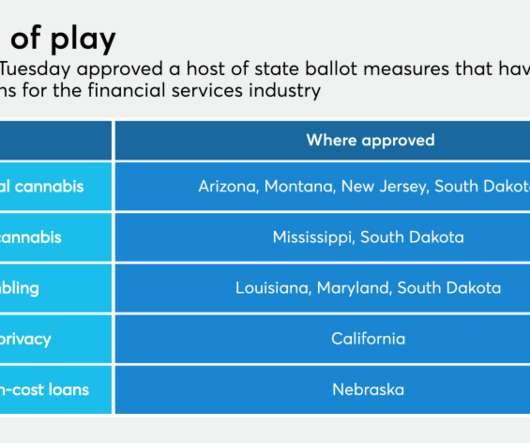

Predatory ‘Rent-a-Bank’ Lending Practices Trigger Calls For Regulation

PYMNTS

MARCH 11, 2020

“A few banks are making [state consumer] protections moot…[and] regulators haven’t stopped them,” said Alex Horowitz, a senior research officer at the Pew Charitable Trusts, a nonprofit organization that has studied subprime lending. ” An uprush in predatory lending has prompted more states to institute interest rate caps.

Let's personalize your content