Modern Core Systems – It’s Time to Get a “Sidecar”

When banks talk about a “sidecar,” they speak about a modern, lightweight, real-time core system alongside a traditional core. The concept is that a “big bang” type conversion will never happen, so a slower, controlled transition is the path to getting a more modern core architecture. In this article, we argue why banks should consider a modern core system in the form of a sidecar as part of their long-term strategy.

Understanding A Core System

In its purest form, a bank’s core system is a ledger to keep track of accounts and balances. A customer gets on their mobile phone to send a payment, and the dirty secret is we “memo post” that debit, changing the customer’s balance and making them think the money is no longer in the account. The reality is, of course, the money is technically there. Banks will move that money from a “master account” via an internal transfer, wire, ACH, card, or other rail to the appropriate destination later that day. The bank not only has a debit to the customer’s account and a credit to the bank’s corresponding master account, but it also has a debit to the master account and a credit to the payee. Thus, most transactions in the bank require four debits and credits happening at different times.

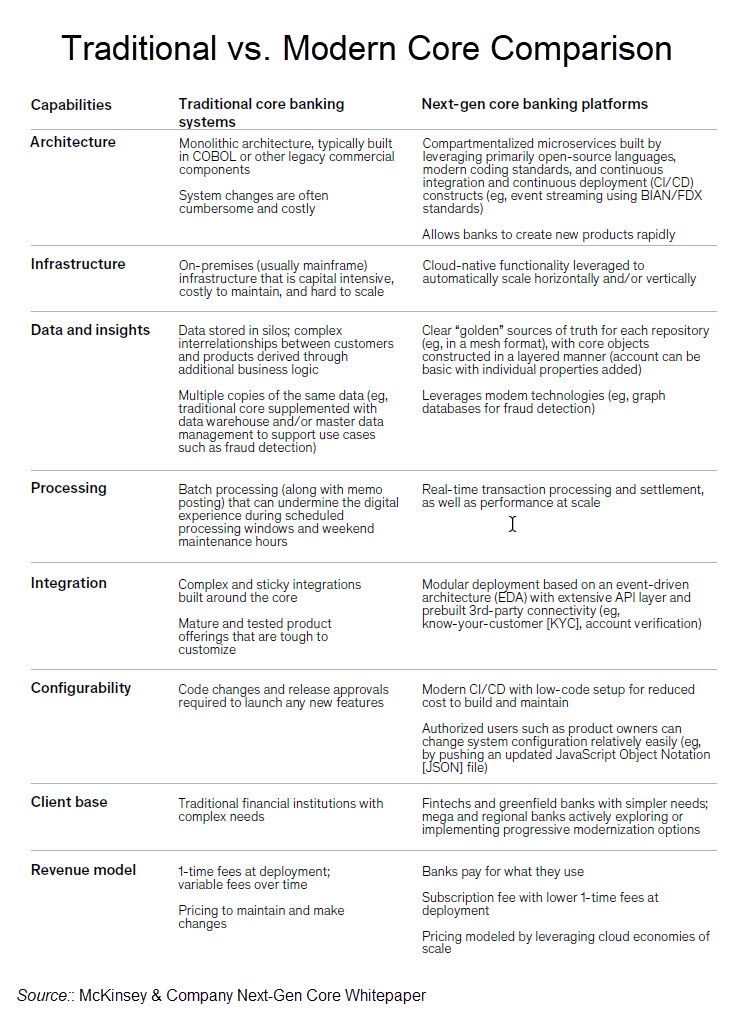

These debits and credits, plus their inherent processes, happen in sequential order. Because all traditional cores are built on a “monolithic architecture,” all functions must be centrally controlled and designed to occur one at a time. Fraud detection, for example, must either be run in a separate application and then brought back into the core, or all core processes must stop to run a fraud sequence.

Somewhere in the dead of night, usually around 2 am, a traditional core system takes all the transactions and activities of the day, stops all workflow, and then processes each of them at once. The system goes down for a period while every transaction and every activity gets processed. When the system is done processing, only then is account information and balances accurate. This information is then pushed out to each ancillary system.

