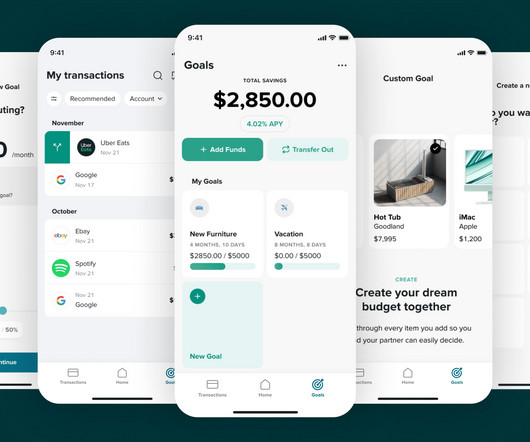

Relationship finance app Tandem debuts new goals feature

American Banker

APRIL 9, 2024

The Ann Arbor, Michigan-based fintech is working with two Michigan credit unions to pilot a service that allows consumers to jointly save for purchases.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

American Banker

APRIL 9, 2024

The Ann Arbor, Michigan-based fintech is working with two Michigan credit unions to pilot a service that allows consumers to jointly save for purchases.

Gonzobanker

MARCH 7, 2024

It happened this week: Fintech Meetup , one of the newer trade events that brought 4,000 or so fintech and banker types to Las Vegas. Distribution, distribution, distribution The quest to scale a fintech company while maintaining high-quality business models came up on repeat.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Banker

AUGUST 1, 2023

Michigan State University Federal Credit Union and Nymbus teamed up to design a package of business banking tools with an eye toward credit unions, which historically have tread lightly into this space.

CB Insights

NOVEMBER 6, 2019

The fintech space is gaining momentum. Last year saw a double record of $46B invested across over 2,800 deals to fintech startups — a 92% uptick in funding year-over-year. GET THE 83-PAGE q2 2019 FINTECH TRENDS REPORT. Q2’19 fintech funding topped $8.3B, boosted by a record quarter of $100M+ mega-rounds. KEY TAKEAWAYS.

CB Insights

OCTOBER 26, 2017

Following our previous mapping of the most well funded startups in each state and most well funded food & beverage startups in each state , we used CB Insights database to identify the most well-funded private fintech startup in each state. FINTECH TRENDS Q3 2017 RESEARCH BRIEFING. Click on the image below to enlarge. 15.7. . $

American Banker

MAY 11, 2023

(..)

PYMNTS

DECEMBER 23, 2019

Its omnipresence is altering how members want to interact with their CUs, though regulatory and compliance issues often mean that members cannot reasonably expect the same lightning-fast interactions they might get from banks and FinTech firms. Developments From Around The World Of Credit Unions. The CUs were able to eliminate more than $2.5

PYMNTS

MARCH 14, 2017

FinTech Autobooks announced new funding to support its SMB banking solutions. The new funding also saw participation from CU Solutions Group, Baird Capital, Detroit Venture Partners and Invest Michigan, the company said, adding that the round follows its self-funded $2 million in seed financing. “We

CB Insights

JULY 30, 2020

Detroit, Michigan-based Rocket Companies — a holding company that comprises mortgage lending brand Rocket Mortgage, among others — is going public. This filing comes on the heels of a flurry of recent fintech IPOs from companies like Lemonade , SelectQuote , and nCino. Free Download: State of Fintech q1’20.

PYMNTS

FEBRUARY 8, 2019

Carnegie Mellon, Cornell, Duke, Georgetown, Morgan State, Kansas, Michigan and Northeastern universities in the U.S., as well as the National University of Singapore and the University of Sao Paulo, have now joined the Institute for FinTech Research at Tsinghua University (THUIFR) in Beijing under the UBRI. “In

PYMNTS

SEPTEMBER 23, 2019

Advanced technology is increasingly raising the stakes of how CUs should operate, with members coming to expect the instant payments and slick mobile interfaces that large banks and FinTechs have made standard. Developments From Around The Credit Union Space.

Independent Banker

MARCH 31, 2022

We must continue to fight increased regulation, specialty charter considerations and the potential for more fintech access to traditional rails without the same oversight. At-large director Doug Ouellette, Chief community banking officer, Mercantile Bank of Michigan, Grand Rapids, Mich. ICBA standing committee chairs (from left).

PYMNTS

APRIL 29, 2019

” Additional research examined the state of small business finance for Q1, revealing a healthy level of competition between traditional lenders and FinTechs like PayPal vying to capture more of the small business borrowing segment. .

Fintech Labs Insights

MAY 15, 2017

Join us on Wednesday at 11am Eastern as we sit down with representatives from three of fintech’s most innovative companies for our first webinar, How to Make It In the Fintech Industry: 3 Startup Success Stories. Check out our How to Make It In the Fintech Industry panel: Kumar Ampani, Chief Technology Officer, Moven.

NCR

DECEMBER 1, 2017

There are plenty of challenges to face up to, from regulatory changes in Europe and fintech disruption, to the startlingly rapid evolution of technology and consumer expectations. The Fed also highlighted competition from fintechs as a trend that could increase the pressure on smaller providers. The value of personalization.

