New Jersey files lawsuit against two buy-here pay-here used car dealers

CFPB Monitor

MARCH 21, 2019

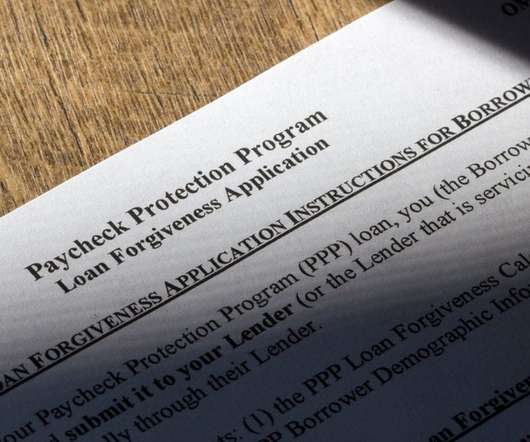

On March 7, New Jersey Attorney General Gurbir S. Grewal and the Division of Consumer Affairs announced the filing of a lawsuit against two “Buy Here-Pay Here” auto dealerships and their owner for allegedly unconscionable and deceptive lending practices.

Let's personalize your content