Last October, as CIT Group was ramping up its integration of

“This management team has time and time again said that we're always open to opportunities that are going to help accelerate or create more value for the shareholders,” Alemany said on a conference call with analysts at that time.

Those comments acquired a prophetic ring Friday, as CIT

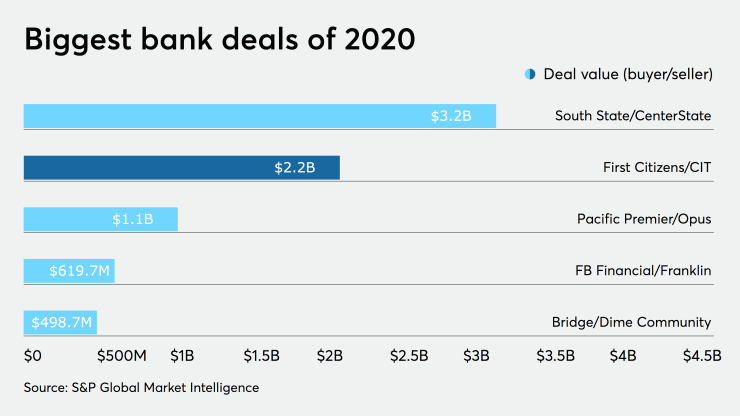

The agreement, the second-largest by deal value in bank M&A this year, pairs a solid commercial lender with an exceptional deposit-gathering franchise.

The $49 billion-asset First Citizens held $42.3 billion of deposits on at Sept. 30. More importantly, perhaps, First Citizens doesn’t pay a lot for them. Its cost of deposits totaled 13 basis points.

“We still have some room to go here,” First Citizens' Chief Financial Officer Craig Nix said Friday on a conference call discussing the M&A deal. “We see deposit costs drifting back down to single digits, similar to where they were in the 2016 to 2018 time frame.”

The $61 billion-asset CIT is a larger institution, so its deposit base is larger at $49 billion. But its loan-to-deposit ratio is 100%, far less favorable than the 79% at First Citizens.

And while CIT’s deposit costs have been declining in recent months, they are 91 basis points, which is much higher than First Citizen’s.

“We’ve always struggled with our cost of funds,” Alemany said on Friday’s conference call.

CIT, which was founded in 1908, operated as a nonbank specialty lender throughout most of its history. It entered the subprime mortgage business in the years leading up to the financial crisis, which led to billions of dollars in losses and a bankruptcy filing in 2009. It had become a bank holding company a year earlier in order to participate in the federal government’s Troubled Asset Relief Program.

Alemany said her overarching goal since joining CIT in 2016 has been remaking the company from a niche lender to a commercial bank — “really trying to get rid of that specialty finance multiple and being — I hate to say it — a boring regional bank.”

Alemany and Frank Holding Jr., First Citizens’ chairman and CEO, said Friday’s deal would do just that.

“When you put everything down on a piece of paper, this deal is just so complementary,” Alemany said. “We've been trying for years to reduce our deposit costs, which would allow us to play more in a traditional middle-market space.”

The deal also checks off a key item on Holding’s to-do list, namely adding scale to what he called an “outstanding” commercial bank “but one that is candidly more narrow in scope.”

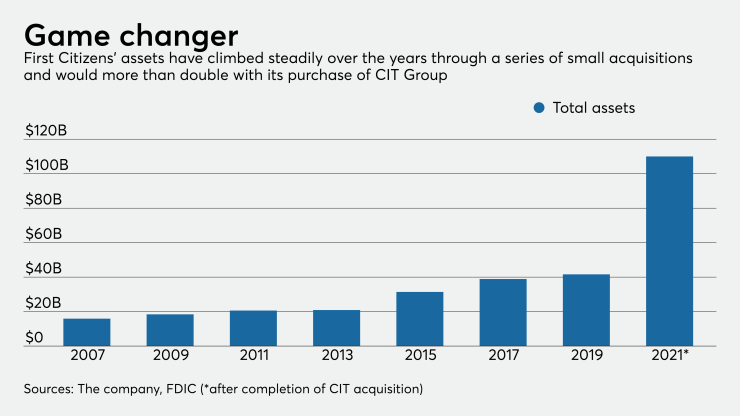

“We were seeing so many opportunities around us, but simply didn't have the product and expertise to compete as effectively as we would have liked,” Holding said. By more than doubling its assets to $110 billion and diversifying its offerings, that presumably would be less of a problem for First Citizens.