FICO

JANUARY 5, 2023

What’s more, unlike some fintech initiatives that assess risk based on cash flow data alone, the UltraFICO® Score presents the best of both worlds, combining cash flow data with traditional data from consumers’ credit files, along with the odds-to-score ratio that lenders understand. Prior to joining FICO, Ms. See all Posts. Related posts.

CB Insights

MARCH 13, 2019

They include cybersecurity company StackPath ($180M) and fintech companies Opera Solutions ($122M) & Petuum ($108M). There are 7 unicorn startups on our map: agtech startup Indigo Agriculture ($3.5B 12 startups on the map have raised over $100M in disclosed equity funding. IDx Technologies. RiskGenius. Lucina Health. Massachusetts.

Fintech Labs Insights

MAY 17, 2016

Michigan First FCU leverages Insuritas to power Michigan First Insurance Agency for its members. Bleu selected for VC Fintech Accelerator in Little Rock, Arkansas. Misys wins awards for its work with Bank of Beijing and Vietnam Technological & Commercial Joint Stock Bank.

Fintech Labs Insights

FEBRUARY 17, 2017

The three FIs are CommunityWide FCU ($395 million) of South Bend, Indiana; Advantage Plus FCU ($125 million) of Pocatello, Idaho, and One Detroit CU ($35 million) of Detroit, Michigan. Founded in 2015 and headquartered in Troy, Michigan, Bankjoy demonstrated its API at FinovateFall 2016 last September.

PYMNTS

JULY 13, 2018

Wells Fargo also announced plans to sell 52 branches in Indiana, Ohio, Michigan and parts of Wisconsin to Flagstar Bancorp. The San Francisco-based bank had a total of 5,751 retail branches by the end of the second quarter, citing 114 branch consolidations during the first half. The bank reported 5,977 retail branches in the year-ago quarter.

Fintech Labs Insights

DECEMBER 30, 2015

For just the fourth time this year, weekly fintech fundings fell below the $100-million mark with 15 companies raising a total of $51 million. With just one holiday-shortened week remaining in the year, the total invested in private fintech companies YTD now stands at $18.8 HQ: Troy, Michigan. Person-to-person lender .

Fintech Labs Insights

APRIL 30, 2015

HQ: Grand Rapids, Michigan. The post Fintech Fundings: 15 Companies Raise $125 Million Week Ending May 1 appeared first on Finovate. Latest round: $1 million Seed. Total raised: $1 million. Source: Crunchbase. Prepaid mobile wallet for fundraising. Latest round: $900,000 Seed. Total raised: $1.5 Source: Xconomy. HQ: Santiago, Chile.

Fintech Labs Insights

JUNE 23, 2015

Larky co-founder Andrew Bank called Lake Trust CU “innovative” and one of Michigan’s leading credit unions. billion in assets and serves customers in a 35-county area in Michigan. 1944) and NuUnion Credit Union agreed to merge to form what is now Michigan’s fourth largest credit union.

Fintech Labs Insights

AUGUST 2, 2016

A look at the companies demoing live to 1,500+ fintech professionals on September 8 & 9, 2016. He was a founder of Techstreet and Larky and has an engineering degree from the University of Michigan. Register today. Features: Ask Clinc anything about finances and it understands. Andrew Bank, Strategy & Business Development.

PYMNTS

JUNE 30, 2016

The latest June count for where Walmart Pay is available is: Virginia, North Carolina, South Carolina, Nebraska, North Dakota, South Dakota, Iowa, Tennessee, Kentucky, Michigan, Indiana, Alabama, Georgia, Louisiana, Missouri, Mississippi and Washington, Missouri, Texas, Arkansas, and Washington, D.C. PayPal’s Consumer Support.

Fintech Labs Insights

OCTOBER 7, 2015

. “ Quisk Digital Services Platform: We are sharing some of the key learnings Quisk has gained from building a next-generation digital payments/FinTech SaaS platform from scratch. Architecture models for B2B2C-oriented FinTech SaaS platforms. Security considerations in cloud-based FinTech platforms. ” Key takeaways.

Fintech Labs Insights

MARCH 1, 2016

Michigan First Credit Union ($764 million in assets) picks Insuritas to open and run turnkey insurance solution. Around the web: Markit to deploy smart automation technology from WorkFusion. Ethoca teams up with Pegasystems to help fight ecommerce fraud. This post will be updated throughout the day as news and developments emerge.

Fintech Labs Insights

OCTOBER 6, 2015

Prior to Xignite he held developer positions at Viagogo, Media Interface, and Network Design Lab, The Ladders and Michigan State University, where he also taught advanced programming. Chang is a fintech industry technology expert. Named one of the 10 coolest brands in banking, Xignite, Inc. He is fluent in Hindi and Tamil.

Fintech Labs Insights

JANUARY 12, 2017

Huron Community Bank of Michigan to leverage Insuritas to launch insurance agency. Around the web. PayPal partners with Discover. Experian partners with reporting and analytics platform dv01 to enable dv01 clients to access to richer borrower credit attributes.

