Silicon Valley Bank Failure – Lessons in Interest Rate Risk Management

The abrupt collapse of Silicon Valley Bank (SVB) is a stunning example of bank leadership not understanding interest rate risk, running into trouble with an inverted yield curve, and ignoring the impact of a severe monetary correction on long-duration assets. There will be much more discussion and information written on this bank’s collapse, as well as the shutdown of Signature Bank and the story about Sterling Bank, and perhaps others in the weeks and months to follow. While we will cover the general lessons HERE, in this article, we wanted to focus on the root cause – how and why interest rate risk caused the second-largest bank failure in US history (Washington Mutual was the largest in 2008).

Silicon Valley Bank’s Specific Situation

Historically banks fail because of liquidity risk caused by credit deterioration. In the case of SVB, liquidity risk was primarily the result of interest rate risk exacerbated by customer concentration. The failure of SVB is the first example we can recall since the Savings and Loan crisis, where a bank failed mainly because of a duration mismatch between assets and deposits.

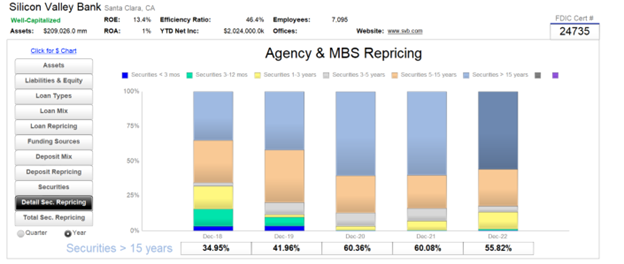

On the liability side of SVB’s $173B in deposits at the end of 2022, approximately 97% were uninsured and above the $250k in FDIC protection threshold. That fact makes the bank’s deposits less sticky and subject to outflow at any sign of insolvency. Equally important is the bank’s securities duration, as shown in the graph below.

Approximately 56% of the bank’s securities had repricing greater than 15 years. Available-for-sale securities are reported at fair value, and any unrealized gains and losses are included in accumulated other comprehensive income (AOCI) in the equity section of the balance sheet. The AOCI is an accounting adjustment meant to reflect the economic value of assets. SVB’s securities portfolio is high credit quality (Treasuries and quality MBS) but long duration. The bank’s available-for-sale (AFS) portfolio was $26.1B at the end of 2022, with $2.4B in adjustment (9.2%) for interest rate risk movement. More importantly, the bank’s held-to-maturity (HTM) securities portfolio was $91.3B at the end of 2022, and the bank’s filing shows that the mark-to-market loss on the HTM portfolio was over $15B, almost equal to the bank’s equity base, thereby, making the bank economically insolvent. Based on the bank’s own filing, and like many banks, SVB did not deploy hedging instruments to manage its securities duration risk.

