Charm Pricing in Banking: How To Use The Left Digit

Most banks completely ignore odd digit pricing. Instead of offering that competitive commercial loan for 7.00%, you offer the loan for 6.99%. Conversely, in a non-competitive situation, instead of offering a 6.20% rate, you offer a 6.23% rate and pick up three basis points per year. However, those banks that do are religious about it and as a result, it ends up increases their product acceptance rate and increasing margin. One bank we know was able to do this on 88% of their $420mm loan portfolio and picked up an extra $111k per year in interest earnings that they might not have had if they lived in a world of round numbers. In this article, we will look at some pricing tactics, the data behind the tactics and how banks best employ these psychological moves to increase earnings and conversions.

Charm Pricing in Banking

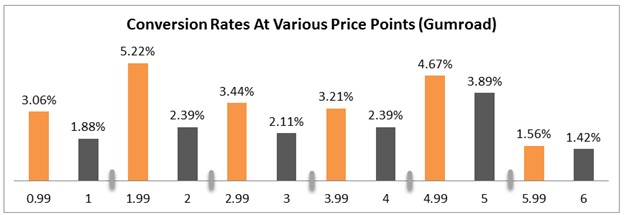

We have all experienced what is known in the retail trade as “charm pricing.” Sellers reduce the left, dollar digit and offer a price for the product that ends in 99 or 95. Gas stations are famous for it. Gumroad is an e-commerce platform for creative intellectual property and did an experiment where they offered the same product for two different price points, one utilizing charm pricing. Their data is graphically presented below:

On average, by decreasing their price by one cent, conversions increased more than 7%. For example, offering the product at $2.00 got a 2.39% conversion rate whereas offering the product at $1.99 helped convert accounts at a 5.22% rate or more than twice as much.

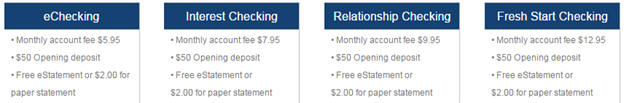

Banks use this tactic for many products from loans, to deposit accounts to fee income products. For example, many banks have retail deposit account fees that end in “95.”

Why Charm Pricing in Banking Works

You might assume from the above data, that dropping the price by one cent hits a certain sensitivity so that sales increase. While this might be a small part of it, it does not explain what is going on as the conversion rate on checking account is almost identical if we offer the same account at $10.05 instead of $10.00 per month.

This tactic works the best when your digit to the left of the decimal gets lower and anchors the reader to a lower price point. Our brains encode information so quickly that when they read a checking account being offered at $9.95, we emotionally interpret the price point as being closer to $9 than to $10. This left-digit effect on price cognition has been supported by multiple academic studies, the most cited of which is Cornell University’s 2005 research by Thomas and Morwitz.

Make The Converse Work for You

This is the same cognitive price effect that causes loan, fee, and deposit customers to be largely indifferent to prices with the same left-hand digit. When we offer loans at a 2.49% spread, the conversion rate is the same when we offer it at 2.45% spread. As such, offer the higher spread and pick up the extra four basis points.

Putting This Into Action

Charm pricing can increase the perceived value of bank products and is commonly used by major retailers and banks alike. Experiment with different price points for loans, deposit accounts, deposit rates and fee income lines such as lock box, loan sweep and others and track your conversions. The results may not only surprise you but will likely surprise your shareholders.