I was a huge fanboy of Simple Bank back in the day. Sure they had great tech, refreshing UX and a talented team. But what I really loved was how they spoke to customers. Real language. Real humor. And they just didn’t seem to take themselves too seriously. Obviously, that edge was destined to fade away under big-bank ownership (it was acquired by Compass/BBVA in 2014). And it has. Though Simple is still hitting well above average by most measures.

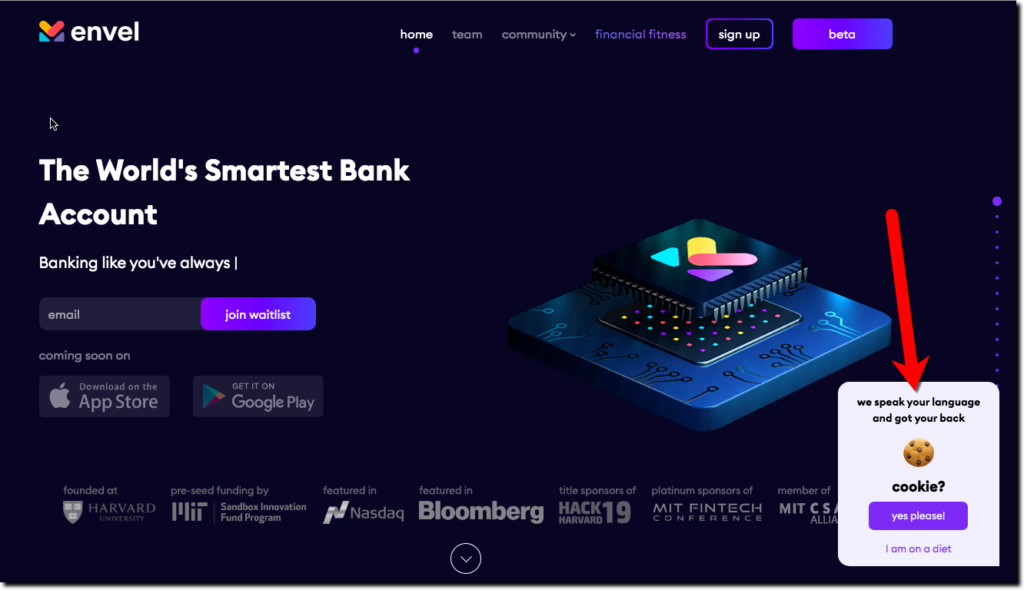

So I’ve been curious to see who becomes the next Simple. Certainly, Chime has gathered the most attention (along with a $15B valuation) and there are many others such as Varo, Current, Sofi, and the like. But, I think we have another strong contender with the latest challenger, Boston-based Envel. It has the tech. It has the team. And someone there has a sense of humor (check out the best “cookies” notification in the business on the screenshot below). I don’t think it will win awards for humbleness (eg the tagline “The World’s Smartest Bank Account” as well as beta testing only at Harvard/MIT), but startups must put their best foot forward, so I won’t hold that against them.

The company has publically announced $2.7M in seed funding (which closed in July according to Crunchbase) and it looks like they have put it to good use given the feature-set they’re promoting. From the outside anyway, Envel looks to be a case study in leveraging partners’ technology to stitch together world-class features without building in house. They have said they are working with BaaS provider Cambr and Q2 for digital banking technology. On the banking side, the startup is working StoneCastle for deposits and Kansas City-based nbkc bank to power banking services, including a soon-to-be-launched debit card.

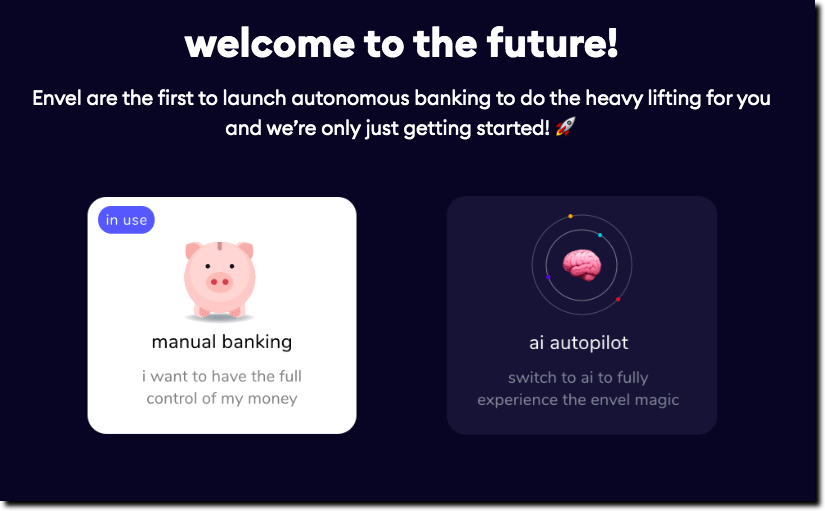

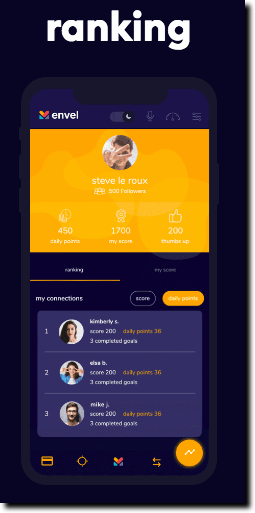

Based on early comments (see Feb 2020 Q&A above) as well as their beta tests at Harvard/MIT, it appears the bank is initially targeting gen Z-ish customers (21+), but the website appears to be going after a more general tech-and social-savvy audience (the Venmo base). The bank uses a number of trendy buzzwords (AI, autopilot, not to mention their URL, envel.ai) and includes a social section on its app where customers can share goal achievements (see inset).

Vitals:

- Founded: 2018

- Funding: $2.7M ($2.6M July 2020, $100k May 2019)

- HQ: Boston

- Founders:

Steve Le Roux (Linkedin)

Diederik Meeuwis (Linkedin) - Number of Employees: 16 per Crunchbase

- BankTech stack: Cambr, Q2, nbkc bank, Visa

- Operating status: Limited beta with Harvard/MIT students; waitlist for everyone else

- Website: envel.ai

- Twitter: @envel_ai

- Instagram: envel_ai

References:

- Fintech Futures overview (22 Sep 2020)

- Envel press release (17 Sep 2020)