The SVB Takeaway For Community Banks

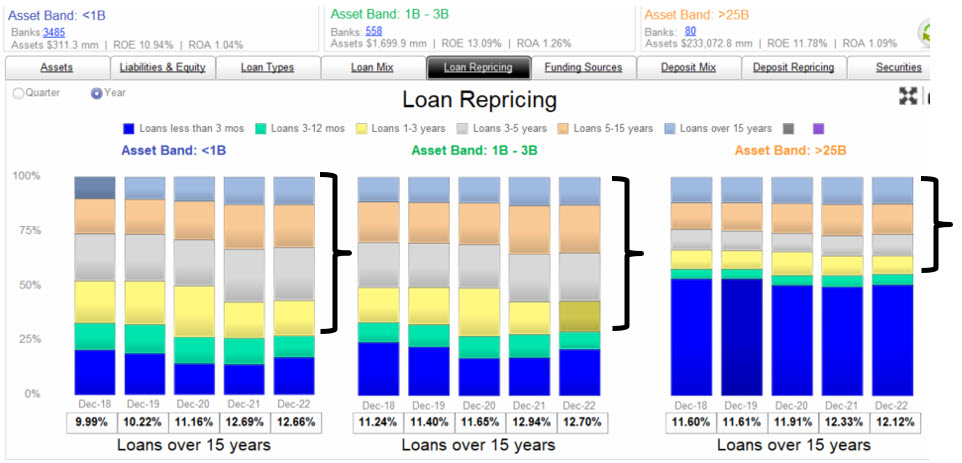

Community banks should continue to monitor their deposit base, liability sensitivities, and duration risks. Notably, most community banks’ duration risk is in the loan portfolio. The graph below shows loan repricing buckets for three asset-sized groups of banks: under $1B, $1B to $3B, and over $25B in assets. In summary, smaller banks have a higher percentage of fixed-rate loans than larger banks, as noted by the black-colored brackets. The proportion of fixed-rate loans has increased for community banks over the past four years. In contrast, larger banks have more loans in the variable bucket, and their fixed-rate loan portfolio has held relatively steady in the past four years.

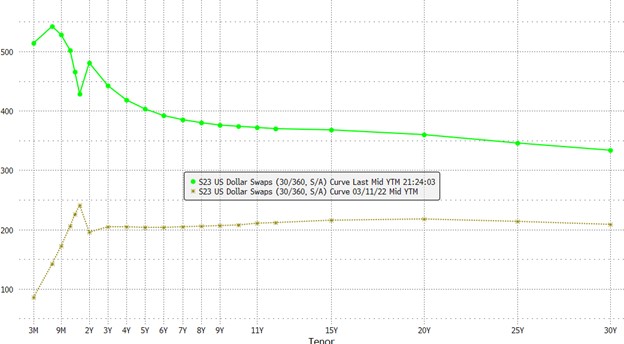

The graph below shows the change in interest rates across the entire curve over the last year. The biggest rate increase is at the short end (2.75% increase over one year for two-year rates), and the smallest increase is at the long end (1.26% increase over one year for 30-year rates).

Each basis point increase in rates decreases the lifetime value of a fixed-rate loan to a bank – the same as the AOCI for fixed-rate securities. The longer the fixed rate, the more sensitive the loan is to negative economic adjustment.

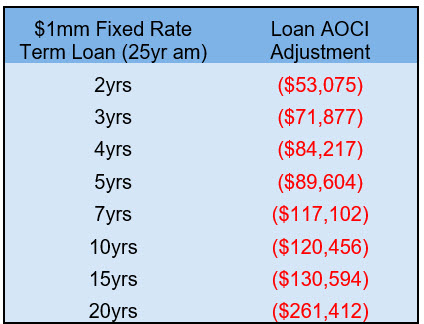

We can further calculate the AOCI for various term fixed-rate loans based on interest rate movement over the last year. The table below shows the negative AOCI of various fixed-rate loans with different contractual terms given interest rate movements over the past year.

This table shows that a $1mm in principal, 25-year amortizing loan, with now a five-year maturity, in the last year, recognized a negative AOCI of approximately $90k. The economic value of that loan is $910k (a 9% reduction in economic value). A $1mm in principal 20-year maturity loan in the last year had a negative AOCI of $261k (a 26% reduction in economic value).

Conclusion

As Silicon Valley Bank learned, even unrealized interest rate risk matters.

Bankers should be concerned about increasing asset duration, and the goal should be to keep the duration between deposits and loans well-matched and short. The longer the duration in the investment portfolio, the shorter the duration should be on the lending portfolio. The argument that fixed-rate loans protect the bank when interest rates are falling, as they may do in the future, is not empirically validated.

Because when interest rates fall, most credit-worthy borrowers refinance their loans – this has been the pattern in almost every decreasing interest rate environment. Banks need to set the duration of their liabilities based on their products and customer base and then actively manage the interest rate risk on the loans and securities side of the balance sheet. The liabilities of Silicon Valley Bank were shorter and more liquidity sensitive than they assumed. A small handful of their venture capital customers held a large influence over the majority of their customer base. The customer segment is such that they tend to follow each other and are active users of social media. That combination made their liabilities very sensitive to safety.