The Power Of Three – Using Our Updated Loan Proposal Generator

Our article last week (HERE) discussed the “power of three” marketing rule and how to use it for loan proposals. The rule states that human brains make better decisions when given a small selection of appropriate options but not too many to become confused. One or two options are usually insufficient, and five or more options are too many, but successful banks present three (sometimes four options) that reflect what the lender understands as the borrower’s goals in financing. In this article, we provide our loan proposal generator that will help steer borrowers into optimal financing decisions. To do so, lenders must identify many criteria that borrowers will consider important, such as amortization term, credit spread, advance rate, credit support structure, prepayment options, credit portability options, etc.

Many lenders cannot access customizable graphic-rich and uniform leave-behind materials or professionally formatted term sheets. We have enhanced our website to be a marketing resource for our lenders, and we make it available to all community bankers (without charge or any other obligations). Our online proposal generator is an easy-to-use tool that allows lenders to create, save, update, print, and share standard formatted PDF presentations with borrowers. Lenders can also view proposals generated by their colleagues at the bank to understand market pricing. The presentation includes the bank’s desired logo. If you like the idea of an online proposal generator but do not want to use ours, we can also share best practices for developing your own.

How The Loan Proposal Generator Works

Because competition is intense for deposit-rich clients and every lender is looking for a competitive advantage, at SouthState Bank, we strive to develop tools to help our bankers retain profitable customers and win more loan business. A better product, faster service, or insightful advice can translate into keeping better clients, additional loans, more deposits, better credit spreads, or additional fee income.

We have created a customized and downloadable proposal generator that lenders can use as a marketing tool or part of a term sheet or letter of interest. This customized presentation shows pricing options, prepayment scenarios, historical rates, and the market’s expectation of future rates. The personalized presentation can be tailored to specific borrowers, loan amounts, amortizations, and terms. It can also show forward starting rates (for construction through term). Our new feature allows lenders to price internal refinancing opportunities by showing borrowers the cost to blend an existing rate or lock a future rate corresponding to the current facility termination. All of this is presented professionally and concisely with your bank’s logo on each page.

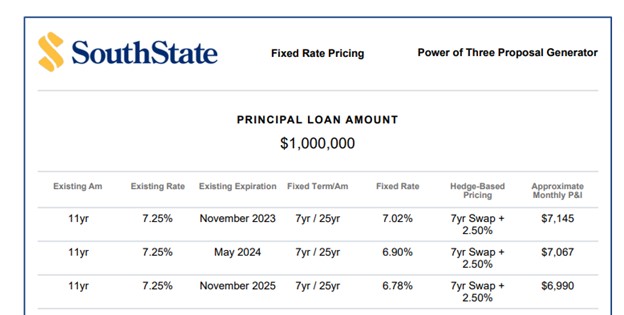

Lenders can save loan opportunities, update pricing as needed, and save, send, and share presentations. Each presentation has up to six loan structuring options and various graphs. The screenshot of the proposal generator below shows a borrower with an existing 7.25% fixed-rate loan and the loan rate at 2.50% credit spread today, in six and 24 months. This example shows the inversion of the yield curve and the lower cost to fix financing costs up to two years in the future.

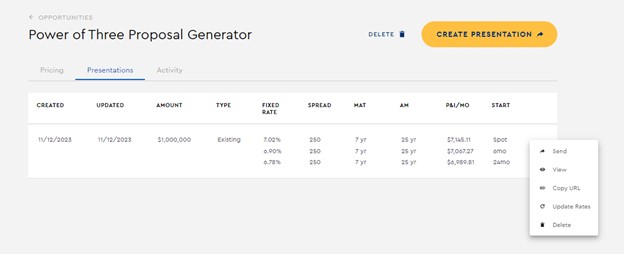

The loan proposal generator is easy to use. The lender must input the loan amount, pricing requirements, structure, starting date, and the borrower’s name. With a click of a button, a customized presentation is emailed or downloaded for the lender to share with the borrower. Rates can be updated daily. The screenshot below shows how lenders can update, send, and save various proposals for different clients.

Why Proposals Work

Touchpoints are critical in sales, including loan sales. Every time a lender contacts the borrower, the contact creates an opportunity to demonstrate superior service, impart market information, offer expert advice, or increase mindshare. However, borrowers do not typically want to see pages and pages of print. Borrowers want to know where general interest rates are, the bank’s pricing structure, a bank’s loan amortization, and fixed-rate term, where the market expects rates to be in the future, and all of this is best presented graphically. Showing multiple options in the same proposal allows lenders to leverage the power of three and better influence the borrower’s decision-making.

Our customized presentation in PDF format is graphic-rich and straight to the point. A lender can re-generate the presentation as often as needed and share it with the borrower (or keep it as a learning tool and store it to file). Research shows that borrowers find graphics 70% more persuasive than typed information. This means that even when a lender talks to a borrower and presents a written LOI, the chances of a successful sale increase substantially if the lender can deliver a graph-rich PDF presentation with the bank’s logo customized to the borrower’s name and borrowing needs. Therefore, having the PDF presentation at the banker’s fingertips anytime they want to generate it and share it with as many borrowers as possible increases loan production and client retention.

Putting The Loan Proposal Generator into Action

An online loan loan proposal generator is one of the least costly tools your bank can offer lenders. It is easy to develop, and the ROI is immense. Our customized online proposal generator is available to bankers to use, and we will even train your lending team on how to use it. However, if you decide to create your own, we can discuss how we built ours. Community banks should want to see their lenders have access to compelling and professionally constructed presentation material because it leads to more profitable loan business and retention of your most profitable relationships.

To gain free access to the Loan Proposal Generator, go HERE or contact your SouthState representative. A video explaining the app can be found HERE.