Why Diversification Fails at Banks

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

Current Environment

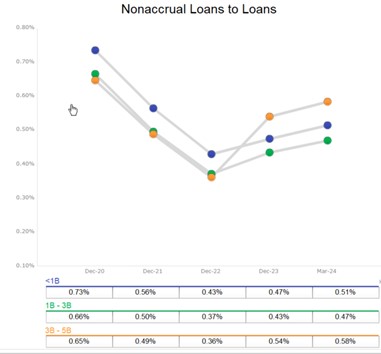

Diversification discussions arise during expected downturns or at the end of an expansion cycle. We are not yet witnessing the end of the current expansion cycle. Regulators are focused on certain CRE concentrations and categories (such as office and multifamily). However, credit quality at community banks is still healthy (the graph below shows nonaccrual loans to total loans for banks below $1B, $1-3B, and $3-5B in assets over the last four years). While nonaccruals have increased slightly, they are currently at historically low levels.

Nonetheless, many community bankers are considering whether it is better to diversify by geography, property type, or business type. Most community banks create in-house limits on exposure, focus marketing dollars, and differentiated return on equity (ROE ) or credit spreads for particular counties, types of commercial real estate loans, or certain commercial & industrial (C&I) industries. The right diversification answers may not be so apparent and vary for each bank, but in this article, we provide data and analysis showing how additional diversification may not help community banks.

Risk/Return and Diversification

We believe that there are three key reasons that diversification by geography and loan category does not enhance community banks’ resilience.

- Community banks are already diversified within their geography and loan categories.

2. Geographic diversification is difficult to achieve.

Community banks have been derided as too geographically focused and much more exposed to changes in local economic conditions, even when they hold a highly diversified loan portfolio across many local customers. Geographic diversification is about spreading assets over locations with low default covariance. The geographic diversification argument has been studied extensively. Research on this subject was conducted by Meslier, Morgan et al. in 2014 (The Benefits of Intrastate and Interstate Geographic Diversification in Banking). They further considered the effects of increasing geographic diversification versus an increase in asset size or scale to account for potential diversification benefits. The above and other studies consistently conclude that the average community bank (under $10B in assets) does benefit marginally from geographic diversification. However, there is an especially important caveat. Spreading across geographic markets has substantial costs. Geographic diversification often leads to higher costs, which diminishes the benefits of diversification. Opening branches in new locations is very expensive. These costs can be particularly high for specialized relationship lending (especially for community banks). As banks grow geographically, the cost of collecting soft data becomes more costly as the distance between the lender and the borrower increases. Furthermore, increasing distances between principals (executives and owners) and agents (lenders) create higher agency costs.

3. Diversification often fails during “left-tail events.”

Diversification disappears when bankers need it most – in a recession (a left-tail event). Prudent bankers look at the behavioral correlation of loan assets during normal times and spread risk across lower-correlated assets. However, correlations increase (unwanted outcome) when the market is stressed. In fact, the correlation in REITs rises from 0.65 to 0.95 in recessions (Leibowitz and Bova 2009). We expect that this same phenomenon will occur with bank assets. Essentially, all of the diversification building blocks fail across asset classes and geographies during a recession.

Recommendation for Community Bank Diversification

After a community bank sets limits on loan categories, the added benefit of geographic or loan category diversification appears to be nullified. However, a bank with lending activity in one state or contiguous counties has one important diversification lever to use – credit quality. It first appears counterintuitive, but lower priced (higher credit quality loans) are a better way to diversify into a looming downturn. Community banks should always have these assets in their portfolio and increase concentration later in the business cycle. To optimize loan portfolio profitability, community banks must recognize how to migrate through the credit spectrum.

During long periods of expansion, banks misprice credit risk more severely. At the end of an expansion period, better credit quality loans have a higher risk-adjusted ROE (but lower spreads). When the economy slows, or when certain loan categories are under stress, forward-thinking community banks rotate into higher credit quality loans (at lower spreads). We will expand on this concept in a future article.