“It does put them into a much deeper pool,” Robert Bolton, a bank investor and president of Iron Bay Capital, said Friday in an interview. “The larger bank will have more opportunities across more markets.”

Bolton, however, said the combined footprint is far-flung geographically. That could make the combined bank difficult to manage, at least in the early years as the companies integrate their operations.

“A national footprint doesn’t suit everybody,” Bolton said. “There will be some challenges there.”

First Citizens’ 550 branches are concentrated heavily in the Southeast, including its home state of North Carolina, while CIT’s 92-branch network is anchored in Southern California.

The deal clearly caught the attention of other regional banks.

Bruce Van Saun, chairman and CEO of the $180 billion-asset Citizens Financial Group in Providence, R.I., said it makes “good sense.”

“This was a pretty unique situation because CIT has been trying over time to secure a more stable funding base,” said Van Saun, who succeeded Alemany as head of Citizens Financial in 2013. “This merger actually works from that standpoint. First Citizens has a big retail funding base and it’s not as developed on the commercial side.”

However, the timing was unusual, he said.

“Typically you don’t see deals done in banking during a recession until you get to peak charge-offs. That’s probably the middle of next year, maybe Q2 of next year,” Van Saun said. “I’m presuming both parties did a huge amount of due diligence … in order to be comfortable proceeding now with this transaction.”

Though both sides billed Friday’s deal as a merger of equals, First Citizens' investors would own 61% of the combined company. Holding’s family controls First Citizens, whose

Ownership aside, the transaction is priced like an MOA, with First Citizens paying $21.91 a share, 44% of CIT’s reported tangible book value, said to Janney Montgomery Scott analyst Freddie Strickland. That helps explain why projected earnings-per-share and tangible-book-value accretion, 50% and 30% respectively in 2022, are so significant.

That should help the merged company weather a difficult economy, Jacob Thompson, a managing director of investment banking at SAMCO Capital Markets, said in an interview.

“If you can bulk up, take out overlapping costs and diversify your markets, you give yourself a better chance of weathering all this uncertainty,” Thompson said.

First Citizens and CIT estimated cost savings from the combination would total $250 million, or 10% of the combined company's noninterest expense base.

In an interview after the conference call, Alemany said the pandemic’s toll on the economy — and by extension, revenue — did not influence the decision to pair with First Citizens. She said the pairing was ideal because of First Citizens’ strong core deposit franchise and a robust commercial lending network that CIT brought to the table.

“The cross-selling opportunities are tremendous,” she said.

Alemany did say, however, that the pandemic and its shocks to the economy do amplify the need for scale and diversification for banks — both in terms of lines of business and geography. She predicts more regional banks will consider mergers for the same reasons.

CIT’s direct online banking deposit platform — developed to address funding challenges — will be part of the combined bank and executives intend to identify new ways to expand it.

“Our direct bank stays — it’s very additive to the combination,” she said. “It’s a really important part of the future of the company.”

Alemany said that she will focus on her new role as vice chairman after the deal closes, helping to ensure a smooth transition and integration. But she said she has no plans for a management position.

“There is always only one boss, and in this case, that is Frank,” she said. “For me, this is a capstone transaction that secures a great future for CIT.”

Alemany, whose career spans more than 40 years, will mark her fourth anniversary as CIT's chief executive in November.

Laura Alix contributed to this report.