While unfortunate, the rising tide of fraud is not necessarily surprising. Financial criminals have been targeting digital transactions for over three decades. As technology has evolved, so have their tactics.

The dial-up world of the 1990s was a golden age for credit card telephone fraud schemes. The smartphone explosion along with other digital devices and the ensuing digital revolution were closely matched by a rise in phishing, ransom malware, the use of botnets and various forms of e-commerce fraud. In the 2020s we’ve seen fraudsters use deepfake voice tech to impersonate victims, build elaborate app-to-app fraud systems, break digital locks with mobile spoofing, and much, much more.

And the future, arguably, looks even more fraught. If you think fraudsters won’t make use of generative AI or quantum computing, or that the metaverse will be fraud-free, I’m afraid you’ll be disappointed.

In a recent presentation on Breaking Down Fraud—an important trend in payments today, my talk included some key data on the growing problem of mobile payments fraud. Here are some of the highlights I shared:

Breaking down fraud:

- Digital payments fraud has grown 25% in the last three years.1

- Merchants spend, on average, 8 – 10% of their revenue combatting fraud.2

- 3.6% of global GDP is lost to fraud each year.3

- Four in 10 merchants have experienced phishing fraud attacks in the last year.4

- Two in 10 financial services customers close their accounts after experiencing fraud.5

- Online commerce is expected to lose $48 billion to fraud in 2023. 6

However, the news is not all bad. Fraud will probably always be with us in one way or another, but that doesn’t mean that payments providers and their telecom partners are helpless.

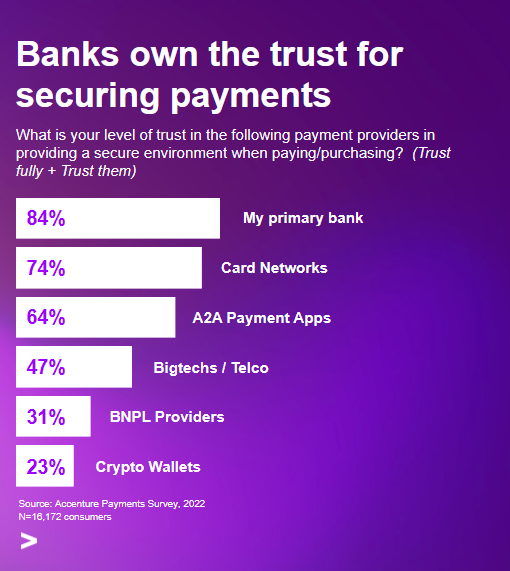

Accenture’s global payments consumer report, Payments gets personal, built on a survey of over 16,000 consumers in markets around the world, found that incumbent payments players have a significant trust advantage for securing payments.

These data, in my opinion, are a strong indication that traditional financial institutions can turn our current tidal wave of fraud into an opportunity. That they haven’t done so yet is, I think, mostly down to the challenges of coordinating action across industries and, on occasion, between competitors.

It’s widely understood today that organizational silos within a business reduce efficiency and boost the risk of fraud. If your IT department and HR teams are not in close contact, for instance, it’s easier for a bad actor to impersonate an employee and access critical systems. Blinds spots like this are at best inefficient and at worst open invitations to financial criminals.

This is old news to every payments player in the world right now. What’s less widely recognized is that most payments fraud today targets not the cracks within organizations but those between them or even between industries.

For example, the most common phishing technique used today might be the digital impersonation of a legitimate organization. A fraudster tricks a victim into thinking that an email comes from, say, their bank, and then exploits this deception. Or a group of hackers might convince a fintech that they are a legitimate credit bureau to gain access to the fintech’s client data. These examples are hypothetical, but the point they make is real—defeating digital fraud will require cross-industry collaboration on a greater scale.

History suggests that payments players can cooperate in this way to advance mutual interest. SWIFT and central payment schemes are just two examples that spring to mind. Whether they can reach the heights required to get ahead of the seemingly always-growing power of digital fraudsters, however, remains to be seen.

Download the full report, “Payments gets personal: How to remain relevant as customers seek control.” To discuss how your payments organization can compete to win the future, contact me.

- Accenture research analysis based on Global Data 2022

- Merchant Risk Council, Cybersource & Verifi, 2023 Global eCommerce Payments and Fraud Report

- Illicit Financial Flows from Developing Countries: Measuring OECD Responses 2014

- Merchant Risk Council, Cybersource & Verifi, 2023 Global eCommerce Payments and Fraud Report

- Accenture research analysis based on Global Data 2022

- Statista & Juniper research