The top lending & credit risk blogs of the year

Abrigo

DECEMBER 22, 2023

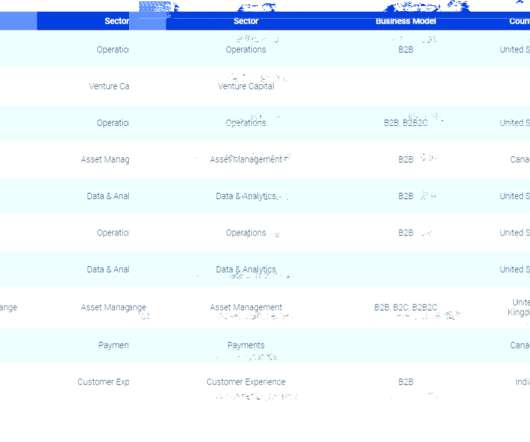

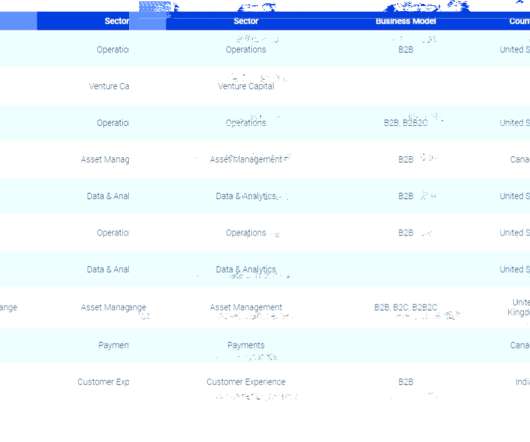

The most-read lending & credit blogs in 2023 Probability of default, CECL model validation, and stress testing were among Abrigo's top blogs on ALM, CECL, and portfolio risk this year. Takeaway 2 The top lending and credit blog posts focused on the benefits of banking technology, interest rate management, and developing risk ratings.

Let's personalize your content