PYMNTS

MARCH 17, 2017

The B2B FinTech investment space has been relatively slow in recent months, but U.S. startups led the way this week with a healthy $101.5 million in venture capital — the most the industry has seen in a while. Autobooks said there is a gap in the small business banking industry that it’s looking to fill. ServiceTitan.

PYMNTS

JUNE 24, 2016

This week it was Minnesota, and then yesterday Walmart really got warmed up and announced the expansion of their new payments service in: Michigan, Virginia, the Carolinas, Indiana, Iowa, Kentucky, Nebraska, North Dakota, South Dakota, Tennessee, Louisiana, Missouri, Mississippi and Washington, D.C. A few things stand out. .

Gonzobanker

DECEMBER 19, 2017

FinTech threats and distractions. While the darling of FinTech conferences, this divestiture seems primarily driven as a means of Customers delaying the $10 billion Durbin hit and maintaining quarterly EPS expectations from the Street. Oh, by the way, that Fintech darling of two years ago Lending Club? Payments chaos.

Fintech Labs Insights

MAY 27, 2015

Michigan-based Isabella Bank to deploy workflow suite from Jack Henry & Associates. Misys unveils its in-memory analytics engine, FusionBanking Insight. True Potential launches its Apple Watch app. Commonwealth Bank of Australia begins testing Ripple as intra-bank transfer solution.

Fintech Labs Insights

APRIL 17, 2017

” Founded in 2015 and headquartered in Detroit, Michigan, Bankjoy demonstrated its Bankjoy API at FinovateFall 2016. .” Bankjoy CEO Michael Duncan added, “Coca-Cola Credit Union has a clear vision of the omnichannel experience it wants to create for its members. No two credit unions are the same, nor should they be.”

Fintech Labs Insights

JANUARY 25, 2022

We call it the FAB score, standing for Fintech Attention Barometer. HQ: Detroit, Michigan. Related: The 34 Biggest Fintech Conferences & Events in 2022. The Fintech Unicorns of the 21st Century (Dec 2021). The score uses money raised, valuation and website traffic as a proxy for company size and velocity of growth.

Fintech Labs Insights

FEBRUARY 22, 2017

Founded in 2015 and headquartered in Ann Arbor, Michigan, Clinc demonstrated its voice-based intelligence assistant app, Finie, at FinovateFall 2016 , earning a Best of Show award. Drive Capital co-founder and partner Mark Kvamme will join Clinc’s board of directors.

Fintech Labs Insights

JUNE 6, 2016

He has a Bachelor’s degree from University of Michigan and earned his law degree from the American University, Washington College of Law. Quantopian, which went live in Australia in March, was named to the inaugural Forbes Fintech 50 in December of last year – along with 19 fellow Finovate alums. The company has raised $23.8

PYMNTS

FEBRUARY 9, 2018

Instead, VCs leaned conservatively toward a mix of B2B FinTechs operating in the financial management space for small businesses (SMBs) and in the treasury management market for mid-level and larger enterprises. It seems VC has cooled off a bit in the B2B FinTech front. All in all, investments totaled more than $178.6 Catfoss Finance.

Fintech Labs Insights

AUGUST 25, 2015

He holds an MS in Computer Science from Michigan State University. Praveen Amancheria, Chief Technology Officer. Amancheria leads all technology and product development at Quisk, Inc. Formerly, he had leadership roles at CyberSource. The post FinovateFall Sneak Peek: Quisk appeared first on Finovate.

Fintech Labs Insights

NOVEMBER 17, 2015

Demonstrating its technology at FinovateSpring 2015 in May, Stratos was founded in 2012, and is headquartered in Ann Arbor, Michigan. European fintech fans! Stratos presented its wallet-simplifying, Bluetooth Connected Card with enhanced security, and emerged from the same New York round as fellow Finovate alum, Wealthforge.

Fintech Labs Insights

FEBRUARY 16, 2016

Founded in 1999, Billhighway is headquartered in Troy, Michigan. In March, Billhighway picked up a Silver Stevie Award for Innovation in Customer Service in the Financial Services Industry category, its second win at the Stevies since 2013. The post BluePay Acquires Billhighway appeared first on Finovate.

Fintech Labs Insights

JANUARY 26, 2016

She has an MBA from the University of Michigan, and a business degree from Germany’s Universität des Saarlandes. The company hired a new Chief Financial Officer John Varughese, earlier this month , and Bru himself joined Taulia as CEO less than a year ago last April.

Perficient

MAY 21, 2021

This FinTech app allows users to invest in a portfolio in their favorite brands or companies (DoorDash, Lululemon, Target, Costco, Amazon, etc.) She completed the Programming for everybody course from the University of Michigan and an introductory coding course (which included both Python and Javascript) via Udacity.

William Mills

SEPTEMBER 9, 2016

An App Store for FinTech applications. Many of the team appears to be professors in Michigan. The company started in the research lab in Michigan with the aim of reducing complexity in our lives. Download: 10 Reasons Why Fintech Startups Fail White Paper. Check back for new updates throughout the day.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content