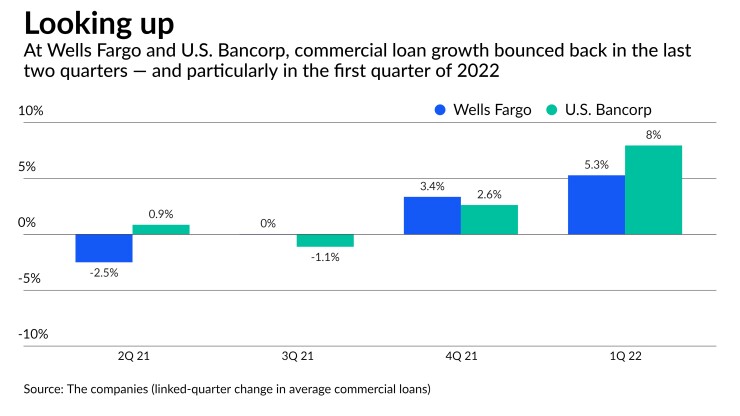

Commercial loan volumes rose early this year at some of the nation's largest banks, as inflation and previously deferred investments were among the factors that pushed business owners to borrow more.

The trend was particularly evident at U.S. Bancorp, where average commercial loans increased 8%

“We are seeing a pronounced pick-up,” said Cheryl Pate, a portfolio manager at Angel Oak Capital Advisors, comparing the recent increase in commercial lending to past periods of rapid growth after a recession.

At Minneapolis-based U.S. Bancorp, executives said the commercial loan growth reflects strength across many subcategories. They also said they expect further momentum as businesses invest in growth to meet pent-up demand from the pandemic.

The commercial loan growth during the first quarter reflected slowing paydowns, increased business activity and higher utilization rates across most sectors and geographies, Chief Financial Officer Terry Dolan said Thursday during a call with analysts.

Dolan noted that sentiment among business clients is positive and stable, and he said that borrowers are using loan proceeds to build inventory, make capital expenditures, and enter into mergers and acquisitions.

Asked about the

Businesses that are grappling with labor shortages and higher salary costs are investing in tech to create efficiencies and offset wage inflation, he said.

“It’s going to be important to automate as much as we possibly can,” Dolan said in an interview, referring to businesses across industries. “At least in the near term, capital expenditure will continue to be reasonably strong.”

At the $587 billion-asset parent company of U.S. Bank, commercial loans fueled an advance in total loans of more than 3%.

“This might wind up being some of the best commercial loan growth that we see on a linked-quarter basis,” said Mike Mayo, an analyst at Wells Fargo Securities.

U.S. Bancorp’s net interest income rose nearly 2% from the previous quarter to $3.2 billion. For the full year, the company projected 8% to 11% growth in interest income, reflecting both loan growth and

At least some bank clients will likely look to borrow in the near term to avoid paying higher rates down the road, potentially providing another boost to loan demand this year, Dolan said. “I expect people will be trying to get ahead of it,” he said in the interview.

At Wells Fargo, executives said that demand for commercial loans continues to rise more than two years into the pandemic. Quarterly commercial loan volumes were flat or slightly down earlier in 2021, but they started to rebound in the fourth quarter of last year, and that trend accelerated during the first quarter of 2022.

Wells Fargo missed analysts’ expectations on first-quarter revenue and expenses as Chief Executive Charlie Scharf continues to face challenges turning around the bank after years of scandals.

Between January and March, average loans in Wells Fargo’s commercial bank grew to $194.4 billion, up from $184.6 billion three months earlier.

Larger clients drove a sizable chunk of the increase, as companies built back their inventories, and inflation led to higher costs for transportation and materials, Chief Financial Officer Mike Santomassimo said during a call with analysts.

The $1.9 trillion-asset bank is also seeing commercial customers use credit to fund longer-term expansion plans, including some businesses that are “catching up” on capital expenditures after keeping them low during the earlier stages of the pandemic, Santomassimo said.

In addition, companies are tapping their revolving lines of credit more, though utilization rates remain below prepandemic levels, he said.

At JPMorgan, average total commercial loans rose to $210.7 billion in the quarter, up by about 2% compared with both the fourth quarter of 2021 and the year-ago quarter. Citigroup, whose corporate loans in North America rose to $129.2 billion, reported similar percentage increases.

PNC's commercial loans rose to $195.6 billion on average last quarter, up 1% from the prior quarter and 19% from a year earlier. The jump was partly due to companies' higher capital expenditures, inventory buildups and usage of revolving credit lines, PNC Chief Executive Bill Demchak said Thursday during a call with analysts.

The industrywide uptick in commercial lending is an indication that “despite increasing uncertainty, the economy is still fairly strong,” said John Mackerey, an analyst at the credit ratings agency DBRS Morningstar.