances.

This brand relation is similar to customers who refer friends and family members to the bank or use their bank for gifts. Customers who refer to or give bank products tend to see themselves in the bank’s brand and be the more loyal and profitable customers. The same goes for customers who engage frequently with the bank.

Another indicator is customers with the highest Net Promotor Score (NPS) (latest bank rankings HERE). When it comes to customer profitability correlations, using NPS is not ideal. Significant correlations are usually only present in the highest (9 & 10) and lowest ratings (0 & 1).

Finally, the type of business tends to be of higher profitability. We covered industries that banks should target HERE for that reason. However, other traits, such as legacy businesses or those that have been or plan to be passed down to the next generation, tend to be more profitable. The same goes for higher-growth, well-managed companies. Companies that grow 10% or more annually in revenue and hire staff to keep up with that growth tend to be in the top quartile of profitable customers.

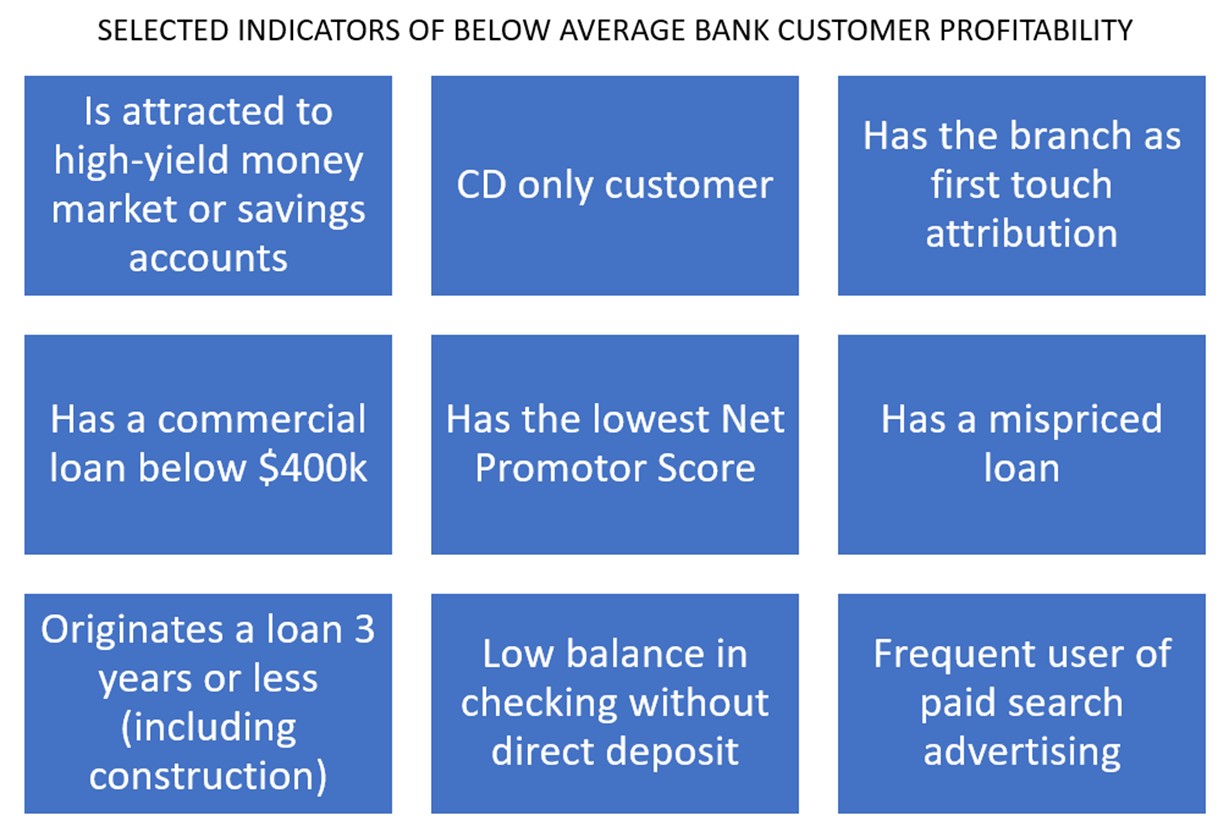

Contra Indicators of Profitability

Of course, there are inverse or contra-indicators of profitability as well. Customers who come to the bank for high-priced CDs, savings, or money market accounts are classic examples. Banks that tell themselves that the higher interest rates on these deposits are like a “marketing expense” to get these customers in the door are fooling themselves. While sometimes true, more often, these customers are rate-sensitive and correlated to customers in the bottom quantile of profitability.

Attracting unprofitable customers is one reason why a digital-only bank is a bad idea and has rarely been profitable. The banking industry is littered with a long list of banks or neobanks that spent millions of dollars to attract customers with low profitability by offering higher-rate deposit accounts or unprofitable small loans only to have to close down or shut down unprofitable operations – Marcus, Finn, Chime, N26, Simple, Bo, Volt, Monzo, NextBank, Security First Network Bank, ING Direct, and the list goes on.

No Correlation Customers

Then, there is a long list of attributes that exhibit low or no correlation to profitability or unprofitability. As we mentioned above, customers that give the bank Net Promotor Scores between 2 and 7, which are most customers, have a low correlation to profitability, which is one reason why we don’t love tracking that metric.

The other set of metrics we don’t love are demographic metrics. Here is another classic example of banks being lazy or misguided. It is far too common in our industry to see banks that spend money on a particular demographic cohort, such as trying to get more Gen X, Millennials, or Gen Z, wasting valuable marketing dollars. Customer lifetime profitability is evenly distributed among every age, so targeting age characteristics will get your bank’s average franchise value. It is far better to go after customers with a certain intent or highly profitable characteristics. That next dollar of marketing expenditure banks are thinking about spending to go after Gen Z is better spent on asking a profitable customer to bring over more business or to give you a referral.

Putting This into Action

The first step to implementing this bank value methodology is to expand your data collection regarding your customers. Building out your CRM system to collect enough customer information will allow you to test what attributes are and are not correlated to profitability. We have given you 25, but there are another 100 that are commonly used.

Next, banks always need to be running experiments to collect more data. Banks each have slightly different customer bases and prospect targets, plus times change. Many characteristics that we knew before the pandemic are no longer valid. The advent of generative AI is about to change profitable customer preferences yet again. When A/B tests sales and marketing campaigns, for example, it is not enough to know which efforts were more effective but which were more effective with profitable customers or prospects.

Once banks have a feel for profitable customer characteristics, they can go after “look-alike audiences” or targets that share similar characteristics. Finding look-alike audiences can be done automatically using Google, Facebook, or other advertising platforms (the fastest and easiest way) or manually targeting by attribute (the more profitable and controllable way).

In parallel, banks need to focus on building and marketing products that attract more profitable customers and are profitable themselves. Investing in treasury management, payments, health savings accounts, retirement accounts, 1039 exchanges, or products that serve above-average profitable industries (like healthcare) are much better moves to enhance a bank’s franchise value rather than worrying about net interest margin or going after Millennials.

Once you have customer and product profitability, the next goal is to try to increase total customer lifetime value by 1% per month. These small steps will end up compounding into a very profitable institution. Once you focus on customer and product value, net interest margin and earnings multiples will care for themselves.