Traditional Core Systems Are Inherently Complex

You can see the issue in the complexity. Because the debits and credits take place at different times and the balances are not truly known until they are updated with batch processing, there is an array of problems banks and customers need to handle. Reconciliation of balances and account data is the largest.

On any given morning, banks must deal with various account issues. Sometimes an internal failure occurs when a software glitch occurs and a process doesn’t run. Other times, the payment didn’t go through for some reason (maybe the payee doesn’t exist), and the previous process needs to be reversed. Still, other times, both the bank and the customer “guess” at their balance during the day. Maybe an incoming payment was not processed by another bank, for example, and the customer never received funds.

This daily reconciliation process is no small feat. It eats up a substantial number of resources for a bank and often causes a less-than-optimal customer experience.

If all that isn’t complex enough, it gets worse. Unfortunately, banks have purchased various systems such as digital/mobile banking, account opening, treasury management, and other banking services from their core service providers because it was easy. All these systems need to talk to each other, which creates multiple points of failure. After batch processing, each of these systems needs to be updated. This workflow is often in the embarrassing form of files that get exported from one system and uploaded by another. Each of these file uploads creates yet another source of potential failure. The more products and services a bank have, the higher probability of failure. The more accounts a bank has, the larger the impact of that failure.

Money Movement will Continue To Speed Up

Since the industry is no longer moving money by stagecoach, money movement is happening faster. In fact, with the rise of instant payments over the last five years, money movement can happen instantly and in a 24/7 cycle. Those four debits and credits are reduced to two. With the rise of tokenized money and assets such as a central bank digital currency found in some countries, debits and credits are eliminated. Money, and the companion accounting entries, are the same. The value and the message get transferred at the same time. You either have the asset or you don’t. Not only is the transfer of those assets from one party to another near-instantaneous but so is the auditing and validation.

If the future is faster payments and more digitized assets, you should realize that your traditional core cannot handle it.

Last month, FedNow, the Federal Reserve’s instant payments platform, went live. While 57 banks, core systems, and fintechs will go live shortly, soon, the platform will see 3,000 financial institutions at least receiving money in real time. The popularity of FedNow, and the variety of new products instant payments will spawn, will force many banks to a modern core.

The Advantage of a Modern Core System

Modern cores have the following advantages, in order of importance, that allows a bank to set up for the future.

Real-time Processing & Speed: A good modern core will have an “event-driven” architecture allowing messages to be processed at any time, including in real-time. An “event” can be a payment, an internal balance adjustment, or a name change on an account. Using a modern core, the account information, including the transaction history and balance, is known with more certainty. Events can flow through a modern core in real time and in parallel instead of being batched and processed sequentially. Now, a modern core can be accurate in real time. Accounts can be opened and accessed immediately.

In modern real-time cores, processes are “containerized” and “composable,” meaning that processes come in a package complete with the code and application program to run the code. These self-contained processes are distinct and can be used across functions and platforms. A KYC process, for example, can now be used in mobile account opening, online account opening, payments, lending, and various other functions. This allows for greater efficiency through standardization and scalability. In addition, the packaged code can be run on any system, which is essential as banking moves to various platforms, such as being embedded in appliances or homes.

Innovation: Because of the complexity of traditional cores, processes are limited to what the core provider, not the bank, can or wants to do. For example, if a bank wanted to add the ability to charge a loan an interest rate based on daily SOFR, it could not because the traditional cores couldn’t handle it. If a bank wants to track reward points in its core, it cannot because that currency has not been created. If a bank wants to create a goal-oriented account where the customer gets added interest if balances reach a certain level, most traditional cores cannot handle it. To create even the simplest of new products, it takes most banks six to twenty-four months to work with their core providers to create a product. This stifles innovation.

There is a reason why most bank products have become commoditized. 95% of our accounts are identical. It doesn’t have to be this way.

Cloud Native: Modern, real-time cores can be cloud-native and continuously updated. That means it is easier to update and expand core capabilities. Each bank can create its own “objects” on the core in the form of products, services, or account types and then create customized processes. These objects and processes are separate from the core. Thus, you can update the core without disturbing these objects and processes. This makes the ability to upgrade and expand core capabilities easier, less expensive, and more stable.

API-First: All modern, real-time cores are API-first which means banks can now integrate with other vendors, partners, and customers with much greater ease and at dramatically lower cost. Instead of relying on your traditional core providers for mobile banking, banks can now choose a variety of other partners available, thereby having more competition and choices. As embedded finance gets more and more popular, any banks will be able to port their banking services, such as payments, wealth, trade finance, or cash management, into their customers’ enterprise/accounting systems.

Cost: Traditional cores are relatively expensive, eating up 30% to 60% of all the costs within a bank. Modern cores are approximately 25% of that cost both in terms of direct payments but also in terms of operating costs in the form of labor efficiency. A typical community bank may pay $1.5M annually in direct costs for their traditional core, which can drop to $500k for a modern core, instead of 25 people to run the system and operations, which can be closer to 10.

Stability: Without multiple debits and credits flying around and batch processing, modern, real-time cores are inherently more stable. Systems communicate with each other via an API, and this can often take place in real time. This cuts down on the number of 3 am crises banks have when their core goes down. Banks can now process transactions throughout the day.

Common Languages and Richness: Many modern cores are, or will shortly be, ISO 20022 certified. This certification means that the core’s business model, topology, syntax, and messaging format will already be at the global standard. Banks will have an easier time communicating with one another and with internal systems such as fraud control.

When a real-time payment comes in from The Clearing House or FedNow, all the fields will already be present in your core. No “translation” will be necessary, and your core will be able to capture 100% of the data in the message. Credit cards will be the same way. Right now, a substantial amount of data fidelity is lost as there is no place to put much of the data contained in a payment message (credit card data, for instance). Banks either lose that data or put that data into a separate system, further creating data silos and access issues. For small banks, a modern, real-time core can eliminate the need for a separate data warehouse, further saving cost and time.

Talent: There are a limited number of people available who are experienced to work on a Jack Henry, Fiserv, or FIS core. However, modern cores utilize open-sourced technology. Coders abound that have the skills to work on a modern core. Instead of operations and system people, banks can find developers that know Python or Golang, which are in greater supply. Further, developers and bank operations staff are more interested in gaining experience and would be better attracted to a bank with modern architecture.

Moving To A Modern Core System Sidecar

One way to transition is to purchase a modern core banking system and move a particular subset of your customers on it to try it out. For example, a bank puts all customers that utilize instant payments onto the modern core. Maybe a bank designs a new deposit account that could not reside on a traditional core, such as a savings account that earns reward points and interest. Another example could be an account for senior citizens that allows custodian control. The possibilities are endless. A bank identifies these customer segments and then boards them onto its new core.

While all this sounds like more work and cost, some of this capital investment is offset by the additional deposit balances and fees the bank could earn, which would not be possible with a traditional core. Further, a bank needs to look at the longer time horizon, such as having a ten-year vision, to know that its core cost will be lower in the long run. A short strategic planning time horizon often prevents banks from taking a long-term view and has always been a major impediment to a core replacement. Increase the strategic horizon, and the compounded return numbers improve to make the project economically viable.

The other factor to consider is the bank’s competitiveness in mergers and acquisitions. Gaining experience with a modern core allows the bank to operate at a lower cost in the future. With each year, a bank will put more and more customers and products onto the modern core and will, in time, be able to board a newly purchased bank. Lower operating costs and greater product offerings make any bank more competitive and increase the return on a potential acquisition. Banks that fail to modernize their cores will find themselves at a strategic disadvantage over the next ten years and be driven into an acquirer’s arms.

Putting This Into Action

A bank looking to upgrade its core capabilities needs to start somewhere. Converting a core system to a modern core is a near-insurmountable task. It is far better to start with a sidecar and learn how to operate and leverage a modern core banking system. Having a long-range strategic initiative to move a small number of customers over to start and then increase the migration rate is a viable, risk-minimizing plan.

Even if a core banking system is not an immediate issue for a bank, it will be as products like FedNow become more popular and fintechs force banks into new products (because many fintechs and neobanks operate modern cores).

Next-gen, cloud-based core banking systems are gaining more and more traction. With deposits so essential and the rise of instant payments, now is the time to consider a modern core. Bank boards and management should proactively consider a sidecar plan to see if it makes strategic sense for them.